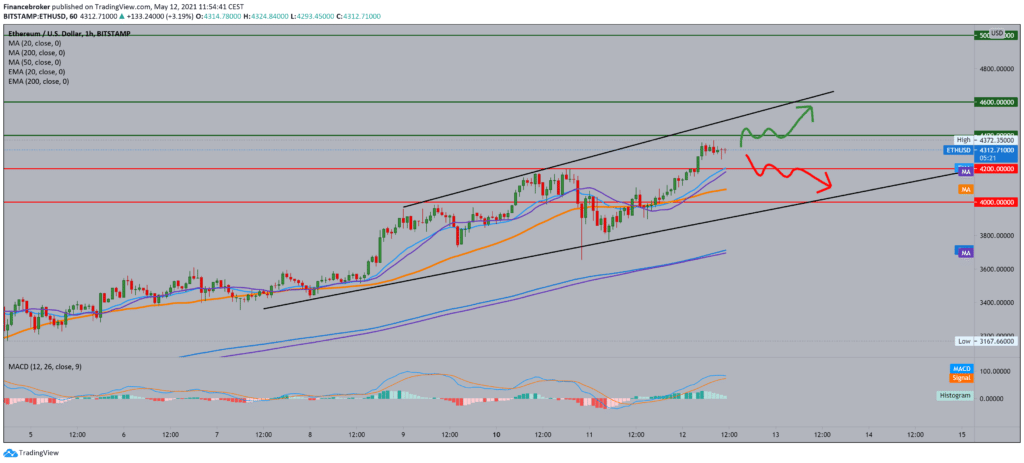

Ethereum analysis for May 12

Looking at the graph on the Ethereum chart one-hour time frame, we can do the following technical analysis. First, we are in a growing channel, and now after reaching a new historic high at $ 4372, we can expect some withdrawal within this consolidation within the channel. Moving averages are still on the bullish side, but we can expect a shorter pullback to bring the price closer to moving averages, and as the main support from moving averages, we see in the MA50. Looking at the MACD indicator, we see that the bullish signal is slowing down and that we can easily get a bearish signal soon. For now, we are in the neutral zone of the MACD indicator.

From the most important statements and news, we can extract the following information:

According to CoinMarketCap, on May 12, the price of ether set another historical record, jumping to as much as 4,346 dollars. Ether’s market capitalization briefly exceeded $ 500 billion, reaching nearly $ 505 billion on Wednesday. Ether is now larger than payment giant Visa or large investment bank JPMorgan in terms of market capitalization. Visa’s market valuation is $ 481 billion at the time of publication, while JPMorgan’s market capitalization is $ 488 billion, according to data from the financial information website MarketWatch. Ether is the second cryptocurrency to reach the $ 500 billion market mark after Bitcoin. Gas charges, however, remain a headache for Ethereum network merchants and users. According to data from BitInfoCharts and Blockchain, the average cost of an Ethereum transaction is currently $ 64, partly driven by demand for the Ethereum token (and Dogecoin doppelganger) Shiba Inu (SHIB) – and its own copies. Stock Exchange CEO Binance Changpeng Zhao tweeted that the platform “was left without ETH (-1.4%) deposit addresses due to SHIB”, which has never happened before for any ERC20 token “. Ethereum fees, called gas, are expressed in ETH and vary depending on the type of transaction; for example, a simple transmission costs less gasoline because it is computationally less intensive. A replacement transaction of, say, ETH for VBTC (-0.04%) would cost more. In 2020 and earlier this year, it was not uncommon for Ethereum fees to become vertical as the DeFi platform grew. But this new pressure for compensation, instead of being the result of real smart contract platforms, mainly comes from traders who speculate about a litter of dog coins.

-

Support

-

Platform

-

Spread

-

Trading Instrument