EUR/CHF forecast for February 17, 2021

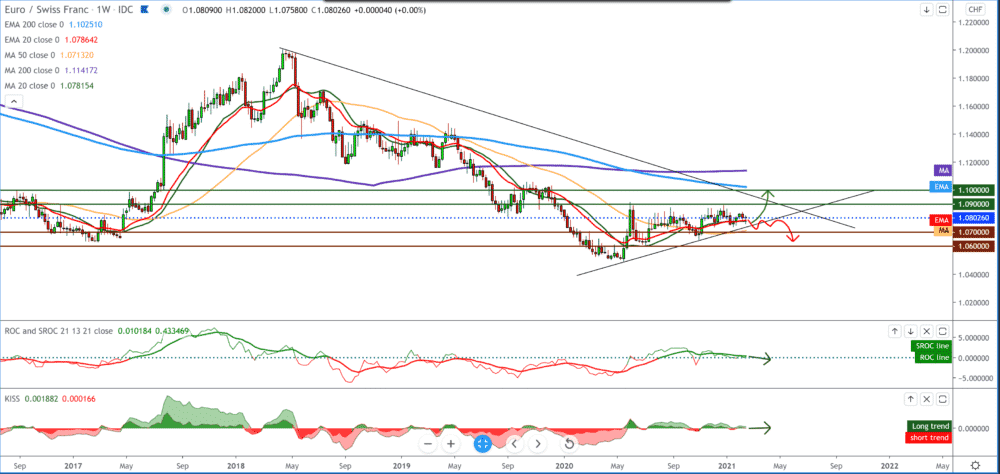

Looking at the chart on the weekly time frame, we see that the EUR/CHF pair has support for moving averages MA20, EMA20, and MA50 but that the range of motion is very narrow. On the upper side, we have a resistance of 1.090000, and looking at moving averages, we can expect further growth, but it will be very slow. The bearish scenario is likely, but we see a break below the moving averages and consolidation below them. We can draw one trend line from the bottom and use it as potential support and break below it for a possible bearish trend.

On the daily time frame, we see the EUR/CHF pair persistently bounce off the resistance zone of 1.09000 and consolidate to the current 1.07900. Moving averages MA20, EMA20 and MA50 are not a trend indicator for now, but for now, they are mostly on the bullish side. For us, perhaps more important is the MA200, which has so far been the biggest support for the pair and an obstacle to the transition to the bearish trend. This way, we can expect a pullback to the MA200, where the EUR/CHF pair will also test the bottom trend line.

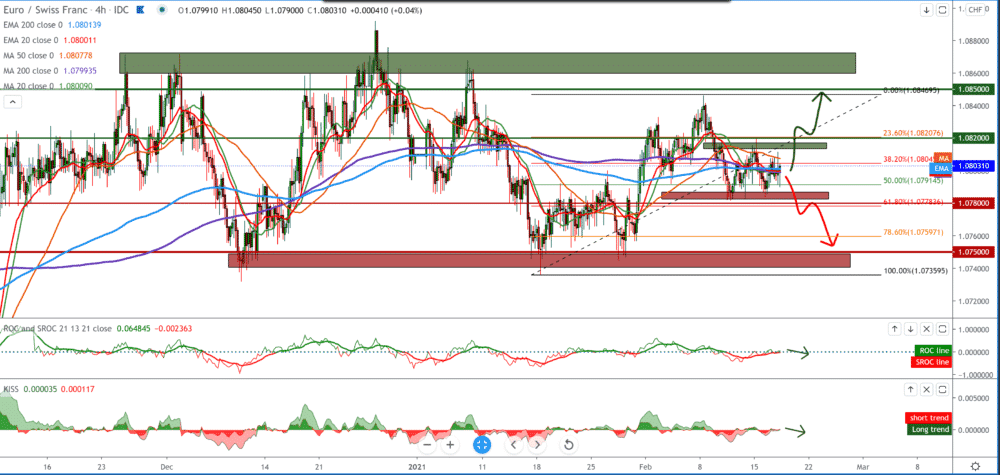

On the four-hour time frame, we see that the EUR/CHF pair moves between the lower zones around 1.07800 and the upper ones around 1.08200. If we want to trade the EUR/CHF pair, it is best to wait for a break below for the sell option or a break above for the buy option. Moving averages are not of any help to us at this time frame and are currently neutral. We need some major shifts in the chart to analyze more specifically. Global influences such as coronavirus, vaccination support the European currency. Still, the European Union’s poor organization regarding vaccination has not given the Euro a greater advantage over the Swiss franc.

From the news for these two currencies, we can single out the following:

Confidence in German investors unexpectedly improved in February, as financial market experts expect the economy to recover within six months, data from a survey by ZEV – Leibniz’s Center for European Economic Research – showed on Tuesday. The ZEV economic sentiment indicator rose to 71.2 in February from 61.8 in the previous month.

The score was forecast to fall to 59.6. However, the economic situation’s assessment slightly worsened by 0.8 points to -67.2 from -66.4 a month ago. The expected level was -67.0. Financial market experts are convinced that the German economy will return to the path of growth in the next six months. ZEV President Achim Wambach said.

-

Support

-

Platform

-

Spread

-

Trading Instrument