Ethereum analysis for April 21, 2021

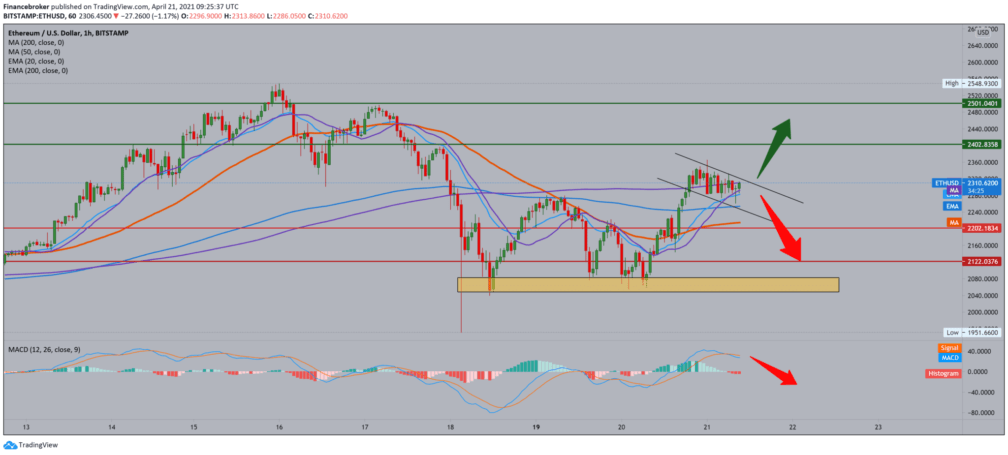

Following the chart on the hourly time frame, we see that Ethereum consolidates around $ 2300. Consolidation is slightly declining, but only a corrective price movement to better support where we can expect the next bullish momentum. Looking at moving averages, Ethereum has support for MA20, EMA20, and MA50, with current testing of the MA200 and EMA200. A break above these two higher moving averages will give us a better bullish signal.

After that, our targets are $ 2400, then $ 2500. We need a pull below moving averages for stronger bearish pressure for the bearish scenario, and then we look at the next supports at $ 2200 and then at $ 2100. The MACD indicator gives us the current bearish signal, and based on it; we expect a further pair of Ethereum to lower levels on the chart. This is an hourly chart so that everything can change quickly.

The price of Ethereum will rise more as three new ETFs gain approval in Canada, moving ETH adoption to another level. Canada’s Ontario Securities and Exchange Commission approved on Monday the Ethereum Stock Exchange (ETF) fund for CI Global Asset Management (ETHKS), earmarked investment (ETHH), and Evolve ETF (ETHR).

The move comes after Purpose Investment’s Bitcoin ETF, launched in February, crossed the $ 1 billion assets under management (AUM) threshold. Hence, the addition of three new ETFs has put Canada at the forefront of the cryptocurrency race. Canada’s decision comes when Ethereum gains major adoption, as Venmo, owned by PayPal, recently announced that it would allow its customers to buy BTC, ETH, and other cryptocurrencies.

While Canada has jumped ahead of the US, Chinese technology giant Meitu seems to be going a long way as it has invested millions in the purchase of ETH and BTC. While MicroStrategy, Tesla, and others have jumped into the Bitcoin bandwagon, Meitu is the first Chinese company in the world to buy large quantities of ETH.

-

Support

-

Platform

-

Spread

-

Trading Instrument