Demodyfi and Freela launched their tokens – DeFi market wrap

DeFi space contains many protocols, and their number is growing daily. However, some of those protocols are unique, based on original ideas and solutions. Freela is one of them. It is a Defi-powered, self-governing DAO. The team specifically designed Freela to act as a broad decentralized platform for freelancing transactions. This protocol provides a platform for both P2P (Peer to Peer) and B2B (Business to Business) commission-free transactions as its user interface matches skilled freelancers for job postings around the globe.

Furthermore, Freela brings in a unique, innovative model with professional mediation, ensuring profitable transactions between employers and employees. The employer gets the best quality work, while an employee has the best remuneration for their efforts.

Many platforms attempted their best to decentralize, but most of them ended up only in the small niche part of the market. Meanwhile, some of those protocols that catered to larger markets were forced to become centralized. Freela is trying to avoid that end by using DeFi liquidity pools, Blockchain technology, and DAO governance on its platform.

How many tokens are available during the ICO?

Like many other protocols, Freela launched its native utility token to offer its customers more advantages. However, only 10,000 FRELs are for sale during the initial token offering, and the ICO price is $58 per token. The sale began on May 26, 2021, and the token has already gained a high ranking.

The company offers people in business to find the right person to do the right job for the right pay. It enables the employer to pay the employee with absolutely no commission or transaction fee in between. The team claims that once an employee/employer experiences this unique model, they will be hooked to their platform for life. Freela transactions are free thanks to being deployed on enterprise-focused Polygon (Matic).

The company offers truly free freelancing. The platform also developed reliable governance with zero human interference. It can provide a greater sense of security to every stakeholder and successfully satisfy their requirements.

What advantages does the Demodyfi token offer?

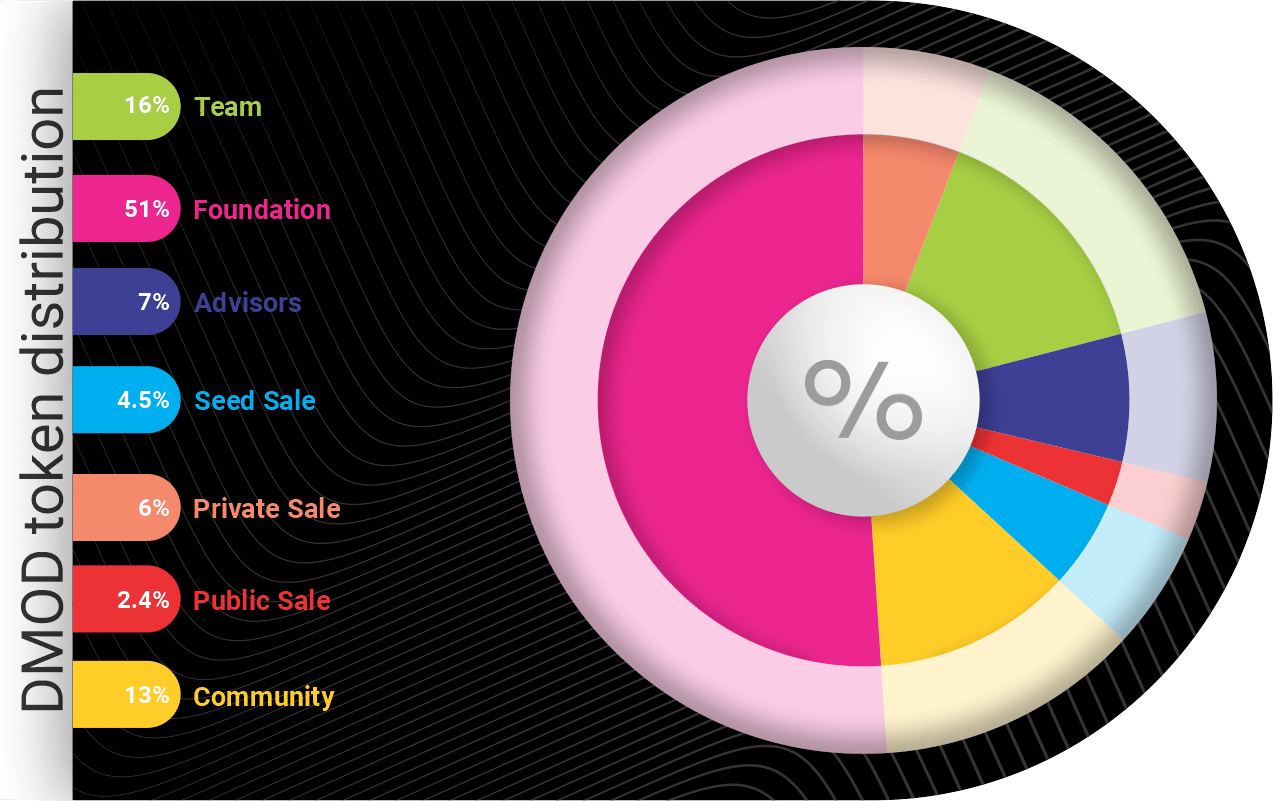

Demodyfi launched its native token DMOD today, and the sale will end on May 29, 2021. This protocol supports the value interoperability between different parachains. As a result, it enables investors to trade and circulate the tokens on the Polkadot chain quickly. Demodyfi is integrating, and it combines communication between different blockchains. The project aims to raise $300 by trading 2,400,000 tokens. An ICO price is $0.25 per DMOD.

According to the team, Demodyfi utilizes Moonbeam’s parachain smart contract interoperability. Meanwhile, the Substrate framework acts as a fundamental layer. Combining these two makes building the protocol on Polkadot much easier. Besides, Demodyfi protocol is compatible with the EVM. It uses tools available from the Ethereum stack to deploy EVM-based bytecode compiled from Solidity.

Substrate and Polkadot lay the groundwork for new forms of social organization and decision-making by building on Moonbeam. On the other hand, Demodyfi platform leverages Substrate’s treasury management capabilities and governance along with Polkadot’s cross-chain messaging. It uses both of them to create a decentralized sovereign wealth fund. Demodyfi aims to fund and secure a parachain slot, as well as drive further development.

The company has the real potential to build a next-generation DEX extending its DeFi product line into a cross-chain and single-source market. The ability to provide both cross-chain swaps and pools, powered by the Polkadot ecosystem, can offer higher throughput for faster and cheaper transactions. And simultaneously guarantee connection with the Ethereum Network and other blockchains for liquidity

How can token holders use DMOD?

The DMOD token serves as the native currency for the Demodyfi protocol. The team designed the token to offer its customers traditional financial products and services without the centralized authority of banks or other financial institutions.

Demodyfi distributes the token as a reward for contributions made to the platform. It also provides access to a variety of economic incentives. Token holders can participate in decisions affecting the parameters of the system. Furthermore, the DMOD will have an annual inflation rate based on the initial token supply after the token sale ends.

Meanwhile, Binance listed LPT token

Binance announced today that it plans to list Livepeer (LPT) token on its platform. The exchange will open trading for LPT/BTC, LPT/BUSD, LPT/BNB, and LPT/USDT pairs at 2021-05-28. An open video streaming infrastructure Livepeer is built on the Ethereum blockchain. Developers use it to power their creator economy live streaming applications.

The platform has launched its native utility token LPT. The token holders can use it for network governance, as well as staking by node operators and delegators to secure work. Besides, the token is another incentive for users to participate in the network development.

Livepeer.org aims to become the best portal to Livepeer for its users and participants. To achieve that goal, it uses the power of open-source software to harness underutilized resources like bandwidth and compute. The platform also uses crypto-economic incentives for participation and bootstrapping. As a result, it is able to deliver an infrastructure that can power video streaming applications at an infinite scale and at a highly efficient price.

Livepeer offers lots of advantages, but what’s more important, it offers developers a chance to create such video applications that couldn’t exist under traditional, centralized cost structures. However, their creation is now possible thanks to this platform, which also provides the proliferation of high-quality cameras and ubiquitous bandwidth. Livepeer has the potential to unlock communications, entertainment, and economic opportunity for society going forward.

What about Livepeer Token type?

LPT is an ERC-20 token, and it is available on a number of non-custodial and custodial exchanges. Token holders can perform or delegate work on the Livepeer network, as well as vote on protocol proposals.

Livepeer team stated that they hope to help capture this opportunity and fulfill the project’s mission – building the world’s top open video infrastructure.

The founders of the Livepeer project created a company – Livepeer, Inc. in 2017. They wanted to help facilitate its early development and guide the project’s path to decentralization.

-

Support

-

Platform

-

Spread

-

Trading Instrument