CPI Fuel and the Smoldering Inflation Fire

For all the CPI hoopla, remember that this is a monthly figure – all data tend to fluctuate, especially those heavily massaged ones (substitution, hedonistic adjustments, owners equivalent rent coupled with exclusion of certain essentials for their prices are deemed too volatile).

The Fed keeps walking a very fine line. It‘s a success that the market isn‘t revolting – given the infrastructure bill passing Senate, calls on OPEC+ to increase production, it‘s clear to me that whatever today‘s figure, inflation will keep being a thorn in its side for a long time – as simple as putting 2 + 2 together.

Again, today’s report will be shorter than usual and focus on select charts to drive position details of all five publications.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

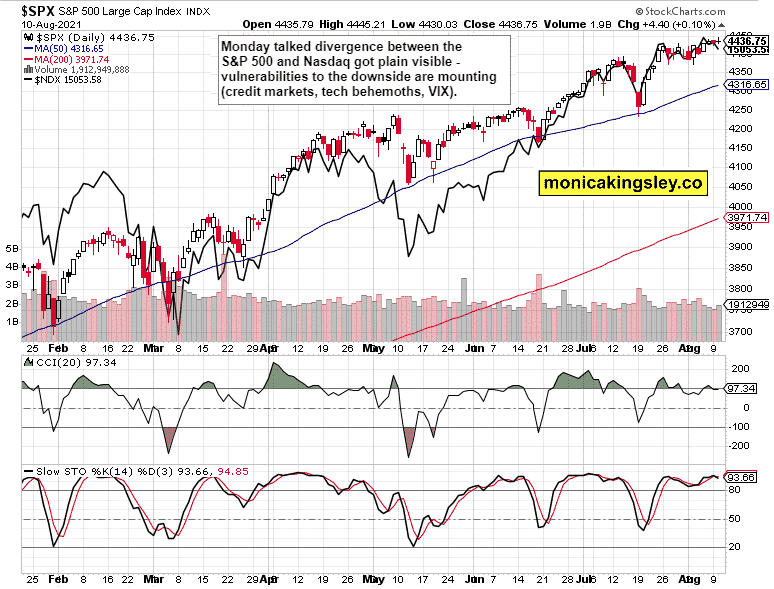

S&P 500 and Nasdaq Outlook

(…) Yes, Nasdaq is in a precarious short-term position as the 500-strong index – about to fall steeply just as gold did? Probably not, but vulnerable to a corrective move that could easily reach a few percent. The infrastructure bill is rather factored into the expectations, and similarly to the Fed taper looming, any surprise could serve as a selling catalyst. The drying up volume may not be a sign of no more sellers here, but rather of a combination of timid sellers and a drying pool of buyers. With the strong CPI data likely to be announced tomorrow, the bears would likely try their luck.

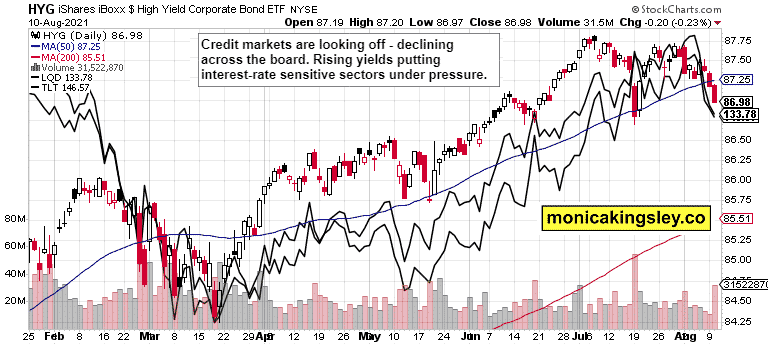

Credit Markets

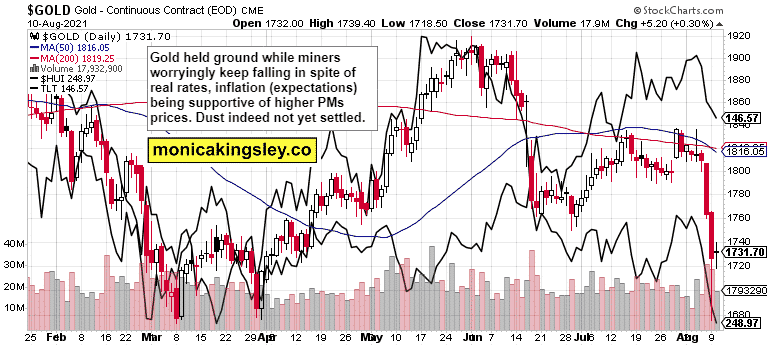

Gold, Silver and Miners

(…) Does the market seriously believe that the Fed would turn into an inflation fighter? That they wouldn‘t lag behind both the incoming forward looking and lagging inflation metrics? Make no mistake, the June ISM services PMIs were the highest ever – there is plenty of inflation in the pipeline, and you‘re, in essence, making a bet whether the central bank will duly mop up the excesses or not. I‘m in the latter camp, which means the current gold and silver values are fascinating to medium-term investors and traders.

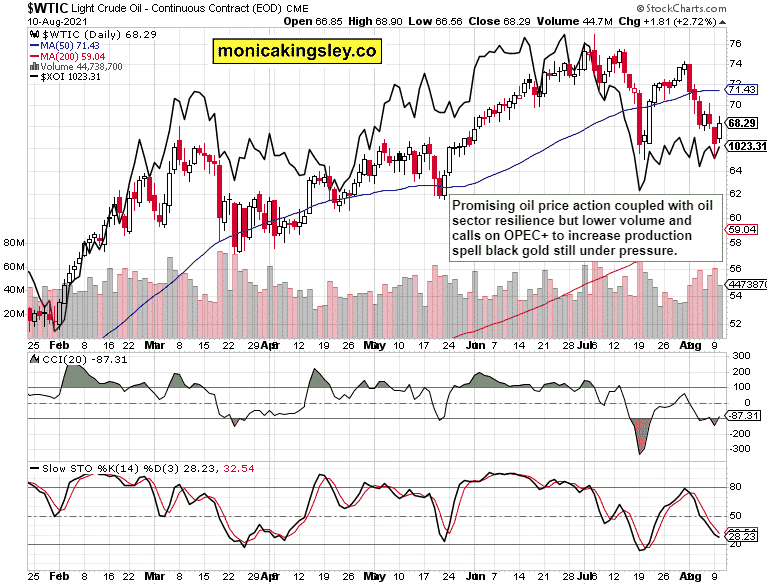

Crude Oil

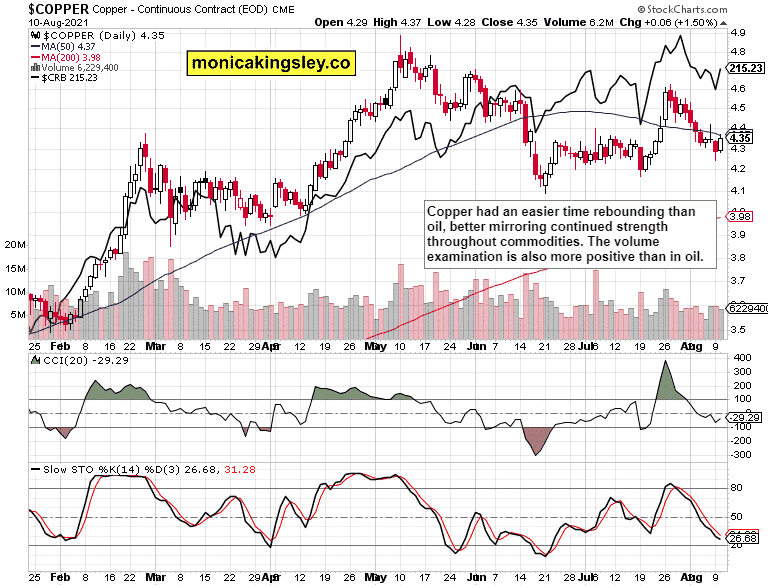

Copper

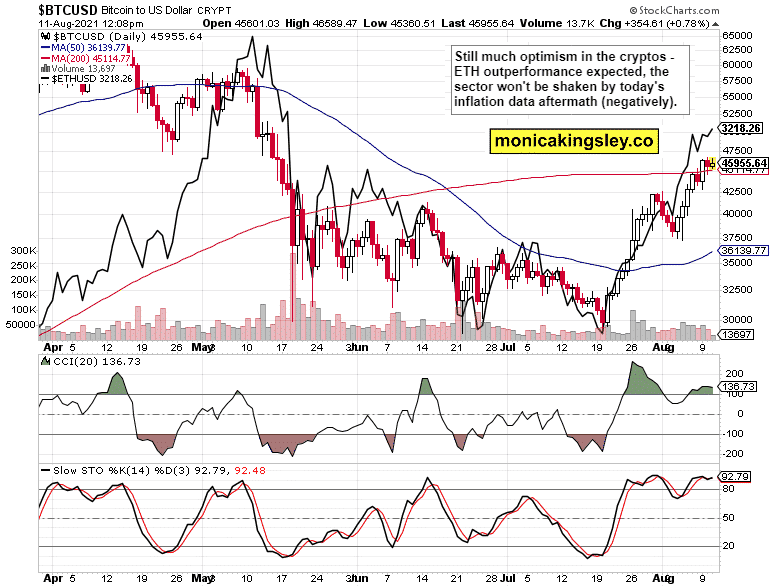

Bitcoin and Ethereum

Summary

In place of summary today, please see the above chart descriptions for my take.

Thank you for reading today‘s free analysis, which is available in full at my personal site. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www. monicakingsley.co

[email protected]

* * * * *

All essays, research and information, represent analyses and opinions of Monica Kingsley are based on availability and the latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes. So, it should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor.

Please know that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible for any decisions you make. Investing, trading and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings. She may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument