Double Doji Pattern – What Is In For Trader

First of all, the Double Doji pattern is made up of two Doji candles, one after the other, and represents a strong reversal pattern. What’s interesting is that the above-mentioned pattern is rare. Usually, the double Doji pattern has stronger reversal strength compared to the Single Doji.

As a reminder, the Doji Star or Single Doji reflects the indecisions in the market. Interestingly, where the Single Doji ends, the Double Doji begins.

Doji forex strategy

Now, let’s take a look at the Doji forex strategy. The strategy mentioned earlier is based on the Daily chart Doji pattern. Usually, it has the most significant impact on daily, weekly, as well as monthly charts when a breakout happens.

The best strategy is to keep an eye on a number of triggers when you create a trade. For instance, important support or resistance level touch can be perfect triggers with a Doji pattern combination.

Types of Doji Pattern

You need to remember that the Doji pattern alone can’t be trusted as an indicator. The Doji pattern must be accompanied by a strong and significant signal in order to establish what the Doji pattern has been forecasting properly.

It is also important not to forget about various risk factors. Traders should pay more attention to risk factors.

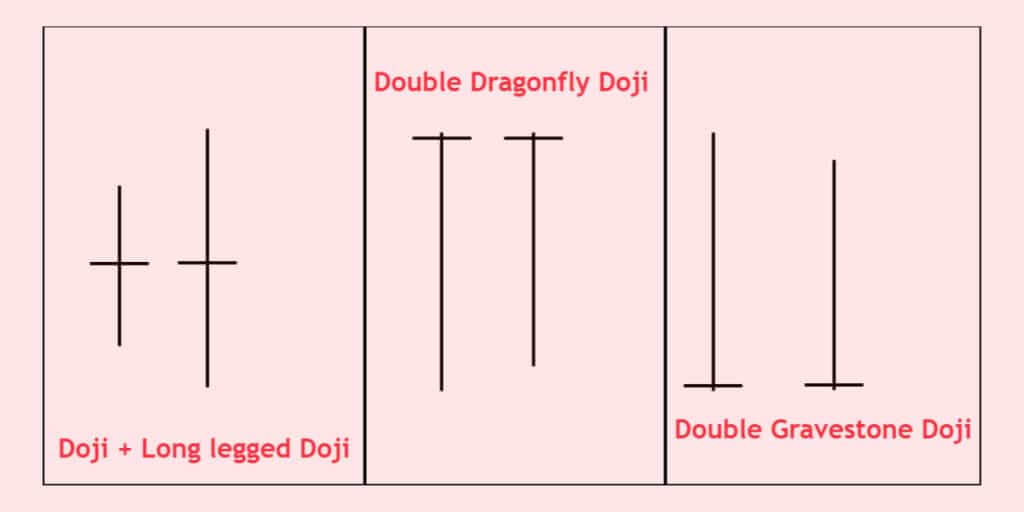

Let’s get back to the Doji candlestick types and take a look at several of them.

One of them is a Long-legged Doji. This type of Doji pattern is often associated with a market that has greater volatility. As in the case of the Doji star pattern, a Long-legged Doji also shows insulation in the market.

What about Dragonfly Doji?

You will find Dragonfly Doji tucked away at the bottom of a downtrend. The pattern mentioned above shows that lower prices have been rejected. It is noteworthy that Dragonfly Doji signals a bullish trend. As a reminder, Dragonfly Doji shows a change in the price direction.

Double Doji pattern and traders

Let’s get back to the Double Doji pattern and its role. What does it tell traders? Let’s find out!

Remember, a single candlestick isn’t enough to explain the complete market structure on a single chart. For instance, the Doji candle shows a trend pause, but how long a trend pause will stay in place? A Single Doji can’t answer the question.

When two Doji candlesticks form, it increases the chance of winning in an analysis. For instance, a Dragonfly Doji or a Gravestone Doji indicates a trend reversal. However, when two indistinguishable types of candlestick form back-to-back, then the probability of the result will increase.

Useful tips for forex traders

Inexperienced and experienced traders should take into account various factors.

It is vital to be familiar with the currency pairs you are trading in. As a reminder, different pairs behave differently. In order to better understand currency pairs, it is important to learn more about the countries, etc.

Moreover, it is hard to overestimate the importance of the bid-ask spread. Importantly, it is essentially the difference between the lowest sell and the highest buy price.

What about the leverage?

It is basically borrowed money. Interestingly, leverage can be your best friend or your worst enemy. For instance, leverage enables you to carry out large-volume trades with comparatively lower amounts of capital. However, too much leverage, together with losses in trading, can make it difficult to repay the borrowed capital.

You should pay attention to the forex trading strategies. Hopefully, there are various trading strategies. So, you can select a strategy based on your needs.

As stated above, there are numerous strategies you can rely on based on the market movements and your plans.

We couldn’t finish this article without mentioning a trading plan. It is important to have a trading plan. To cut a long story, a trading plan also ensures that you monitor your trading goals before you buy a foreign currency or sell it.

Last but not least, you need to control your emotions. It is a well-known fact that the forex market is very volatile. However, in spite of the many price movements, it is vital to remain unbiased.