EUR/GBP Another Attempt for Bullish Traders

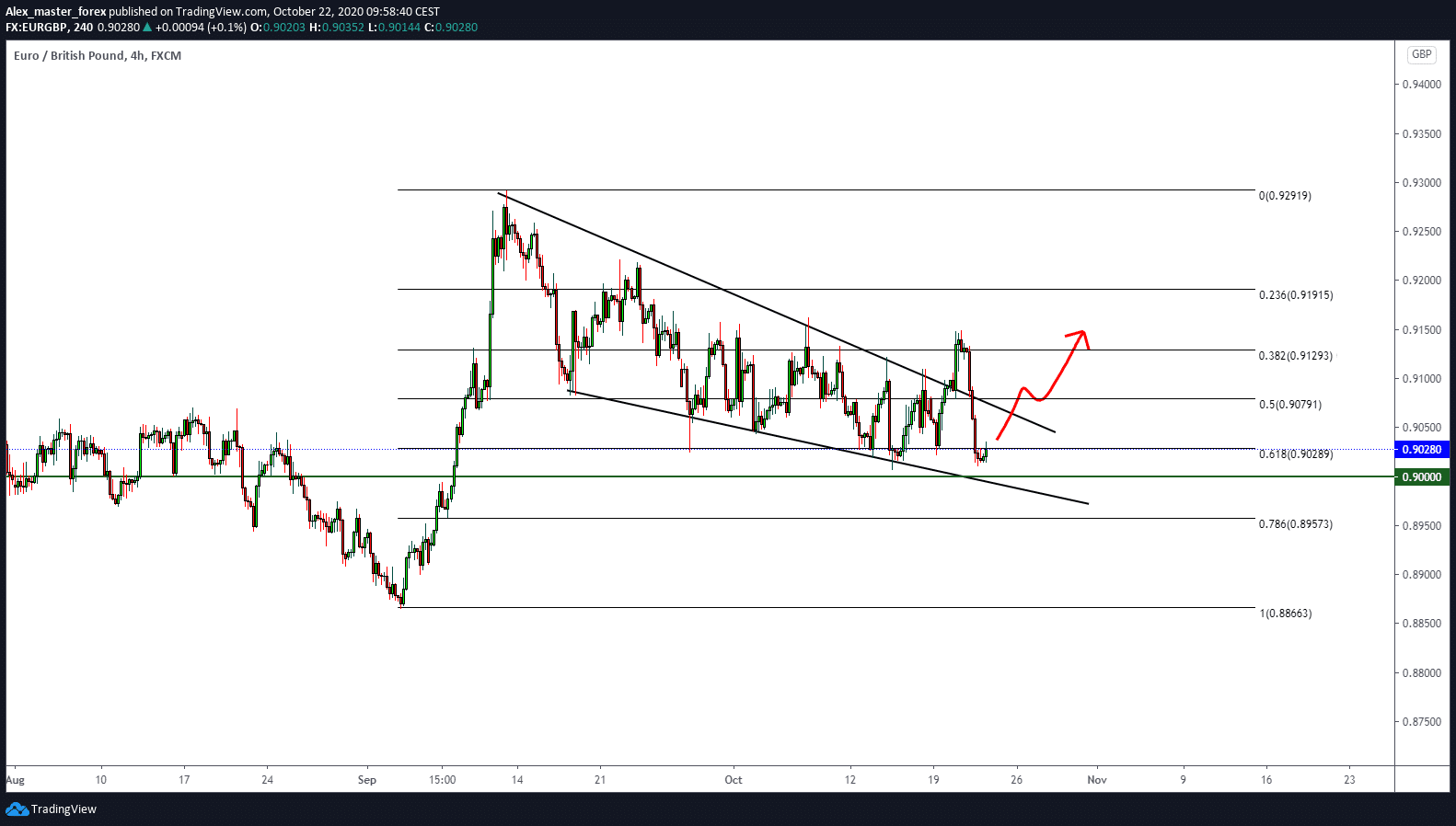

EURO lost everything it did the day before yesterday. The bull traders managed to take a break from the descending canal. The joy was short-lived, and today they are at the beginning again. Price is currently testing support at 0.91000. After a brief consolidation during the Asian session on Wednesday, the cross witnessed some dynamic sales amid a definite rise in demand for the British pound. Upcoming Brexit headlines have opened up prospects for further Brexit negotiations, encouraging traders to unwind bear bets in GBP.

The fall in EUR / GBP is the most significant in the last few months. So far, the area above 0.9000 has had limited slippage. Breaking below 0.9000 could open the door to greater losses. The next support could be seen at 0.8965 and then at 0.8935.

The EU’s chief negotiator for Brexit, Michel Barnier, said the Brexit agreement was close and showed readiness to discuss all topics of the legal text.

The EU auto lobby is forcing chief Brexit negotiator in the bloc, Michel Barnier, to soften its negotiating position on the rules governing trade in electric cars through the Channel. In particular, the rules on how much content in the finished car should be produced locally either in the UK or in the EU to allow duty-free trade in finished vehicles. Approximately 80 per cent of cars produced in the UK are exported and more than half are destined for EU markets.

Barnier also said that equal conditions remain a basic concern and that there will be no trade agreement without a fair solution for fisheries. Brexit is in many ways a side issue for building risk as COVID spreads. We still see the negative risks reflected in our idea of foreign exchange trading from last Friday. During the day, we will also have a statement from the Bank of England (BOE), Andrew Bailey.

-

Support

-

Platform

-

Spread

-

Trading Instrument