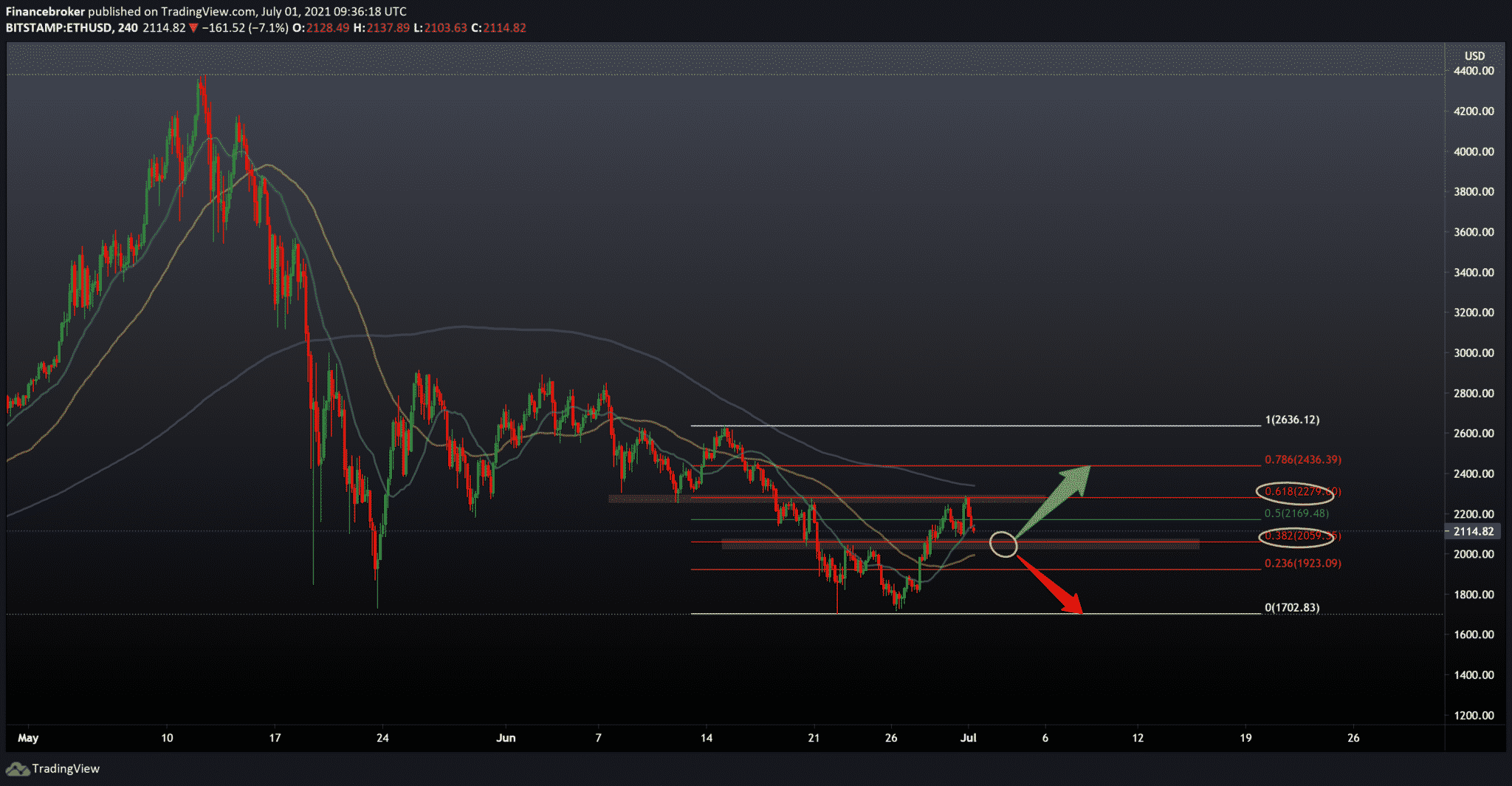

Ethereum bearish forecasts continue to put pressure

Ethereum’s upgrade to EIP-1559 is fast approaching, but derivative data shows retailers are less optimistic and predominate in terms of ETH’s short-term outlook.

Data on derivatives show that Ether traders feel less bullish compared to Bitcoin. Although ETH recorded almost 200% profit in the first half of 2021 compared to the modest increase in the price of Bitcoin of 22%, it seems that traders are more affected by the recent failure of Ether and the weak recovery of the price.

The institutional flow also supports the reduced optimism seen with Ether derivatives, as ETH investments suffered record outflows over the past week as Bitcoin flows began to stabilize. According to CoinShares, Ether funds experienced a record outflow of $ 50 million last week, and based on that; Ether investors have reason to fear because there is an abundance of uncertainty. Perhaps miners supporting a competitive chain of smart contracts or some other unexpected development could negatively impact the price of Ether.

Regardless of the rationale for the current price action, derivative indicators now signal less ETH confidence than Bitcoin.

Another thesis that could negatively affect Ether’s premium is the impact of the potential negative performance of 30% of Bitcoin.Co-founder of the Decentrader trading package and An independent market analyst Filbfilb said a 30% drop in Bitcoin could encourage altcoins to fall twice as high as 60%.

Clem Chambers, CEO of the financial analytics website ADVFN, also predicts another potential decline, which would repeat the crypto period at the end of 2018. Chambers claims Bitcoin could collapse and fall back towards $ 20,000. Although the overall view of the market is neutral with a mild bearish, it seems reasonable to predict a frightening scenario for Ether, including uncertainties from the transition to Proof-of-Stake (POS).

-

Support

-

Platform

-

Spread

-

Trading Instrument