DYDX token is already on Binance. TB COIN and DXB are hot

Binance announced on Thursday that it would list dYdX (DYDX) tokens on its platform. The exchange will also open trading for DYDX/BTC, DYDX/BNB, DYDX/USDT, and DYDX/BUSD trading pairs. The dYdX layer two protocol created DYDX to use for utility and governance purposes. DYDX token gives its owners the right to propose or vote on changes to the protocol. It also allows users to receive various trading fee discounts and earn staking rewards.

However, dYdX offers much more than its native token. Blockchains have enabled people to own and transfer assets across an open network without needing to trust any third parties. Besides, blockchains are freely available worldwide, and they offer equality. Users don’t need to worry about other parties controlling their assets, as they have complete control. Such conditions have led to a rapidly increasing number of digital assets existing on the blockchain. While many centralized and decentralized platforms, designed to guarantee the efficient exchange of these assets, already exist, more are in development.

Such platforms enable traders and investors to take long positions in various assets. Despite that, it is currently very difficult and sometimes even impossible to take more complex financial positions. So, the dYdX team decided to improve the situation and offer its own solutions. This platform allows the creation of new asset classes which derive their value from underlying blockchain-based assets. Thanks to dYdX, financial products like margin trades and derivatives will allow Defi market players to achieve superior risk management with their portfolios. Investors will also be able to open new avenues for speculation. This network will increase market efficiency for the underlying asset by aiding its users in price discovery. dYdX will allow individuals to express more complex opinions on price and volatility.

What other advantages will dYdX offer to investors?

Nowadays, the size of the derivatives market far outstrips the market size of any other type of financial asset. By rough estimation, it is over $1.2 quadrillion. dYdX team believes that an ever-increasing number of traditional assets will start to be listed on the blockchain as decentralized platforms mature and offer significant advantages over traditional financial systems.

dYdX plans to offer a number of decentralized protocols implementing different types of crypto-asset financial products. The team created these protocols based on open-source Ethereum Smart Contracts.

Only a few existing decentralized protocols support margin trading or derivatives, and none of them have any significant usage. Meanwhile, centralized exchanges don’t offer adequate financial products on decentralized assets. As a result, it’s hard to take short or more complex financial positions on the bulk of decentralized assets at present.

The platform should be able to trustlessly exchange assets and determine the transactions’ price for decentralized derivatives or margin trading protocol to operate successfully. However, the market dictates the prices even as a decentralized exchange protocol facilitates the trustless exchange of one token for another.

According to dYdX, its platform can work with standard Ethereum-based decentralized exchanges. Initially, it plans to use the 0x protocol. With it, dYdX will enable token exchange at rates supplied by the protocols’ users. The team proposed several types of decentralized exchanges, including a hybrid off-chain order book approach, state channels, automated market makers, and on-chain order books. However, the company chose to base the dYdX platform on the hybrid approach offered by 0x. The dYdX team believes that this model will allow the creation of the most efficient markets.

What makes dYdX different from other similar platforms?

dYdX users will be able to sign and transmit orders on an off-blockchain platform. They will need to use the blockchain only for settlement.

Other platforms also attempted to create decentralized derivatives. For example, Velocity proposed using an Oracle-based approach. In this case, it would feed the exchange rates of asset pairs to smart contracts, which are responsible for the operation of options contracts. Afterward, the contract would use this price information to create as well as exercise options. However, using such an Oracle-based approach has several drawbacks, including the limitations on frequency, latency, and cost of price updates. The nature of blockchains makes it impossible to make such Defi markets as efficient as those built on traditional centralized exchanges.

Besides, using an oracle also adds a big deal of centralization to any protocol because some central parties have complete control over setting the price. That goes against the nature of blockchain and decentralized finance. And those central parties would have a huge economic incentive to manipulate prices in their favor if they were also trading on the protocol.

dYdX protocols will allow users to trade financial products at any price agreed upon by two parties. As a result, there will be no need for the contracts to be aware of the market price. Investors or traders can provide orders of their choosing, and the platform will use them to execute the exchange. Traders will be incentivized to choose orders with the best prices, as they will gain in the process.

What about TimeBox’s token?

The idea of Time Box is ingenious. It seems so easy to preserve our memories in the digital age in the form of photos or videos, or even diaries, but what happens if our treasured computer suffers some disastrous failure? Even Google Drive isn’t infallible. Time Box Network promises to keep its users’ valuable digital assets such as family photos, wills, and cryptocurrencies in a manner that would ensure their security, privacy, and accessibility.

According to the team, TimeBox is like a time capsule. It utilizes decentralized storage technology, along with smart contracts. Besides, the platform leverages blockchain technology with guaranteed delivery services.

The company launched its native token for utility purposes on August 8, 2021. It aims to raise 20 000 000.00 USD by trading TB COIN. Time Box Network accepts ETH in exchange for its ERC20 token.

DefiXBet is another hot token. What does it offer?

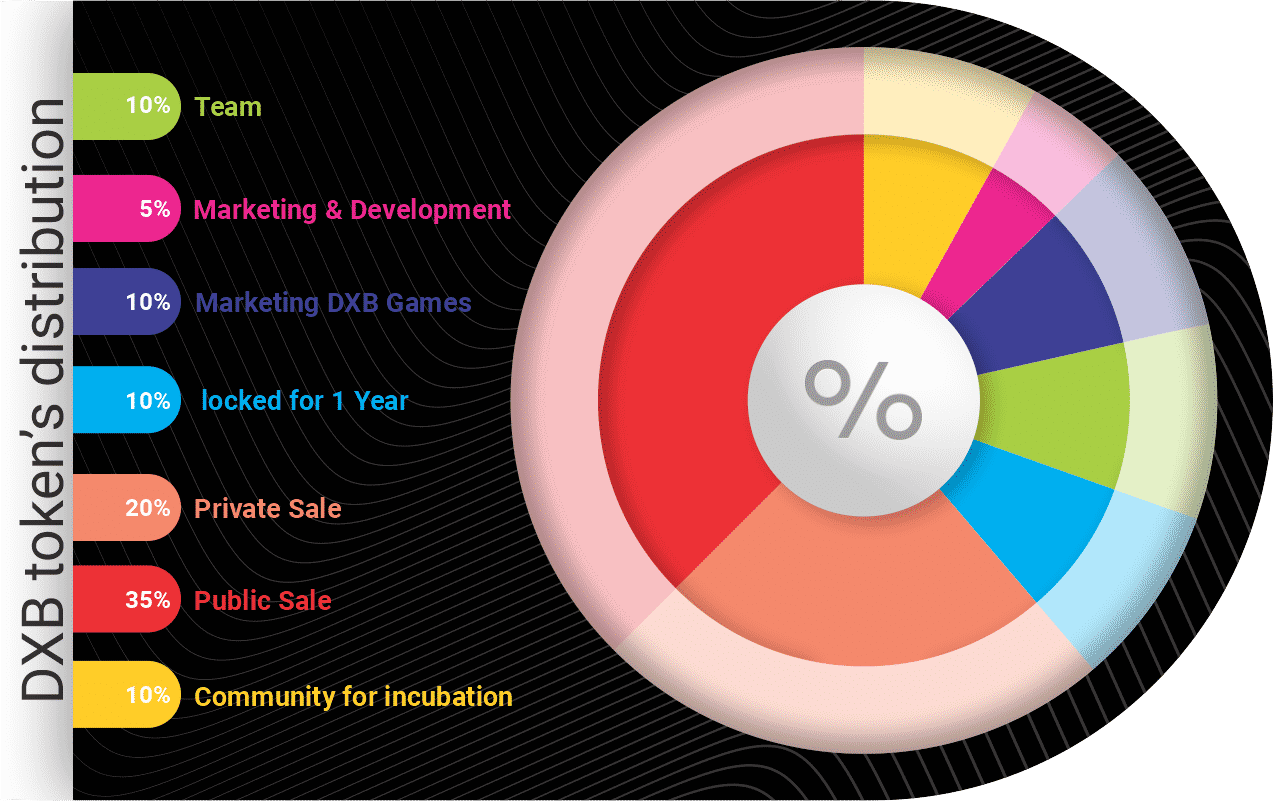

DXB is a fully decentralized P2P gaming and betting platform, which has no off-chain data. Instead, all data will be stored on the Blockchain using the chainlink oracles, SOLANA ecosystem, and chainlink VFR. The company is planning to share its profits among token holders by using the Defi protocol.

Furthermore, the DefiXBet platform introduced “C.D.B – Custom Decentralized Betting.” This interesting feature provides the ability for any player to create a new custom decentralized bet. It also provides a variety of betting options on DefiXBet’s platform. Users can share the result of their bets with other players.

More importantly, the DXB token has an actual use case. That makes this token unique and enables it to grow with the scale of the platform.

The company began its ICO sale on August 26, 2021. Currently, the DXB token has a very high ranking on the market. Its total supply is 20000000 tokens.

-

Support

-

Platform

-

Spread

-

Trading Instrument