CHF/JPY forecast for February 4, 2021

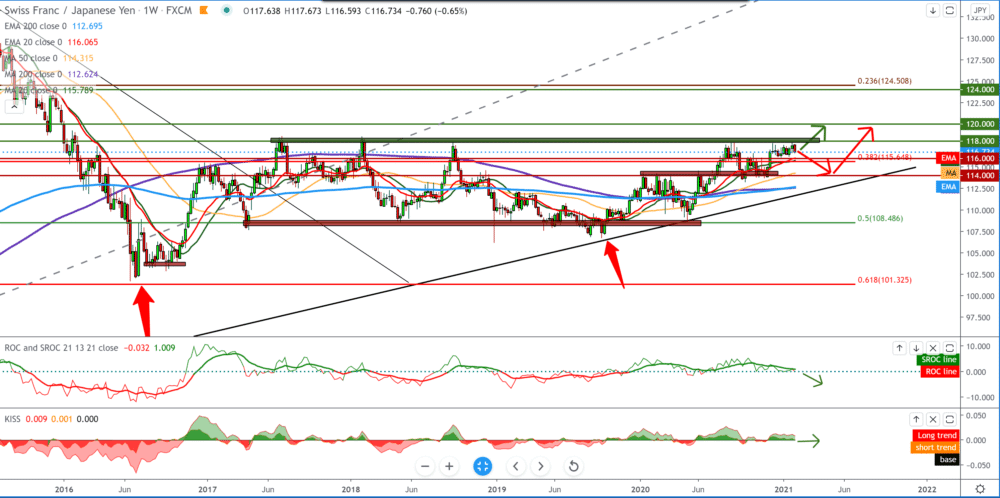

Looking at the chart on the weekly time frame, we see that the CHF/JPY pair failed to make a break above 118.00 but bounced again towards lower levels at the current 116,700. Now the picture is a little different and based on that, we can expect a pullback to continue to find better support. We have a long-term trend line at the bottom, support for moving averages for now, but soon the CHF/JPY pair will be on the MA20 and EMA20. The target for the pullback voyage is our zone at 114.00-115.00, but first, we need a break below 116.00. We will work it out in a smaller time frame.

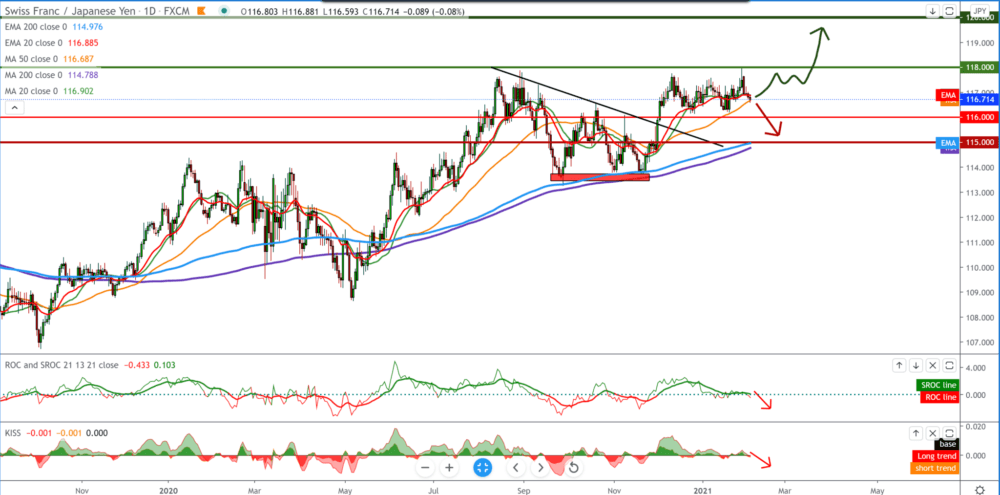

On the daily time frame, we see the pressure from the top of the moving averages MA20 and EMA20, and the CHF/JPY pair is now testing the MA50. If we see a break below, we can expect the bearish trend to continue until the first 116.00, and potentially from 115.00 asking for support on the MA200 and EMA200. The last month can be seen as a consolidation between 116.00-118.00. For the bullish version, we need support at this level with a target at 118.00 and possible resistance before we go to 120.00.

Check-out Financebrokerage’s Comprehensive Review on Fundiza

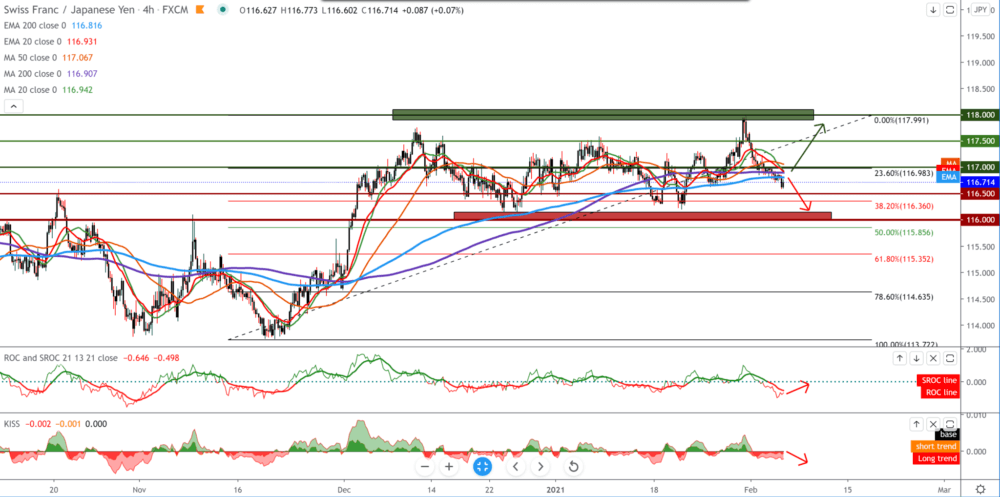

In the four-hour time frame, we can see if the CHF/JPY pair is moving sideways in the zone between 116.00 and 118.00. The pressure on the bearish side and the probability of testing the zone again at 116.00 are confirmed by moving averages on the upper side. If we look at the bullish, we need a break above 117.00 where it will probably then come to the support of all moving averages because everyone is in that zone, and they split this big consolidation in half.

From the news for the CHF/JPY currency pair, we can single out the following: Swiss consumer sentiment deteriorated slightly in January. Data from a survey by the State Secretariat for Economic Affairs (SECO) showed on Thursday. The consumer sentiment index fell to -14.6 in January from -13.0 in the previous quarter. The indicator remained below its long-term average of -5.0. Expectations regarding the general economic development were more pessimistic than in the October survey, with the index falling to -18.6 from -14.3.

-

Support

-

Platform

-

Spread

-

Trading Instrument