EUR/CAD support at 1.41600

Consumer price inflation in the eurozone accelerated for the third month in a row and faster than expected in May. The unemployment rate eased in April, and preliminary Eurostat data showed on Tuesday. Higher consumer price inflation rose to 2.0 percent from 1.6 percent in April, while economists forecast inflation of 1.9 percent. Core inflation, which excludes energy, fresh food, alcohol, and tobacco prices, accelerated to 0.9 percent from 0.7 percent in April, in line with economists’ expectations.

The European Central Bank continues to target inflation below, but close to 2 percent. Compared to the previous month, the CPI rose by 0.3 percent in May.

Separate Eurostat data showed that the unemployment rate in the eurozone fell to 8.0 percent in April from 8.1 percent in March, while economists expected the rate to remain unchanged. The German unemployment rate fell slightly in April, with the unemployment rate falling slightly to an adjusted 4.4 percent in April from 4.5 percent in March. In April 2020, when the coronavirus crisis began, employment fell by 285,000 people in the previous month.

However, the spring growth in the labor market, usually noticed in April, was relatively weak this year. For Canadians today in the American session, we will have very important news in the gross domestic product, which is estimated to be at 1.0%. It will beat the previous result from April of 0.4%.

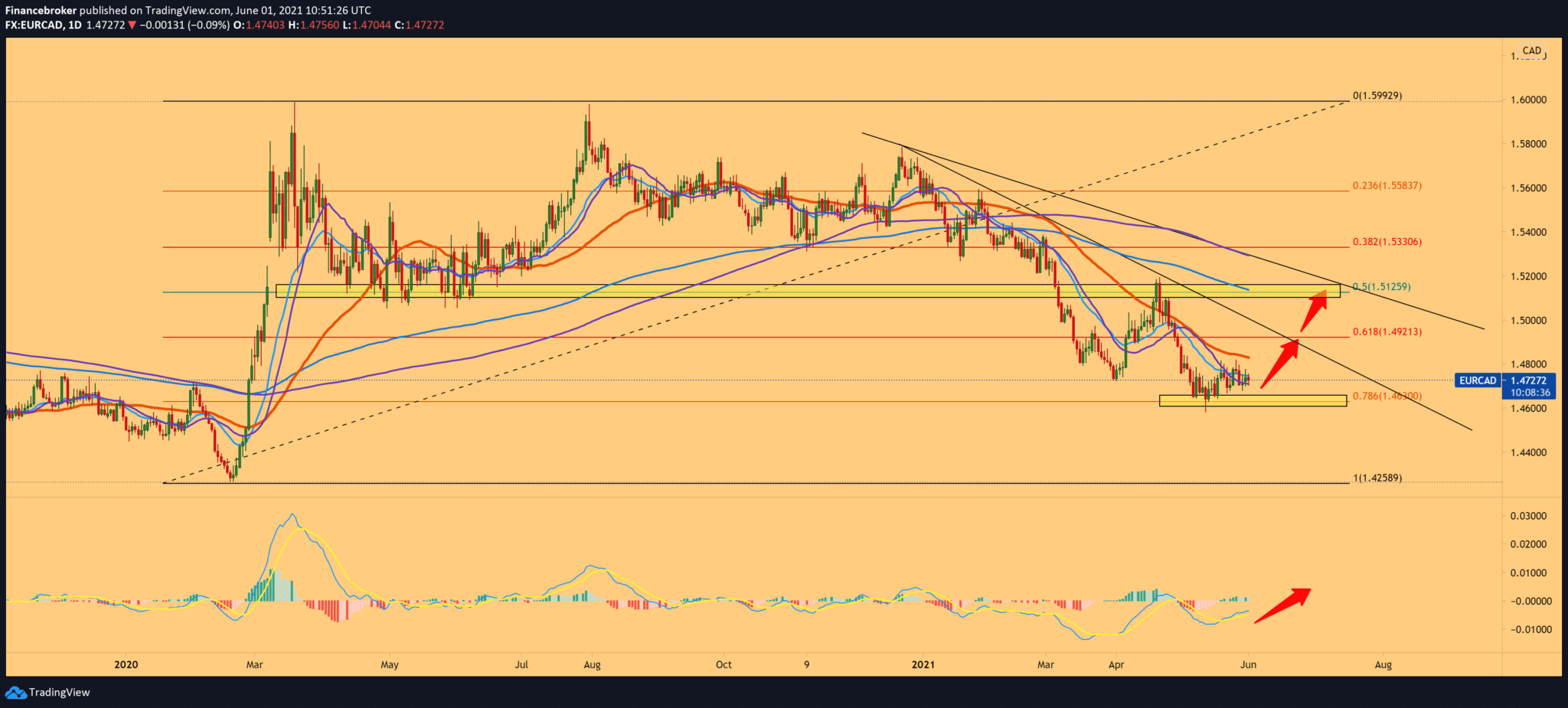

Technically, we see that the EUR/CAD pair has found support at 1.46000. After that, we have a consolidation so far of the current 1.47200. By setting the Fibonacci level, the rejection coincides with 78.6% Fibonacci level, and as a bullish target, we have a 61.8% Fibonacci level at 1.49200. If the euro consolidates after the good news, then we expect it to rise above moving averages and break above MA50, as a stronger signal that we can move on. Our first major target is the previous high at 1.52000 at 50.0% Fibonacci level. We need a drop below 78.6% Fibonacci level again and below 1.4600 to think about the bearish trend.

-

Support

-

Platform

-

Spread

-

Trading Instrument