Ethereum on the Negative Side with the Crypto Market

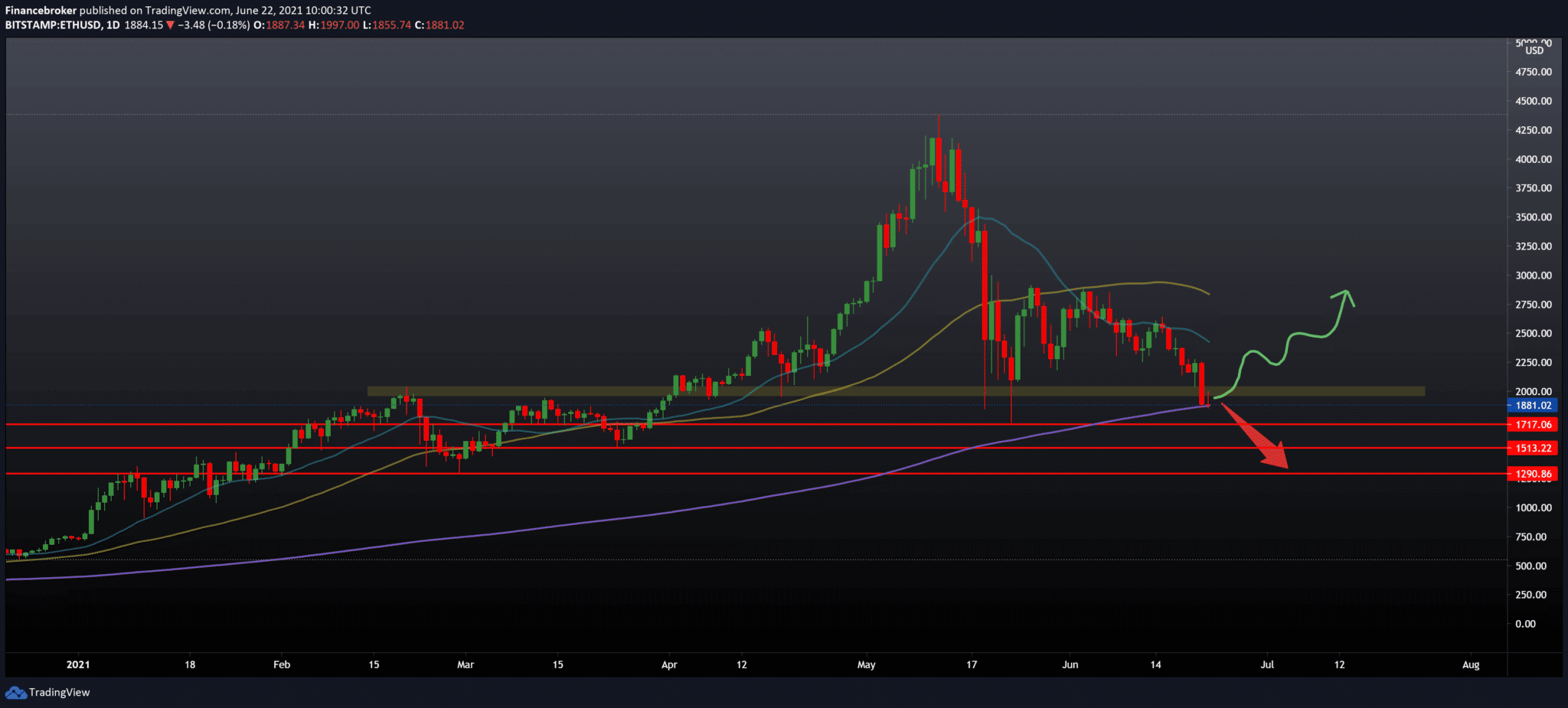

The new week began with the continuous decline of the cryptocurrency market because all 10 of the best coins are in the red zone. The Ethereum rate has fallen by 7% since yesterday, while the price change over the last week was -23.54%. Ethereum (ETH) broke support at $ 2,040, confirming the bearish impact. However, the current decline may continue to support high sales.

In this case, the chances are high that the price will be reduced to the next level at $ 1,720. However, in the weekly time frame, the decline does not seem to stop. Therefore, Ethereum (ETH) can reach 1,200 dollars if the bears break through the zone at around 1,500 dollars.

Bitcoin and Ethereum prices have been hit hard as major Chinese banks have suspended all transactions related to crypto products. The latest action followed weeks after local directives aimed at removing mining work.

Digital Currency Group announced on Monday that it would buy ETCG worth $ 50 million – a share owned by its subsidiary Grayscale, the proxy for owning Ethereum Classic. “DCG plans to use cash to finance the purchase and will make the purchase on the open market, at the discretion of management,” the company announcing the purchase said in a statement. However, the DCG announcement does not seem to have given Ethereum Classic a noticeable market boost. On the contrary, the currency fell by about 10% on Monday, when there was a decline in crypto markets.

-

Support

-

Platform

-

Spread

-

Trading Instrument