Currency Pairs Major, Minor, and Exotic Pairs – Chapter 3

To thrive in the world of forex trading, one must recognize the significance of currency pairs – the base currency and the quote currency. Every movement in the exchange rate, every fluctuation in the market, becomes an opportunity to capitalize on the intricate dance between currencies.

Remember that trading currency pairs is not just about understanding the nuances of each currency but also about grasping the larger economic narratives that drive them. Whether it’s the EUR/USD or the exotic rhythms of USD/CHF, successful forex trading hinges on a deep comprehension of how these pairs interact with the global economic landscape, shaped by liquidity, trading volume, and the ever-present pulse of market sentiment.

What is currency pair – definition

A currency pair is the quotation of two different currencies, with the value of one currency being quoted against the other. The first listed currency of a currency pair is called the base currency, and the second currency is called the quote currency.

Understanding Forex pairs – Types of Currency Pairs

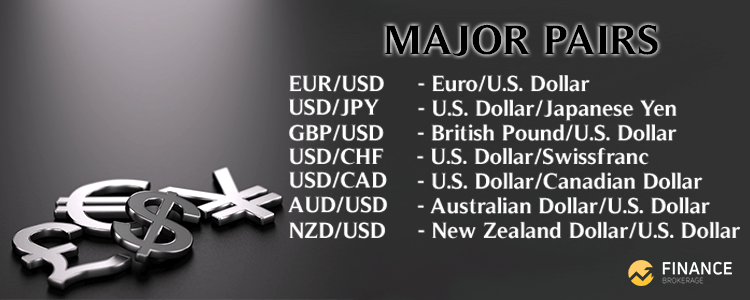

Major Pairs

Major currencies like the US dollar, British pound, and the euro, often paired with each other as in EUR/GBP, stand as pillars within the forex trading landscape, frequently dictating the tempo for other currencies.

Currency pairs such as USD/CAD and USD/CHF allow traders to speculate on the movements of the Canadian dollar against the US dollar and the Swiss franc against the US dollar, respectively. These major currency pairs are not just indicators of individual currency strength but also serve as economic barometers for their respective nations.

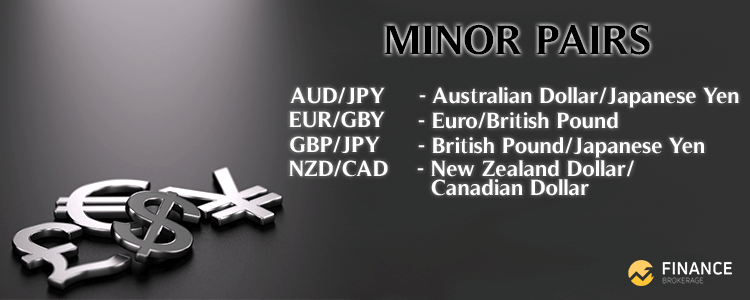

Minor Pairs

When there is a major, there is always a minor. These pairs don’t include the US dollar, and they’re also known as cross currency pairs.

These pairs often show more wild swings due to less liquidity. Therefore, theirs spreads are also often wider than the major pairs. Here are few examples of minor pairs:

The most actively traded crosses are derived from the three major non-USD currencies. These are the EUR, JPY, GBP.

Exotic Pairs

These are the pairs that are rarely traded in mainstream financial markets. Exotic pairs consist of on major currency paired with the currency of an emerging economy. This economy could be strong but smaller from a global perspective such as Hong Kong, Singapore, and European countries outside the Euro zone. Here are some good examples of exotic pairs:

These pairs are not traded as often as the majors or minors. Meaning, the cost of trading with these pairs can get higher than the other types of pairs due to the little or lack of liquidity.

Now that you understand the different types, it makes sense to pick a currency pair now, right?

No, not yet.

You might be asking yourself, “Why can’t I just pick these pairs if they have narrow spreads and high liquidity?”

That’s right, narrow spreads and high liquidity are good. But you’ve already made a rookie mistake.

If you don’t know what you’re doing when trading multiple pairs simultaneously, you can just watch your account burn slowly.

Fortunately, because this is currency trading for dummies, we’ll show you why.

Currency Pairs Correlation

Trading in forex, you have to know that no currency is an island in the forex market. Currencies are always quoted in pairs. Therefore, all currency pairs are interlinked.

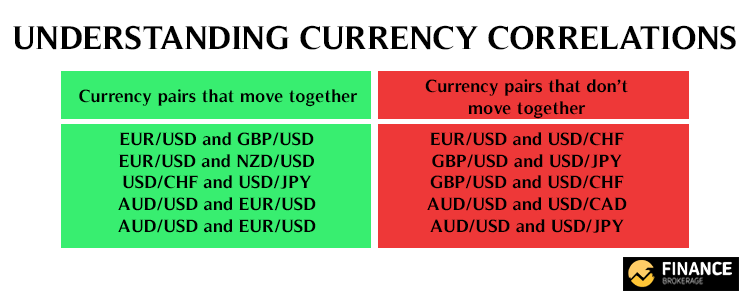

Currency correlation refers to whether two pairs move in the same, opposite, or random direction.

With that said, it’s very important that you understand how different pairs move in relation with each other. All the more if you’re not familiar with how currency correlations can affect the amount of risk you’re exposing.

How would you know if it’s a correlation?

When you notice a specific currency pair rises and another pair falls, that is correlation. Even if that pair falls, and the other pair also falls, that is also correlation.

But what if the other pair didn’t do anything?

Correlation Coefficient

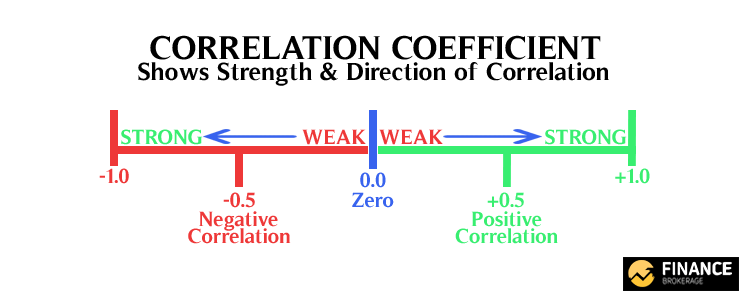

A correlation coefficient ranges between -1 and +1. This is how we measure the correlation.

When you reach +1, this is a perfect positive correlation. This means that two currency pairs will move in the same direction 100% of the time.

When you reach -1, this is a perfect negative correlation. This means that two currency pairs will move in the opposite direction 100% of the time.

What if the correlation is 0?

Then the movements between two pairs have zero or no correlation at all. They are entirely independent and random from each other.

What are the possible currency pairs that correlate with each other?

GBP/USD, AUD/USD, NZD/USD, and EUR/USD are positively correlated with each other. As you can see, the counter currency is the US dollar.

Thus, any change in strength of the US dollar directly affects the pair as a whole.

USD/CHF, USD/JPY, and USD/CAD are negatively correlated pairs. As you may have notice, the base currency is the US dollar. That is the reason why they move in the opposite direction of the majors mentioned above.

Knowing which pairs move opposite and which move the same is very useful for a trader. However, it can be difficult to determine, especially the correlation in forex can change.

What Makes Currency Pairs Move?

Currency pairs don’t just randomly move up or down by themselves. There are several factors that drive the market. And you can take advantage of them.

Trading currency pairs offers a window into the financial heartbeat of the world’s economies. From the popularly traded EUR/USD and USD/JPY, embodying the highest trading volume and high liquidity, to the commodity-driven pairs like AUD/USD where the Australian dollar meets the US dollar, each pair presents unique opportunities and reflects a myriad of global economic forces.

How Currency Pairs Work

Currency pairs are the foundation of forex trading, representing the exchange rate between two currencies. Here’s a breakdown of how they work:

-

Composition of Currency Pairs:

Base Currency: The first currency listed in a forex pair is called the base currency. This is the currency that you are buying or selling. For example, in the pair EUR/USD, the EUR is the base currency.

Quote Currency: The second currency listed is known as the quote or counter currency. It represents how much of the quote currency you need to spend to purchase one unit of the base currency. In EUR/USD, USD is the quote currency.

-

Reading a Currency Pair:

The value of a currency pair is how much one unit of the base currency is worth in the quote currency. For instance, if EUR/USD is trading at 1.1800, it means that 1 euro is equal to 1.1800 US dollars.

-

Trading Actions

Buying (Going Long): When a trader expects the base currency to strengthen against the quote currency, they will “buy” the currency pair, meaning they buy the base and sell the quote currency.

Selling (Going Short): Conversely, if a trader believes the base currency will weaken, they will “sell” the pair, selling the base and buying the quote currency.

-

Pips and Lots

Pips: A pip is a standard unit of movement in forex trading and represents the smallest change in value a currency pair can make (except for fractions of a pip or ‘pipettes’).

Lots: Forex is traded in specific amounts called lots, which refers to the number of currency units you will buy or sell. The standard lot size is 100,000 units of the base currency.

-

Spread

The spread is the difference between the bid (sell) and ask (buy) prices quoted for a currency pair. Tighter spreads generally mean lower trading costs.

By understanding these aspects, traders can effectively enter and exit positions, capitalizing on the fluctuations in the relative strength of one currency against another. The forex market’s complexity offers a variety of currency pairs to trade, each with its own characteristics and volatility levels, catering to the different trading styles and risk appetites of traders worldwide.

Why is the economic calendar important for trading currency pairs?

It lets you see when the Fed will make an interest rate announcement, what rate is predicted, what rate actually occurs, and how it impacts the forex market. These are all possible with an economic calendar.

Some economic calendars let you look at different months and years. They also let you sort by currency and set your local time zone.

Not all forex traders live in the same place. The time zone features will help you get ready for the next big event since 2:00 pm in Eastern Time isn’t the same in your time (if you live in a different time zone, of course).