EUR/GBP forecast for February 19, 2021

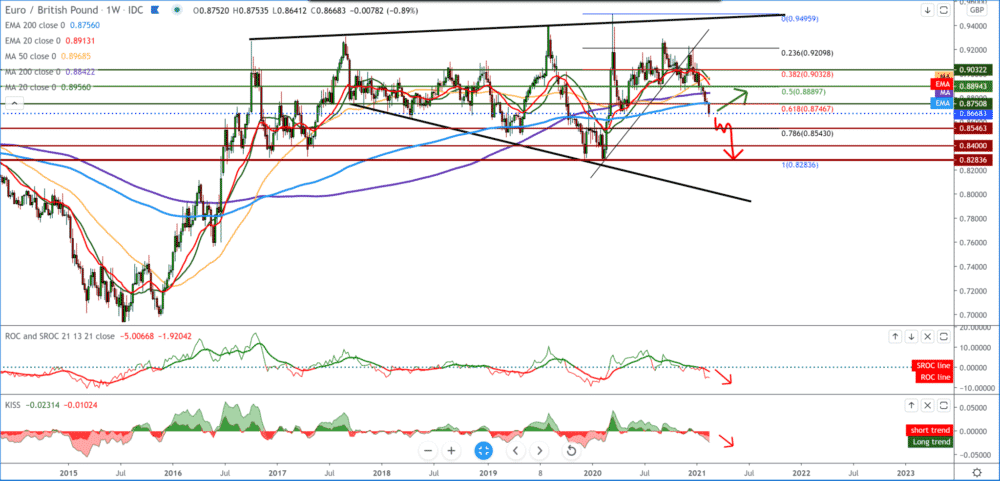

Looking at the chart on the weekly time frame, we see that the EUR/GBP pair is in a bearish trend and expects a continuation towards lower levels. By setting the Fibonacci retracement level, we see a break below 61.8% 0.87500, at the moment now 0.86700. Based on Fibonacci, our next support is at 78.6% at 0.85450. Where we are now, we had support in March 2020, and it can easily be a good support for possible consolidation and potential reversal of the trend, but in general, the pound seems much stronger against the Euro.

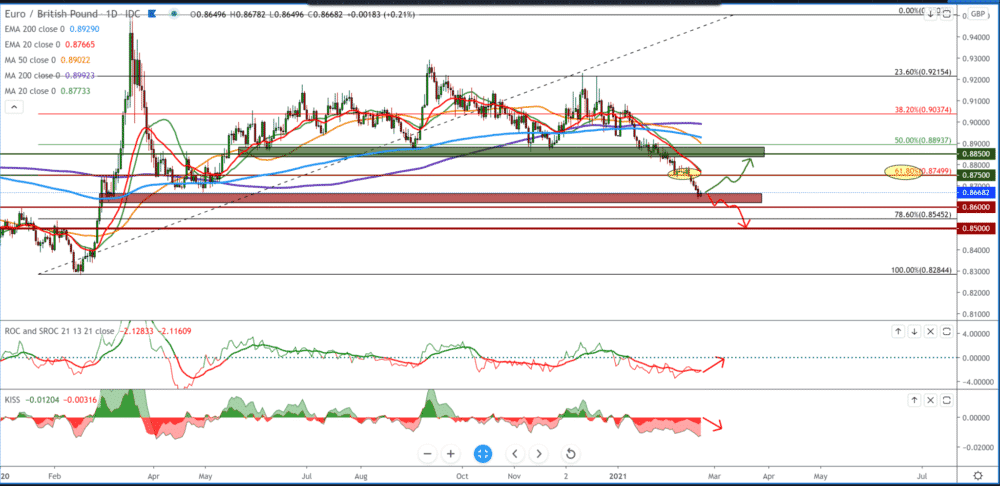

In the daily time frame, we see that the EUR/GBP pair was in consolidation at the Fibonacci retracement level 61.8% 0.87500 and slid down to 78.6% 0.85450. Moving averages are on the bearish side, and based on them, and we can expect the bearish trend to continue. If we expect a possible pullback, we can expect it to MA20, EMA20 previous resistance to the bullish trend. If we see it, our target is 61.8% level Fibonacci at 0.87500.

Today, if the candlestick closes on the positive side, we can expect a continuation in the coming days as the Euro makes smaller gains against the pound.

On the four-hour time frame, we see that the EUR/GBP pair is moving in one falling channel and that now after touching the bottom line at 0.86400, we have indications of a potential pullback, and our target is the top line of the channel. Here we see that the most interesting of the moving averages are the MA20, EMA20, while the MA50 is the more serious resistance for now on the chart.

From the economic news for these two currencies, we can single out the following: The UK budget balance showed its record biggest deficit for January due to higher government spending in the middle of a pandemic, the Office for National Statistics reported on Friday. Net public sector borrowing, excluding public sector banks, increased by £ 18.4 billion compared to last year to £ 8.8 billion in January.

This was the largest January borrowing since monthly records began in 1993 and the first January deficit in 10 years. Retail sales in the UK fell sharply in January as tougher restrictions against coronavirus across the country affected demand, the National Statistics Office said on Friday. Retail sales fell 8.2 percent month-on-month, up from a 0.4 percent increase in December. Economists are forecast a 2.5 percent drop.

The European Central Bank policymakers continued to assess that there is a case for maintaining a sufficient incentive and stressed that the measures taken in December should be given time to take effect. Members agreed that substantial monetary incentives remain essential to maintain favorable funding conditions during the pandemic period.

-

Support

-

Platform

-

Spread

-

Trading Instrument