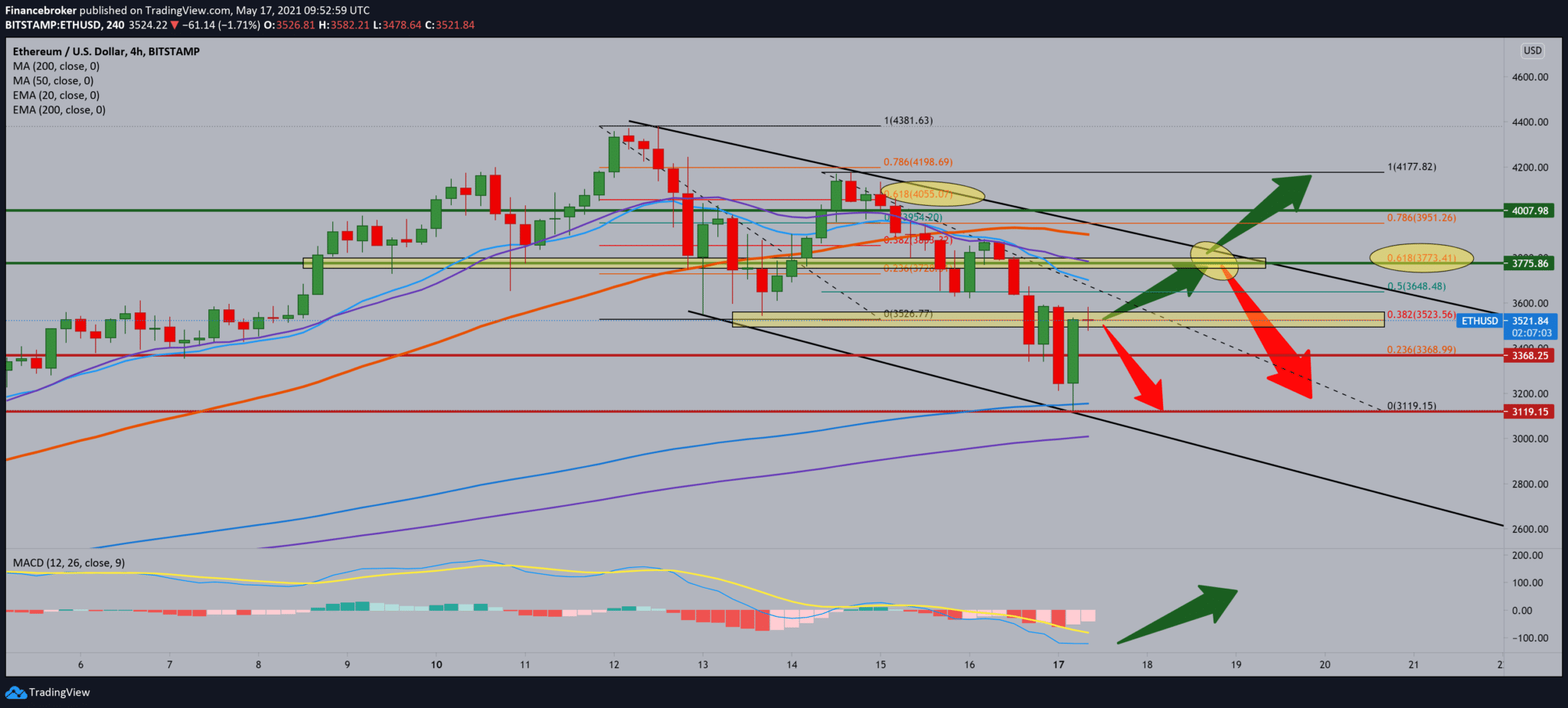

Ethereum analysis for May 17, 2021

Looking at the chart for Ethereum on the four-hour time frame, we can do the following technical analysis: After falling to a new low this morning at $ 3100, we can form a certain falling channel. Inside it, we see certain retreats, and previously it was up to the zone 61.8-78.6% Fibonacci level, which coincided with the upper line of the channel. Based on previous events, we can assume that we again see another pull to the top line of the channel to 61.8% Fibonacci level at $ 3775. Looking at the MACD indicator, we see that the bearish trend is gradually weakening. There is a likelihood of shifting to the bullish side to support the pullback towards the upper channel line.

The second-largest coin by market capitalization, Ethereum also recorded a price drop. There is no doubt that Ethereum took a long time to correct, especially after its price doubled from the maximum from 2017. Investors should not worry about the current decline in the crypto space because the fundamentals have not changed significantly. Institutions are in the market, and they will greatly support the current sell-off. For them, this is an opportunity they have been waiting for for a long time. Transaction fees are falling rapidly on Bitcoin and Ethereum, as coin prices deviate from both recent highs. Fees for Bitcoin and Ethereum transactions have fallen by 81% and 71%, respectively, in the last few weeks, as the wider cryptocurrency market continues to fall from its recent all-time high.

The average cost of using the Ethereum blockchain fell from 69.92 $ per transaction on May 12 to 20.06 $ by May 16, according to Bitinfocharts data. The daily number of Ethereum users has quadrupled since the beginning of 2020, rising from about 400,000 to 1.6 million, according to Bitinfocharts. This number does not take into account transactions that take place on Ethereum layer 2 protocols.

-

Support

-

Platform

-

Spread

-

Trading Instrument