CHF/JPY forecast for January 14

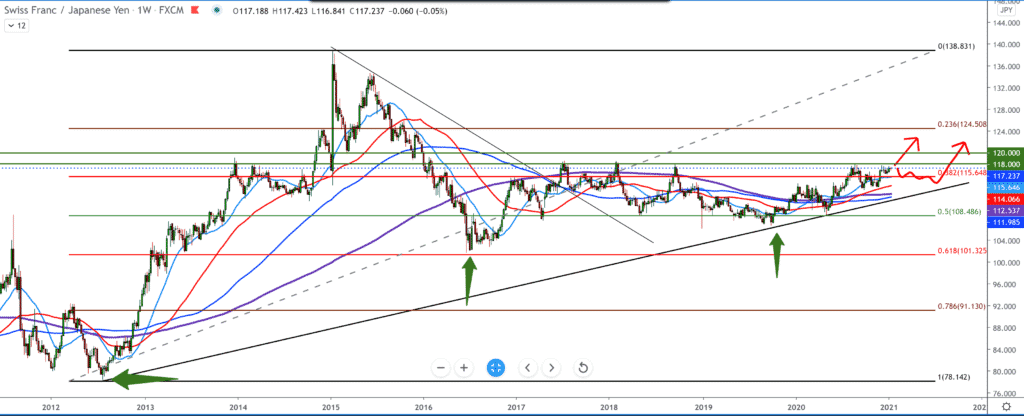

Looking at the chart weekly time frame, we see a strong bullish trend from 2012 with a pullback to a Fibonacci retracement level of 61.8% and continues to grow up again. Now the pair has crossed the level of 38.2%, and we can expect in the coming period to continue to higher levels, but with the possibility of a smaller pullback. The pair has huge support from all moving averages in this growing trend. If the pair continues up, there is significant resistance at 118.00, the level from which the pair bounced four times, making a pullback again to better support. If we see a smaller pullback caused by a stronger yen, we can ask for support at 116.00 and technical support on Fibonacci retracement level 38.2%.

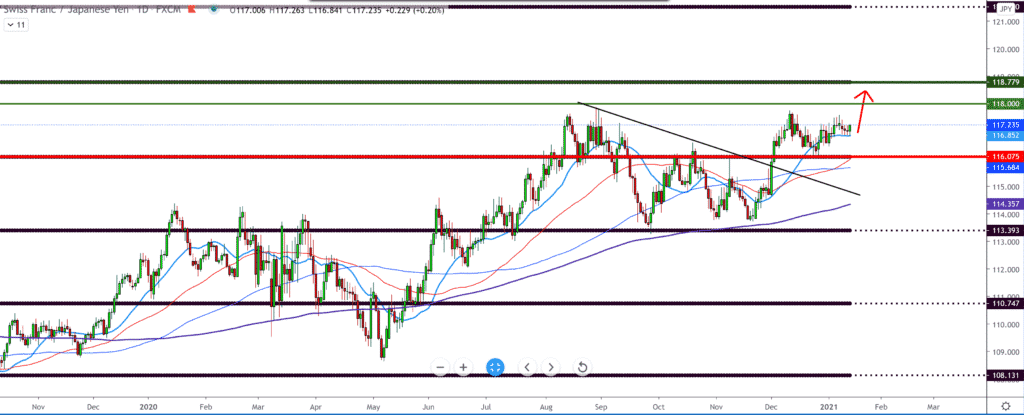

On the daily time frame, the chart is much simpler, and we see that the pair first made a break of the smaller trend line, then a FLAG pattern with a retest to the previous break with the support of moving averages 116.00. we can expect to continue to be on the bullish side in the coming period. For a possible bearish scenario, we need a break below 116.00 with some consolidation as confirmation for the falling scenario.

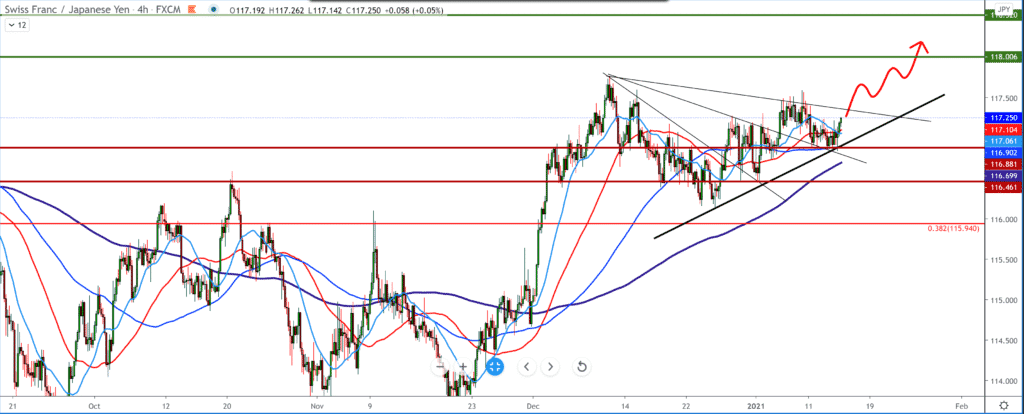

On the four-hour time frame, we see a smaller trend line as support from below. The pair also has support for all moving averages from below. A bullish scenario in the coming period is very likely, and for now, there are no signs of a possible reversal of the trend.

From the news for these currencies, we can single out the following.

The Bank of Japan has improved its economic assessment by three of the nine regions, and one by one, according to the latest Regional Economic Report released on Thursday. Although they noticed that their economy was in a difficult situation due to the influence of the new coronavirus, there were signs of growth in many regions. Also Thursday, the Bank of Japan said producer prices fell 2.0 percent in December from a year earlier – beating expectations for a 2.2 percent drop, which would be unchanged from the November reading. On a monthly basis, producer prices added 0.5 percent – again exceeding expectations for growth of 0.2 percent after a sharp reading a month earlier. Export prices rose 0.8 percent month-on-month and down 1.3 percent year-on-year on the yen, the bank said, while import prices rose 1.9 percent a month and fell 9.8 percent on an annual basis.

-

Support

-

Platform

-

Spread

-

Trading Instrument