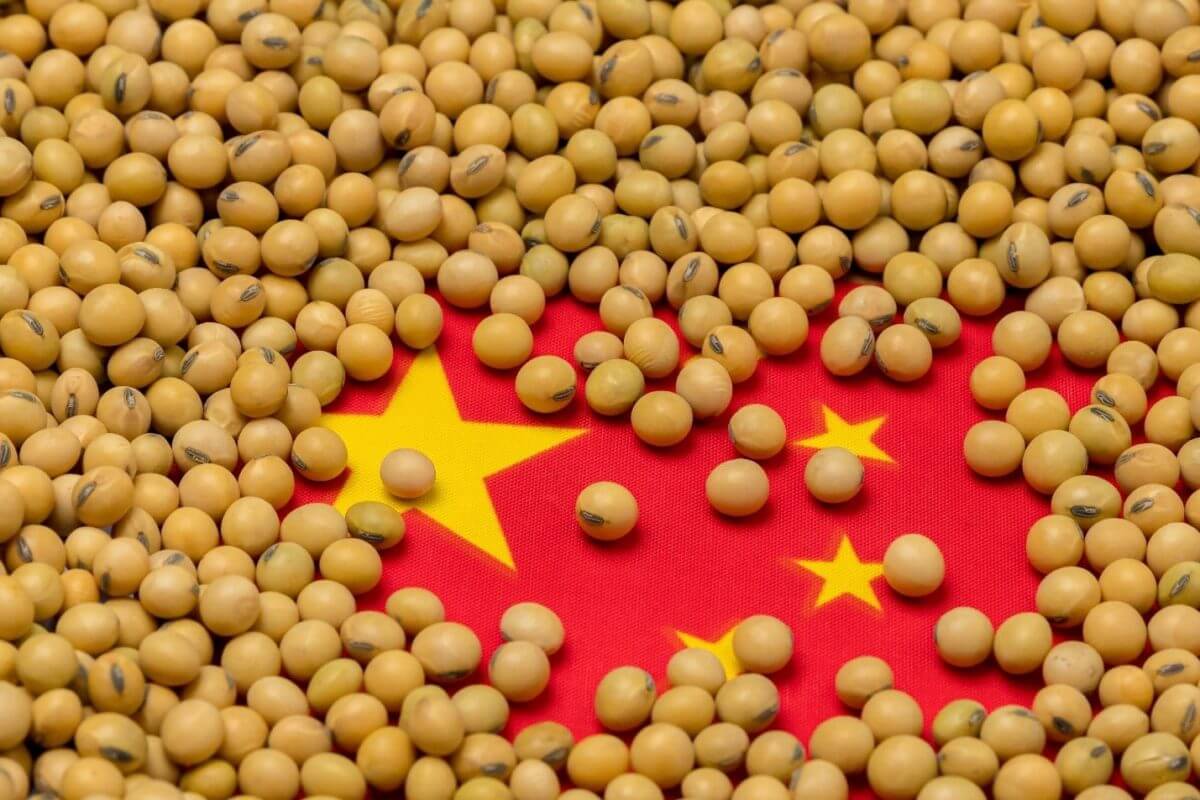

China’s Commodities imports drive a bulk-shipping sector

China’s rising imports of metals, grain, and other commodities are driving a bulk-shipping sector at the center of global industrial production.

Daily freight rates for Capesize ships, the largest bulk carriers, increased to an 18-month high this week at about $35,000. Meanwhile, the Baltic Dry Index, which measures the cost of moving commodities by sea, hit a 10-year high of 2,808 on Monday.

The recovery follows a steep slump early last year as factory production crumbled at the start of the pandemic. China is now investing in industrial production to support economic growth, and consumer demand in Western economies is getting stronger.

In the first quarter, China’s iron ore rose by 7.9%, while coal imports gained 9% from a year ago.

China is the world’s largest commodity importer, making up about 45% of maritime’s dry-bulk market.

According to Hamish Norton, president of Star Bulk Carriers Corp., China and other economies that import dry bulk are strengthening fast. Remarkably, Star Bulk Carriers Corp operates 128 vessels.

the market is going to cool down at some point in 2021

Corn is also in high demand. Rates rose above $6.5 a bushel last week, the highest level in almost eight years. The rise started after the Beijing office of U.S. Agriculture Department announced it anticipates China to import a record 28 million metric tons of the grain this year. The Asian giant is stepping up its grain imports as it seeks to replenish its pig farms after an outbreak of deadly swine fever.

Moreover, daily shipping rates for dry-bulk transporters are among the most volatile in the shipping sector. Spot rates often fluctuate widely on factors ranging from mining and crop outputs to tariffs and weather patterns.

According to Peter Sand, a chief shipping analyst at maritime trading body Bimco, there are still too many ships in the water, and the global fleet increased 4% last year with very little demand. Sand added that the market is going to cool down at some point in 2021.

-

Support

-

Platform

-

Spread

-

Trading Instrument