China’s economic outlook for 2020

As the coronavirus outbreak continues to spread in Mainland China, every economic news analyst anticipates slumped economic activity. And the first signal of a shaken down manufacturing sector came in Mid-Feb. This occurred when Apple revealed it was having a hard time finding employees to run its factories in China. Reuters started polling world economy experts about the possible impact the coronavirus outbreak in Wuhan, China would have on the country’s manufacturing sector.

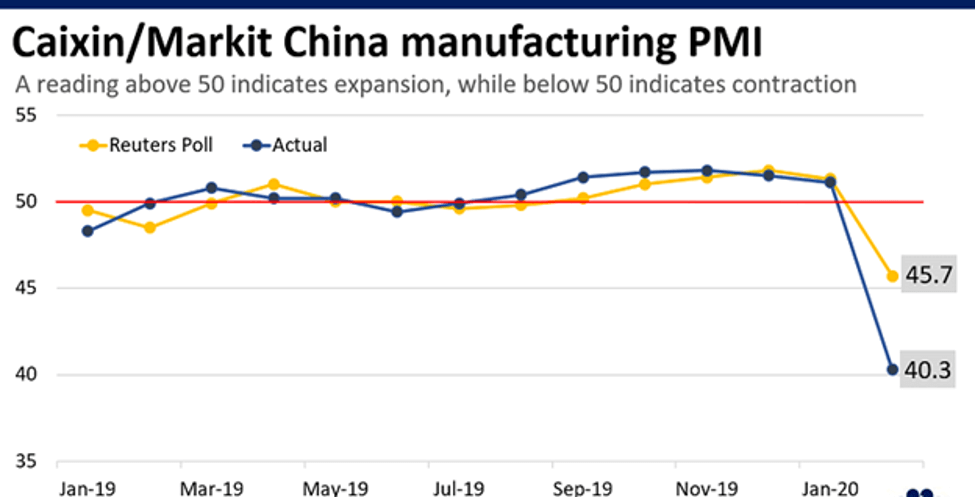

As a result, these experts expected the country’s Caixin/Markit Manufacturing Purchasing Managers Index (PMI) to fall to about 45.7 in February after January’s 51.1 skid. On Saturday 29th, however, China’s statistics bureau released the manufacturing PMI. It showed that factory output in the country has slumped to 35.7. The official readings take into account the activities of major companies and government-owned enterprises. The figure adjusted upwards to 40.3. The private PMI takes into account both the large and medium-to-small manufacturing company’s data.

Factory Output’s Record Low

The 40.3 figure is nevertheless the lowest ever recorded of any developed nation since the launch of the manufacturing PMI index in 2004.

Ideally, any PMI reading above the 50 shows manufacturing industry expansion while below 50 is an indication of market contraction.

ZhengSheng Zhong, the chief economist at CEBM Group acknowledges the significant blow that the coronavirus outbreak created. He argues “the supply and demand sides both weakened, supply chains became stagnant, and there was a big backlog of previous orders.”

The recovery of the Chinese manufacturing economy is pegged so much on the discovery of the coronavirus cure or any other alternative that curbs its spread. But to date, COVID-19 killed more than 3000 people. Moreover, it affected more than 88,000 – the majority of whom are in mainland China.

With these in mind, what economic experts views on China’s manufacturing economy outlook for 2020.

- Check-out Financebrokerage’s comprehensive review on Finmarket.

The Economic Outlook for 2020

In appreciation of the fact that the Chinese economy will eventually recover, world economy experts are sharply divided. They are unsure of the time it takes for the country to recover. But they also worry about the speed at which it recovers.

Sian Fenner shows particular optimism about China’s economic rebound. The lead economist at Oxford argues that the world expected a “Terrible Number” with regards to the contraction of the Chinese manufacturing economy. Its impact on the country’s factory output and economy, in general, will be short-lived. Prior to the release on PMI readings, Fenner mentioned, “We do see some destruction, that’s bound to happen in this situation. But a lot of this is deferrals as well.”

She is nonetheless optimistic that the country will experience a strong rebound by the second quarter of 2020. She believes that will push the country to full recovery by the end of the year.

But Julian Evans-Prichard holds a different view of the inevitable recovery. The senior China economist at Capital Economics believes that the factory output is worse than the PMI index reveals. He argues that “despite their sharp declines, the headline indices actually understate the recent weakness”

He also recognizes the increased business confidence in the recovery of China’s economy based on a Caixin/Markit survey. Julian argues that “with the jump in virus cases overseas, there is a growing risk of a protracted downturn in foreign demand. The likelihood of a quick V-shaped recovery in the coming months is falling fast.” He mentions that while the Caixin/Markit survey indicates China rebounding to a 5-year high, the rebound may not be as soon as possible.