What is ETF compound interest?

In an economic context characterized by galloping inflation, becoming financially stable is essential to living decently and facing the future with serenity. Have you ever thought of investing in financial markets, and notably in ETFs and profiting from ETF compound interest? These trading instruments are considered safer than individual stocks and can generate you great passive income over time. Also they could be a part of your retirement planning. Let’s see what are ETFs, ETF compound interest and how you can benefit from it.

ETF compound interest – What are ETFs, and do they generate compound interest?

An ETF (Exchange Traded Fund), also called a tracker, is an index tracking that seeks to follow the evolution of a stock market index as closely as possible, both upwards and downwards. ETFs are investment funds issued by management companies and approved.

They have the particularity, unlike other funds, of being quoted continuously, i.e. they can be bought or sold throughout the day. As with shares, you place your stock market order with your financial intermediary and control the price of the order.

These trading instruments do not generate interest like other asset classes but they create dividends. Therefore it is viable to yield compounded interest investing in ETFs.

How to generate alternative income with compound interest?

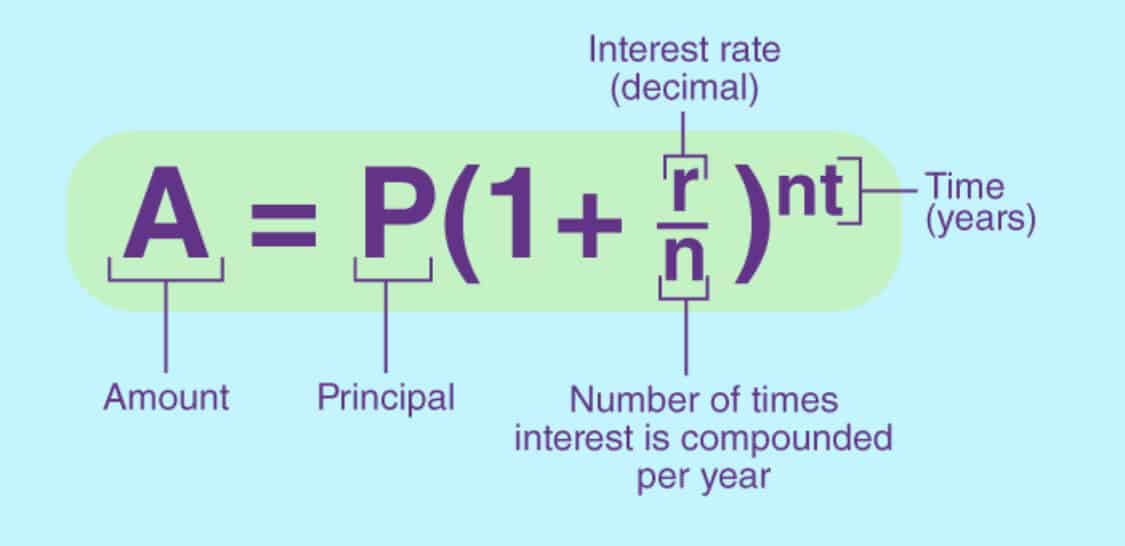

Unlike simple interest, the concept of compound interest is very impressive. You deposit capital that generates interest after a predefined period. At the end of this period, the interest generated is added to the initial capital to form new capital, which, in turn, will produce new interest. The interest is said to have been capitalized.

With compound interest, your capital grows exponentially at the end of each period since periodic returns are always reinvested. That said, it is important to note that interest rates are currently very low, given the economic situation.

For this reason, if you bet on savings accounts, you will not really enjoy the effect of the principle of compound interest. The best way to take advantage of this effect is to opt for investments because investment securities can earn you much more than just a savings account.

By reinvesting the income from your securities, you will greatly increase the growth curve of your income over the years. And the more you leave your capital, the more your financial wealth will grow and can even double over a certain time.

To determine the period after which your capital will double, divide the number 72 by the compound annual interest rate. If we take the previous example, the capital will more or less double in 18 years (72 / 4 years). Compound interest is, therefore, one of the main alternative income sources.

Compound interest and capitalizing or distributing ETFs

ETFs (or trackers) are baskets of financial securities, usually stocks or bonds. ETFs come in two versions: capitalizing or distributing.

When capitalizing income, ETFs retain dividends and interest paid by financial securities to add to total assets. This helps to increase the value of the ETF over time. With a capitalizing ETF, compound interest, therefore, occurs naturally.

In contrast, when distributing income, ETFs accrue dividends and interest over time but periodically (usually quarterly, half-yearly, or yearly) return them to investors, driving down the asset’s value. ETFs in proportion. In this case, to benefit from compound interest, the investor must buy new ETF units; otherwise, he is in the logic of simple interest.

It’s a bit restrictive but quite easy with ETFs: just pay a few transaction fees. On the other hand, it is much more difficult with a property: impossible to reinvest the rent by buying a few square meters each month!

For example, suppose you deposit $10,000 as an initial investment into your savings account at an interest rate of 4%. After the first year, your savings will earn you 400 euros. From there, your new capital will be 10,400 euros instead of 10,000 euros.

At the end of the following year, this new capital will produce 416 euros in interest, which brings your capital to 10,816 euros. In the third year, 10,816 will have produced 432.64 euros. You will therefore have 11,248.64 euros and so on. After 10 years, you will have 14,802.44 euros.

Now suppose that instead of leaving your capital as it is, you make a small monthly contribution of 50 euros. After 10 years, you get 22,294.25 euros. Even if we did not take into account the taxes to be paid, we could notice that for each year, the interest you collect will be higher than those which you received the previous year.

So, are you interested in compound interest? You can find a compound interest calculator to plan your next investment. There are many platforms where you will find built-in compound interest calculators that allow you to find the return on your investment.

ETF compound interest – how does it work

If ETFs pay you with dividends, these dividends can be treated in two different ways. Depending on the method of processing the dividends of the underlying securities, a distinction is made between distributing ETFs and capitalizing ETFs.

With a distributing ETF, dividends will be paid to you monthly (rather rare), quarterly or annually (more frequent). Your dividends are therefore paid directly into your pocket. So you can dispose of it as you wish.

If you are looking for an investment solution that will allow you to receive regular and stable long-term passive income, distributing ETFs may prove to be a perfect choice.

However, in this logic, you will have to prepare to declare your income to the tax authorities and pay taxes of 30% on the dividends you receive. In addition, if you decide to increase the number of your dividends at some point, you must acquire new ETF shares, which means paying transaction costs.

On the other hand, with a capitalizing ETF, the income from the investment is capitalized.

Thus, this ETF retains the interest paid and the dividends they add to the initial investment. In other words, compounding ETFs operate on the principle of compound interest.

They allow dividends to be reinvested in the fund, which increases the value of the ETF as the years pass. Obviously, this increase in the value of the ETF will be done without any particular procedure and without you having to pay additional costs.

Consequently, you will receive ever greater capital gains since your dividends also work for you. You will not have to pay tax unless you decide to resell your ETF. Note also that these two types of ETF, i.e. the distributing ETF and the capitalizing ETF, are equally accessible. So that’s how you can generate alternative income.

Note, however, that every investment involves a certain degree of risk and that you will have to make your choices after having done sufficient research.

Why invest in ETFs to generate alternative income?

The advantage of dividends is that they help you generate regular and stable earnings. It is very practical as an alternative source of income.

ETFs (Exchange Traded Funds), also known as Trackers or index funds, are funds that replicate the performance of an index or a commodity.

When you invest in a given ETF, you are investing in all the securities (stocks, bonds, etc.) contained in this ETF. For example, if you want to invest in the big French companies of the CAC 40 GR and you don’t really know the securities on which you will have to position yourself, you can simply position yourself on the Trackers CAC 40 GR.

These Trackers will therefore reproduce the performance of the CAC 40 index and, therefore, those of all the shares making up the index. This means you won’t have to place as many orders as there are stocks in the index. With a single ETF, you diversify and buy the entire CAC 40. This also applies to other indices, such as the NASDAQ.

- the duration of the investment;

- the annual rate;

- the amount of the initial investment;

- the amount of monthly contribution that you can decide to add to your investment.

So you may need to start getting a rough idea of the potential return on your investment over the years with the compound interest calculator.

ETFs – one of the best passive investing options

They are particularly suitable for passive investors. This is one of the best financial investment products if you want to generate alternative income with the stock market.

They can produce 90% better performance than traditional stock market investing. In addition, they come with relatively low management fees, approximately 0.2% – 0.5% per year compared to 2% for active funds. Also, note that ETFs are not subject to tax on financial transactions, which is 0.3%.

Furthermore, the fact that each ETF replicates the performance of all the securities of the relevant index means that the risk is spread over a large number of securities. Your investment is, therefore, not particularly likely to suffer from the individual failure of a company.

The economic, local or sectoral risk is considerably limited because you have invested in several companies simultaneously and located in several regions at the same time. This is the advantage of diversification.

Conclusion

However, it is not really possible to achieve financial independence without alternative income. In this article, we reveal secrets that allow you to generate alternative income and increase the value of your wealth over the years. Without further ado, here is how to generate your first alternative income, particularly with the help of dividends and ETF compound interest.