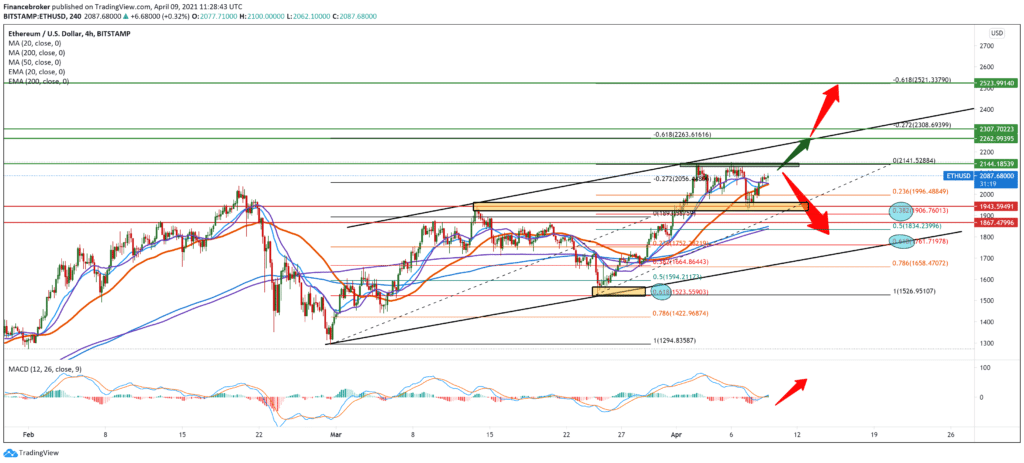

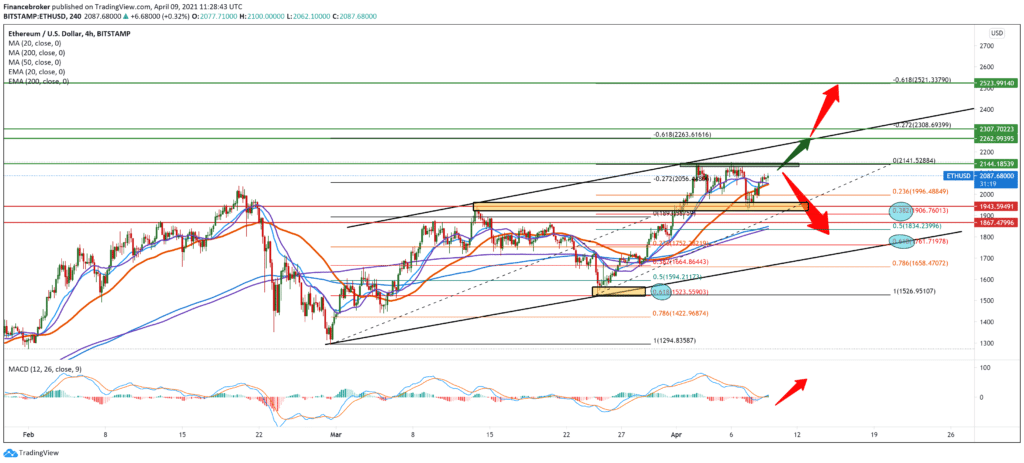

Ethereum analysis for April 9

Looking at the chart on the four-hour time frame, Ethereum found support at $ 1900 by retesting to the previous high at $ 1943. By setting the Fibonacci retracement level, we see the following. By setting the first Fibonacci level, the pullback ended at 61.8% level, making it higher low, which helped us form a certain growing channel. Ethereum reached the top line of the channel based on that channel, making the next pullback but only up to 38.2% on the new Fibonacci setup. If we see the rejection again from the previous maximum, we can expect a bigger pullback, and as the maximum target of this pullback, we have $ 1761. For something like that, we have to wait for the next few days to see how the price will behave around the previous high. A break above the previous high at $ 2145 takes us to new historical highs. Our next psychological target is $ 2200. With the Fibonacci target setting, we have $ 2262, $ 2307, and a maximum target of $ 2524.

The price of Ethereum is targeting new highs of all time with little forward resistance. Ethereum, worth about $ 52.2 billion, is currently locked in Defi. Several indicators show that ETH bulls have an advantage in the short and long term. The price of Ethereum has been consolidating over the past week after reaching its new record of $ 2,151. Digital assets are facing weak resistance to various chain indicators, while bulls are targeting $ 3,000. One of the main strengths of Ethereum is the significant number of coins locked from the stock market. At current prices, there is Ethereum worth over 52 billion dollars locked in Defi protocols. The ETH2 deposit agreement also holds 3.75 million ETH worth about $ 7.7 billion, which means that Ethereum is out of exchange close to $ 60 billion.

-

Support

-

Platform

-

Spread

-

Trading Instrument