EUR/AUD forecast for February 16, 2021

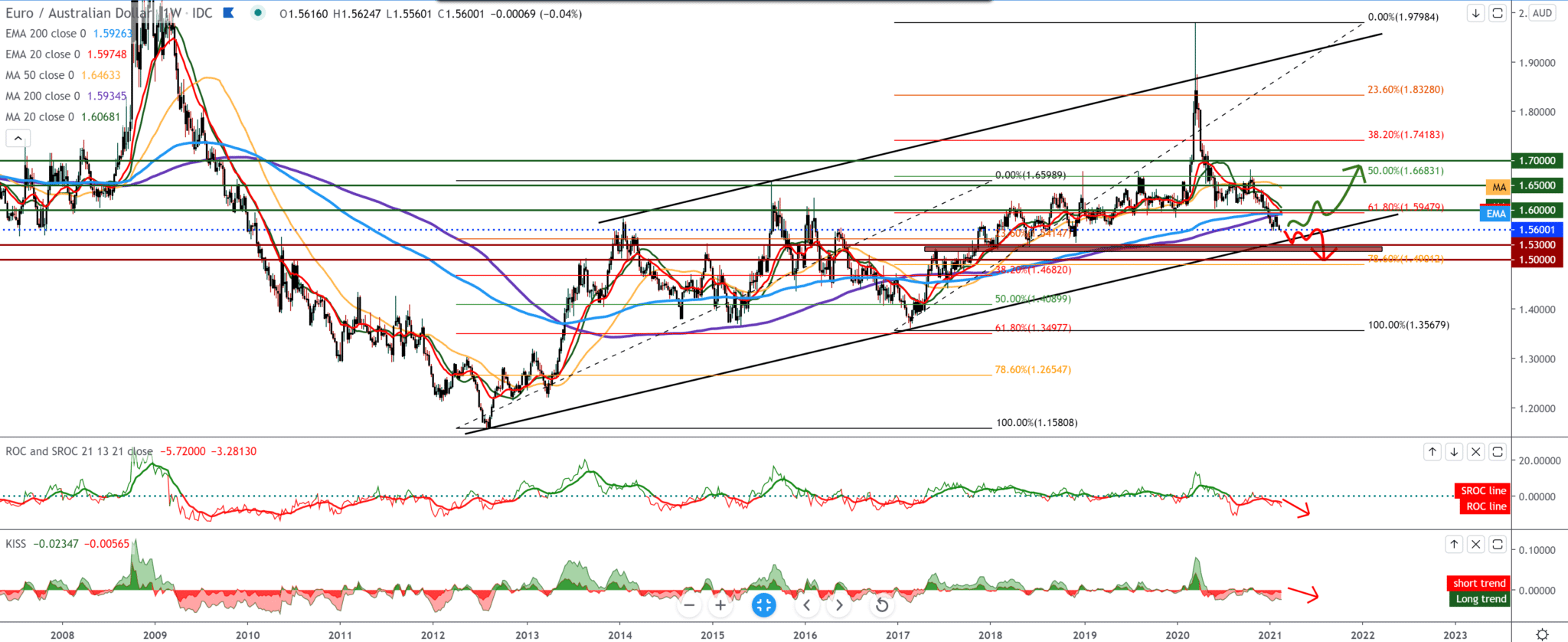

Looking at the chart on the weekly time frame, we see one big rising channel, and now the EUR/AUD pair is very close to the bottom line of the channel. If we look at it that way, it is logical that we see a deduction towards higher levels on the chart after touching the bottom line.

On the contrary, the bearish trend is still in force, and for now, the EUR/AUD pair is not moving towards lower levels, and we are still looking towards 1.55000 and below that towards 1.50000. All moving averages are also on the bearish side, pushing the pair down. By setting the Fibonacci retracement level, we see a break below 61.8% level, with a probability to drop to 78.6% at 1.50000. For a more secure bullish scenario, we need a break above moving averages and above 1.60000.

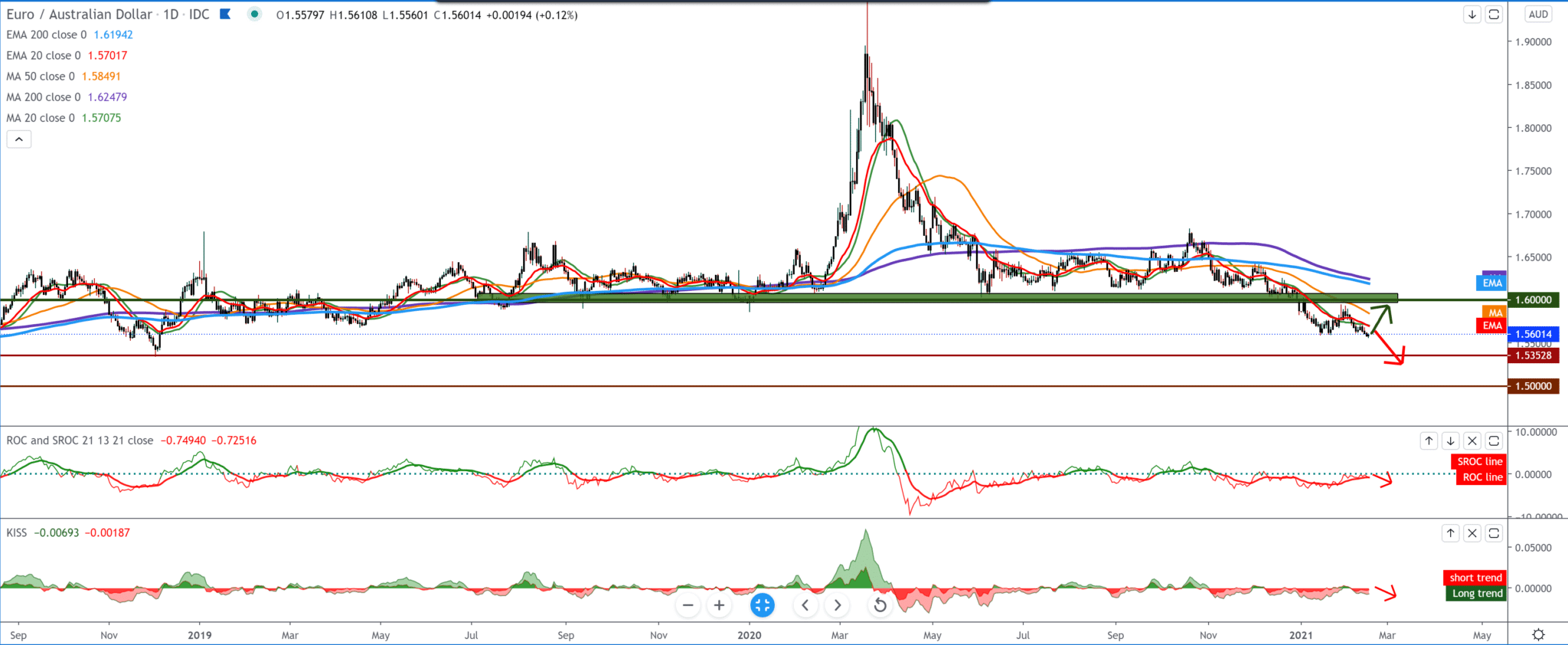

On the daily time frame, we see that the EUR/AUD pair is under pressure from moving averages on the bearish side, especially MA20 and EMA20, which are so far good indicators for continuing the bearish trend. At the same time, MA50 is currently a great resistance to the bullish trend. As the first next bearish target, we look at the previous low at 1.53500 from December 2018. Like New Zealand and Australia, it proved to be good in the fight against Coronavirus. With a good organization of vaccination of the population, it certainly helped the economy recover faster. The European Union has a lot of problems putting it all into action.

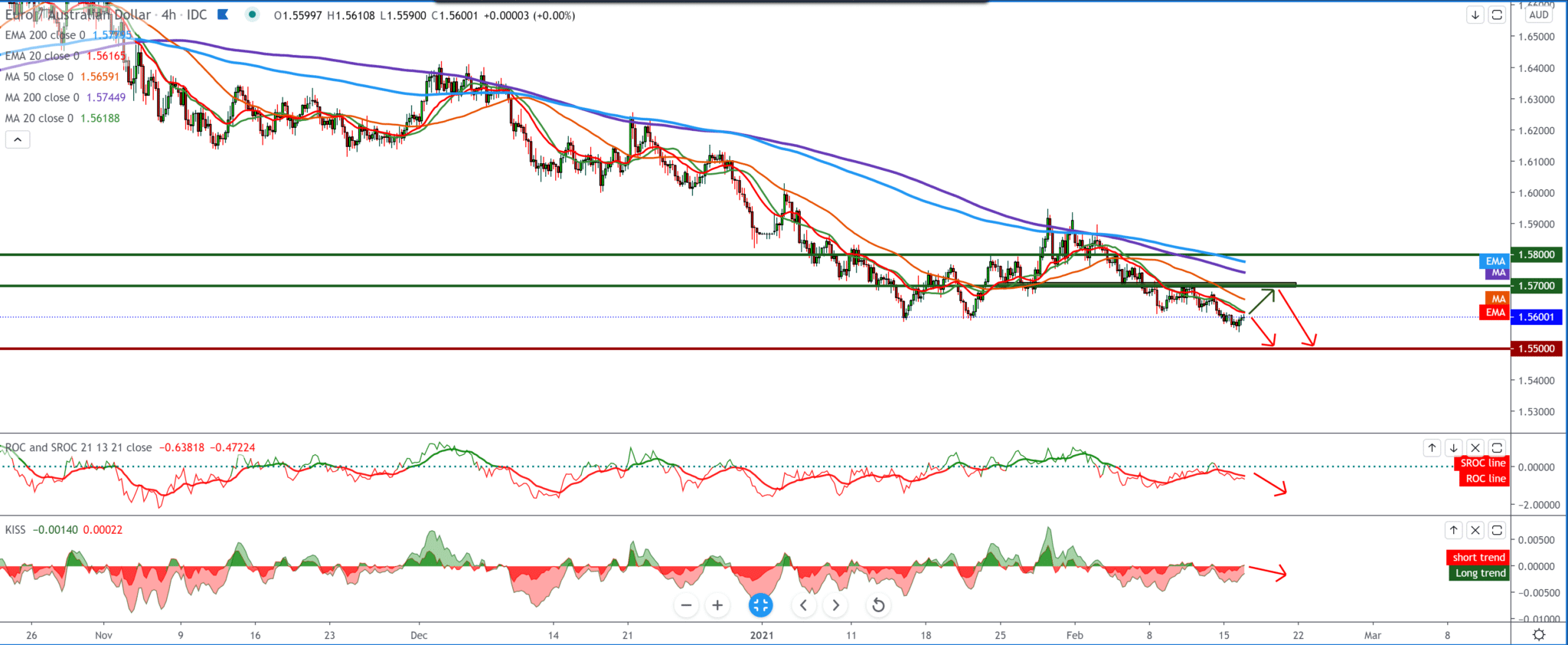

On the four-hour time frame, we see that the EUR/AUD pair finds support at 1.55500, but looking at the bigger picture, we can expect the pair to drop soon below that level. A big obstacle to the bullish trend is the MA200 and EMA200, and the pair never manages to make a better break and stay above them. So if we see a pullback again, we can expect it to zone 1.57500-1.58000. Below we first have 1.55000 waiting for the first psychological level for this couple, and whether they will find support will also depend on global economic and political influences.

From the news for these two currencies, we can single out the following: The eurozone economy declined somewhat more slowly than originally estimated in the fourth quarter amid Covid-19 controls. A quick estimate released by Eurostat on Tuesday showed.

Gross domestic product fell sequentially by 0.6 percent instead of 0.7 percent estimated earlier. The decline reversed a record 12.4 percent of the recovery recorded in the third quarter. On an annualized basis, GDP fell 5 percent, higher than the 4.3 percent drop in the third quarter but slower than the 5.1 percent drop estimated on Feb. 2.

Further, the data showed that the euro area’s employment growth declined to 0.3 percent in the fourth quarter from 1 percent in the third quarter.

Year-on-year, employment fell 2 percent from a 2.3 percent drop in the previous period. Members of the Monetary Policy Committee of the Reserve Bank of Australia agreed that the country’s economy is recovering from the Covid-19 pandemic at a faster pace than expected.

The development of numerous vaccines for the pandemic treatment has stimulated the improvement of the global economy, the minutes showed. In Australia, unemployment fell more than expected, while inflation remained well below target. Members added that the stimulus is expected to last for a more extended period of time, although negative interest rates are unlikely. At the meeting, the RBA decided to maintain targets of 10 basis points for the cash rate and yield of three-year Australian government bonds.

-

Support

-

Platform

-

Spread

-

Trading Instrument