DeltaStock Review 2022 – All pros and cons

| General Information |

|

|---|---|

| Broker Name: | DeltaStock |

| Broker Type: | Forex & CFDs |

| Country: | Bulgaria |

| Operating since year: | 1998 |

| Regulation: | FSC |

| Address: | 6 Korab Planina St, 1407 Sofia, Bulgaria |

| Broker status: | Active |

| Customer Service | |

| Phone: | +359 2 / 811 50 50 |

| Email: | [email protected] |

| Languages: | English |

| Availability: | Monday to Friday, 08:45–17:45 EET |

| Trading | |

| The Trading platforms: | MetaTrader5, Proprietary |

| Trading platform Time zone: | N/A |

| Demo account: | Yes |

| Mobile trading: | Yes |

| Web-based trading: | Yes |

| Bonuses: | No |

| Other trading instruments: | Yes |

| Account | |

| Minimum deposit: | N/A |

| Maximal leverage: | 1:200 |

| Spread: | N/A |

| Scalping allowed: | Yes |

CONTENT

- General Information & First Impressions

- Fund and Account Security

- The Trading Accounts

- DeltaStock’s Trading Platform

- Funding and Pricing

- Customer Service at DeltaStock

- Conclusion

General Information & First Impressions

DeltaStock is a Bulgarian CFDs brokerage that offers trading services on a variety of assets. It primarily targets EU customers, offering them a place to trade effectively. Our DeltaStock review will inspect its service to see how well it fares against other popular brokerage options.

And right off the bat, we’ve noticed that DeltaStock is a bit all over the place. The website has a lot of redundance, with multiple web pages having similar or the same content. That creates confusion when you’re trying to navigate the website, which can be hard on newer traders.

Getting around the website isn’t the only issue. The similar pages often have informations their pairings don’t. As such, to get the full picture, you might need to comb through multiple pages, although they concern one topic.

That leads us to our next issue in that the broker writes a lot without saying anything. A lot of the content on the website is meaningless and burries information that users may actually be looking for. As such, the process of going through deltastock.com is much more tedious than needed.

Lastly, even the information that’s there isn’t complete. There’s a lot of crucial info missing from the broker’s website, as you’ll see later in our DeltaStock review. So even if you take the time to rake through the boring bits to find the important ones, it may not matter.

Needless to say, that isn’t a great first showing for DeltaStock. We believe websites serve an important role in presenting the broker to its desired public. With DeltaStock’s shoddy performance, it doesn’t set expectations quite high, although it is at least out of scam territory.

Fund and Account Security

DeltaStock’s security is in a strange place. As we said just a bit ago in our DeltaStock review, we don’t think it’s a scam. However, it’s apparent that it doesn’t shy away from lying to make its security look beter than it is. The funny part is that it didn’t need to do that at all, as the security was solid.

The broker’s safety hinges on two things, its experience and its regulation. As an EU broker, it adheres to MiFID II, and it holds a license from Bulgaria’s Financial Supervision Commission (FSC). National regulators within the EU are reasonably strict, so that’s reassuring.

It’s also been around since 1998. While that’s an extremely long time, it’s important to note that its appearance and features have changed drastically. So while we can’t count all that as experience, it is an established company. As a rule of thumb, more experienced companies have an exponentially lower chance of turning out as scams.

However, there is the outstanding issue of how the broker presents information about itself. In the previous section of our deltastock.com review, we said that it was quite reserved information-wise. But when talking about itself, it tends to frame statements in a way that it’s easy to misinterpret them in the broker’s favor.

For example, on the broker’s “about us” page, it starts listing regulators for various EU countries. The implication is that DeltaStock is regulated by all those entities, but of course, it’s not.

As we said, we don’t believe it’s a scam, but it does look like it’s not afraid of underhanded tactics. And while we don’t believe the broker will try and steal from you, it’s best to be careful.

The Trading Accounts

Due to DeltaStock’s odd approach to information, it’s fairly difficult to figure out the account specifications. We’ll start with what’s clear and work our way down, but there’s still we’re in the dark on.

For starters, it’s clear that DeltaStock has a demo account that its customers can use. To give credit where credit is due, we feel like that improves the service quite a bit. It also mends the issue of the broker’s lack of info slightly. Since you can check everything out on the demo account, you can still learn what you want.

Of course, that’s no excuse for the broker’s shoddy structure that needs significant improvements. For example, the broker doesn’t say anything about its retail account anywhere. And since we’d say a majority of DeltaStock’s potential audience is retail traders, that’s a significant mistake. Even worse, there is a “my DeltaStock account” page, but it’s a fakeout since it’s a login screen.

After that, the broker fixes the situation a bit with its pro account by explaining the specifications. Still, it’s not out of the woods yet, as the pro account isn’t anything special. There’s nothing to support specific trading conditions, and nearly no customization. If the account targets professional traders, the broker should have had the foresight to let them trade their own way.

Altogether, the account structure is fairly disapointing. As we explained earlier in our DeltaStock review, it could have been much better, but the broker wasted the opportunity. As-is, there are a lot of brokers out there that are better both customization-wise and have simply more potent accounts.

DeltaStock’s Trading Platform

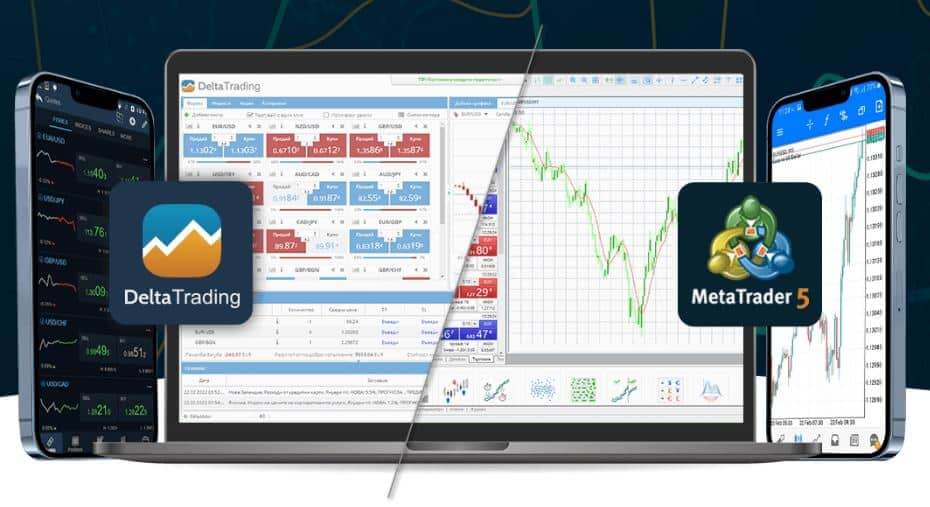

If there’s one spot where DeltaStock didn’t flounder, it’s the broker’s platforms. It offers multiple choices, which goes a long way toward making its traders feel familiar and secure.

The first option is the broker’s proprietary platform. The software is alright and the platform is about what you’d expect it to be. The interface is intuitive and the analysis and automation features work properly. At this point, most brokers’ proprietary platforms fare well against more standard solutions.

However, some traders do feel an instinctual animosity towards broker-crafted software. Some have security-related premotions and for some, the functionality is the issue. Luckily, the broker also provides MetaTrader 5, which is one of the most widely-used platforms globally.

It also gives traders a sense of familiarity as soon as they join, as they won’t need to learn how the new software handles. We believe that’s a solid solution that provides traders the best of both worlds.

Of course, both platforms have web and mobile options for traders that prefer those.

Funding and Pricing

The prominent issue in our DeltaStock review becomes even more pronounced when it comes to pricing. As we know, how much money goes to your service provider largely shapes your experience. That’s especially true if you’re someone that aims for incremental gains instead of shooting for those massive wins.

If your yearly gain target is let’s say 5% but a broker takes 1% of your investment, that’s 20% of your profits. However, DeltaStock didn’t seem to bother with detailing its fee structure or the conditions you get.

As such, joining the brokerage is a gamble, especially since its demo account doesn’t include fees. We feel like that’s much more egregious than the previous areas where it was already a problem.

We can use a product without a price to recontextualize the issue. If there were two similar products on a shelf and one was $5 while the other didn’t have a price tag, which one would you grab?

Unfortunately, the amount of money here far exceeds $5, and you can lose hundreds or even thousands of dollars to fees. Naturally, that depends on your trading volume. No matter how much money it is, it’s ridiculous that the broker didn’t bother with detailing its pricing scheme.

Deposits and withdrawals are more of the same. DeltaStock did put up the methods you can use on its website, so that’s a slight win. However, it doesn’t clarify whether or not they have any additional charges attached to them. Furthermore, there’s no info on how fast the payments process, so who knows when you’ll get your money.

What little potential DeltaStock had left got destroyed by it not clarifying the most important part of its service. As it stands, we can’t suggest you put any money into a deltastock.com account.

Customer Service at DeltaStock

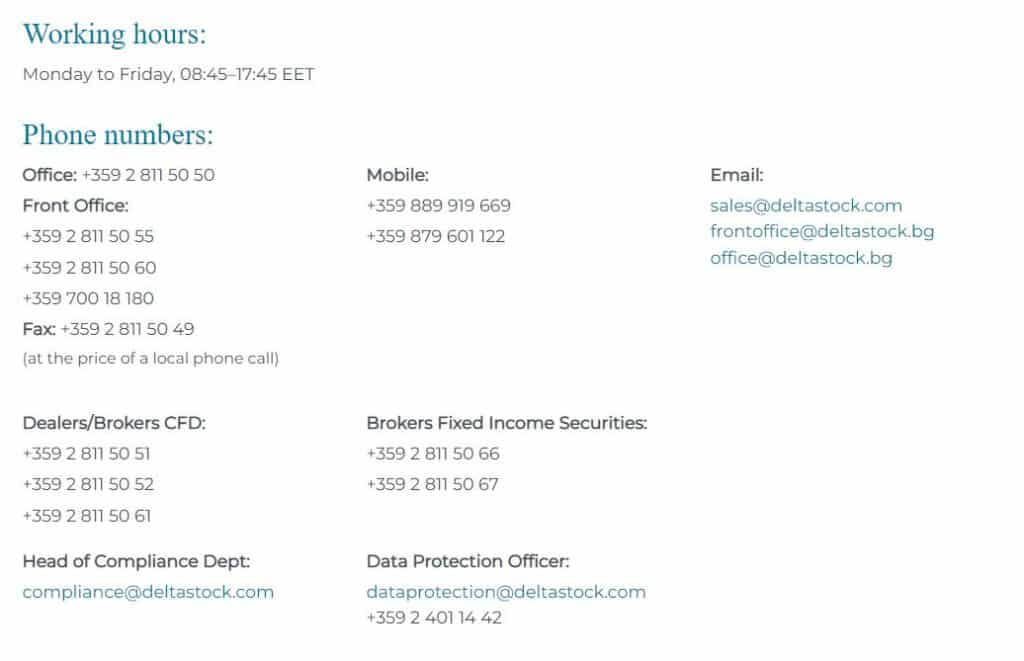

Besides a slightly odd operating time of Monday to Friday, 08:45–17:45 EET, there’s nothing notable about DeltaStock’s support. That isn’t necessarily a bad thing, as all it needs to do is answer questions and resolve issues. One thing that’s missing is a live chat, but the broker makes up for that with multiple phone lines. Altogether, we don’t believe there will be any issues in the broker’s communication with customers.

Phone: +359 2 / 811 50 50

Email: [email protected]

Conclusion

Throughout our DeltaStock review, the one prominent issue is it not keeping its customers informed. We actually believe the broker has a solid product on its hands, and the brokerage itself may need a few minor tweaks. However, the issue arises in how the higher-ups are handling and designing the company.

On numerous instances, the broker lies or at least tells half-truths to make itself seem better. Perhaps that wouldn’t be as much of an issue if it wasn’t also extremely secretive about important aspects of its service.

Unfortunately, the broker’s current state doesn’t have enough going for it to choose it over alternatives. It’s not that the broker is horrible, but the competition is cut-throat and you can’t afford glaring mistakes like not pricing your product. It’s unfortunate to end our DeltaStock review on a low note, but that’s how it has to be for now.

-

Support

-

Platform

-

Spread

-

Trading Instrument

Impressive services

Impressive services with good signals. The moment I started trading I have zero knowledge and zero trading experience. Glad I traded with the right broker, they’ve helped me succeed.

Did you find this review helpful? Yes No

Great trading experience

I had a great trading experience with this broker. I was able to withdraw a decent profit monthly. I never had any problem with any of their transactions.

Did you find this review helpful? Yes No

The best forex company

The best company for online trading. I really had a blast.

Did you find this review helpful? Yes No

Quick withdrawals

Quick and easy withdrawal process. I gain good profit, too.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker service. Signals are always accurate and profitable. Services are always efficient.

Did you find this review helpful? Yes No

Delivers fast resolution

They always deliver a fast resolution. Very minimal losses, good services from day 1 till present. Been trading with them for a year now.

Did you find this review helpful? Yes No

Good broker services

Fast execution, swift withdrawals and good services are just among the good things I like about this broker.

Did you find this review helpful? Yes No (1)

Fast and easy withdrawals

Fast and easy withdrawal process all the time. I have made several withdrawals and all are smoothly processed.

Did you find this review helpful? Yes No

Good broker

No regrets joining, I got really good profit and no problem with services. I have been with them for almost 2 years and they have helped me change my lifestyle for good.

Did you find this review helpful? Yes No

Good trading platform

Good trading platform and services. Thumbs up for this broker company.

Did you find this review helpful? Yes No

Hassle-free withdrawals

They are transparent on all transactions. They also process withdrawals swiftly and hassle-free.

Did you find this review helpful? Yes No

Good broker

I had a really good start with this broker. The services are good and the signals are reliable, too.

Did you find this review helpful? Yes (1) No

Affordable trading

I can trade at a lower cost. They have affordable initial deposit and trading assets. Signals are also reliable.

Did you find this review helpful? Yes No

Professional brokers

I would like to commend this broker for having such a knowledgeable and skilled broker. They have accurate signals and sound marketing analysis.

Did you find this review helpful? Yes (1) No

Good broker services

Fair trading terms and conditions. Good broker services as well. I have been trading for a couple of months and had several withdrawals. So far, all is good.

Did you find this review helpful? Yes No