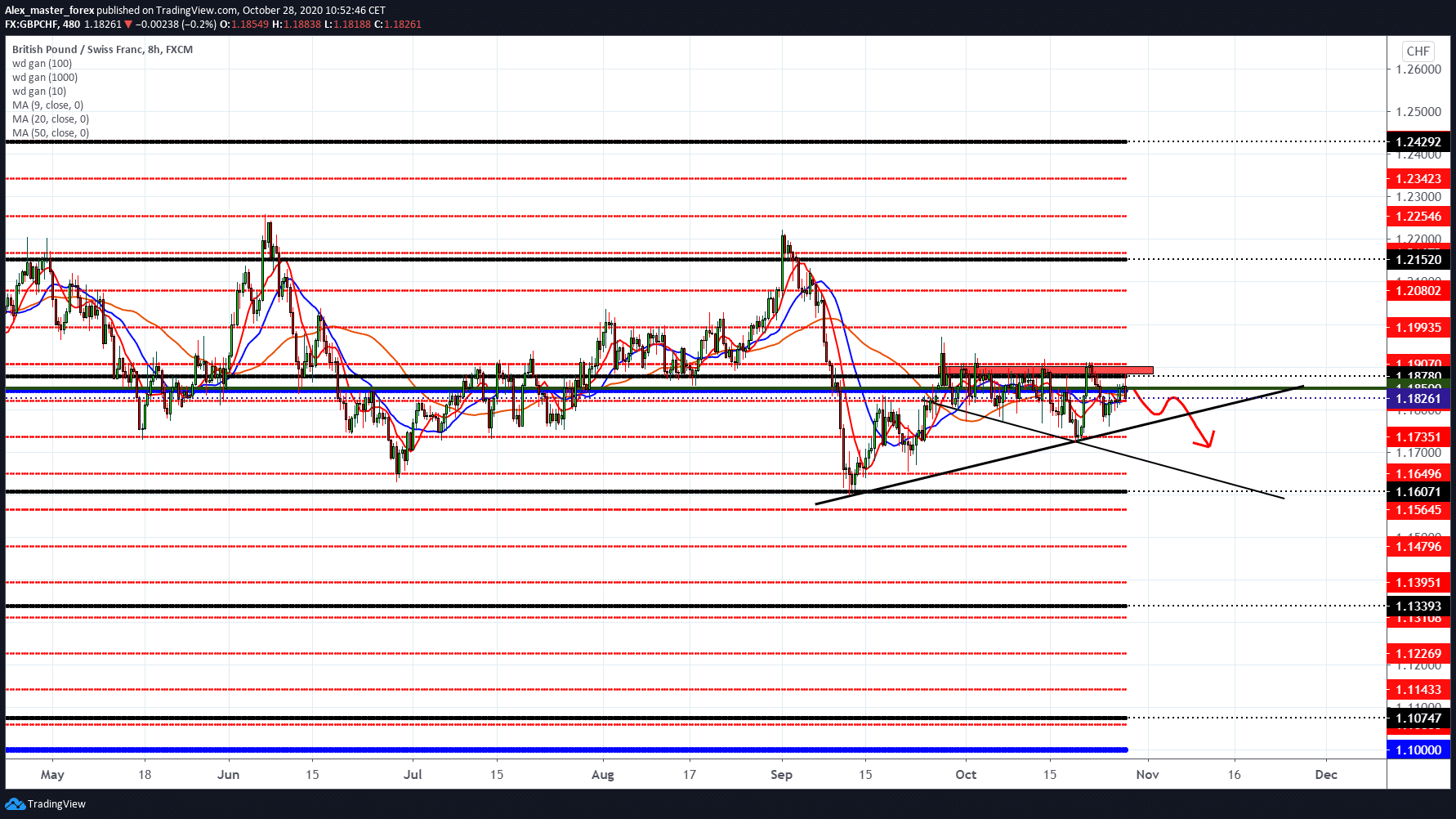

GBP / CHF strong resistance to 1.18500

Investors remain concerned that re-locking measures to curb the second wave of COVID-19 infections could prove detrimental to the already fragile global economic recovery, which has been pushing for investor sentiment.

Despite the resumption of negotiations between Britain and the EU on Brexit and reporting on the progress made in several areas, the stalemate over the future approach of the EU fishing fleet to UK waters has diminished the prospects for an immediate breakthrough. On the chart, the pair is consolidating around MA 9.20.50. We can expect some major shifts soon.

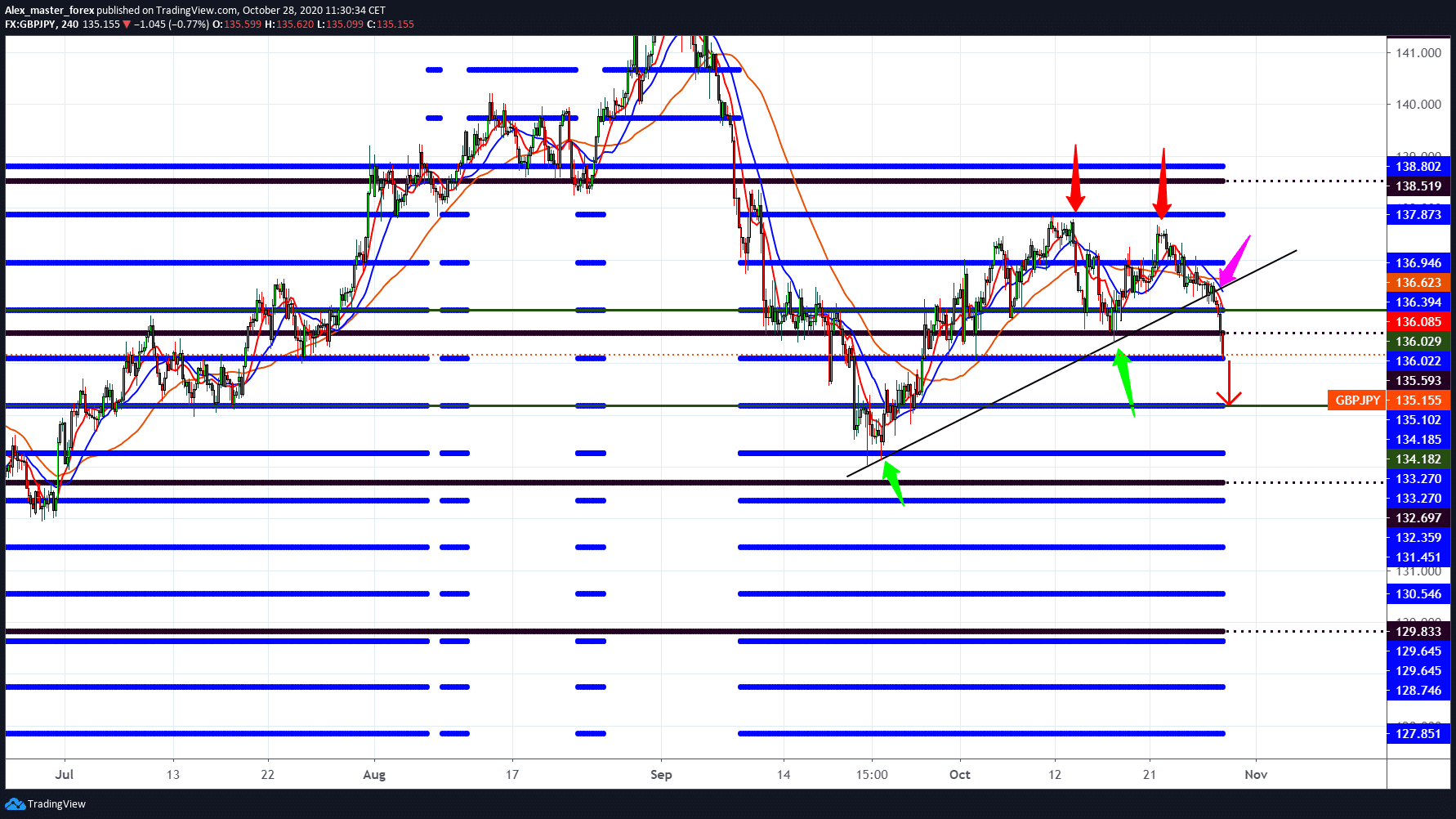

GBP / JPI Chance to fall below 135,000

There is no important news for the pound today; the only thing possible is Brexit’s political statement. Looking at the chart, it was made to break the rising trend lines. Above, we have two lower highs, just waiting for us to continue the decline. The first support is at 135,100 if the next is only down at 134,200.

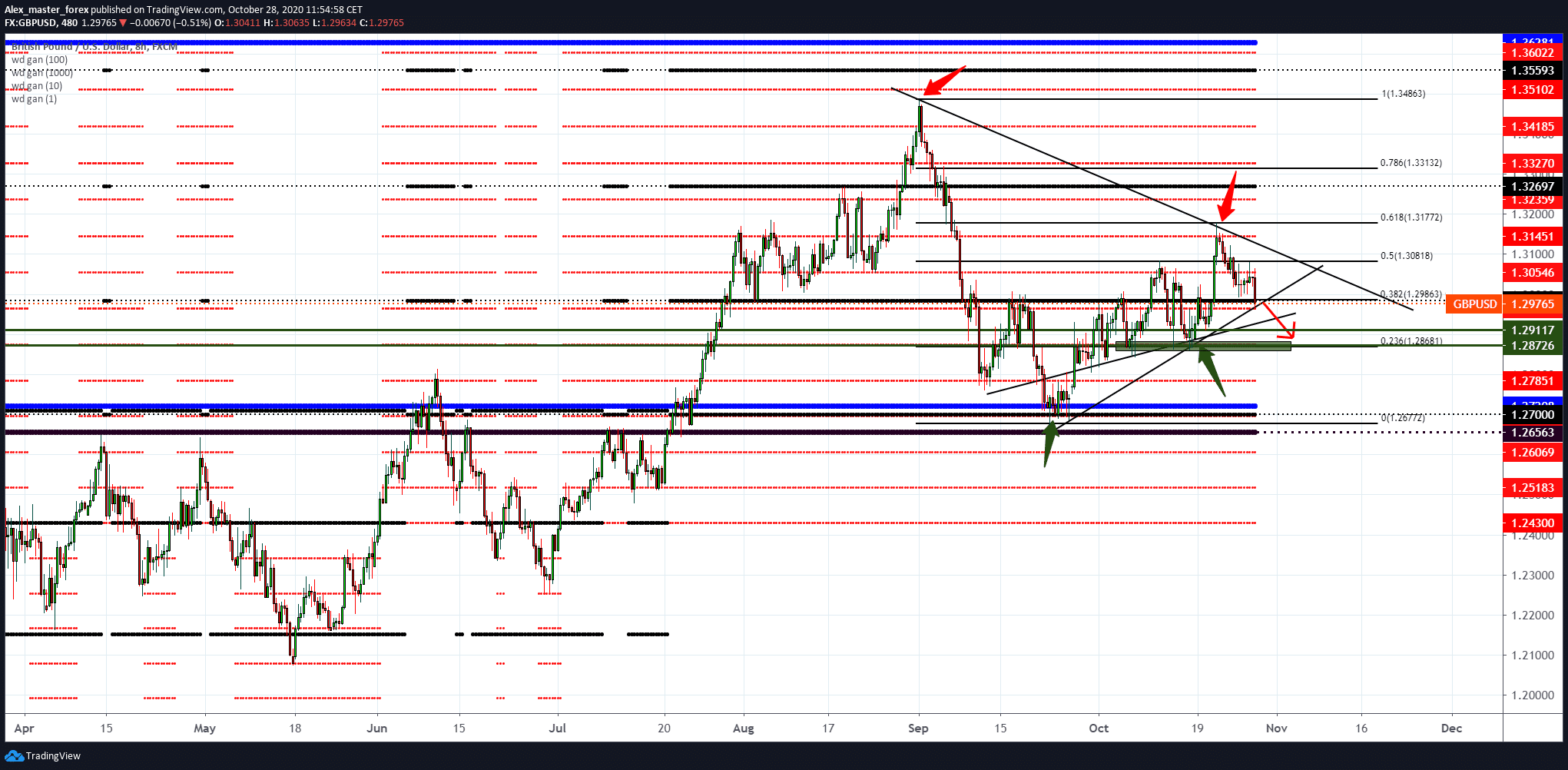

GBP / USD resistance at 1.31500

Tensions are rising towards the US election. More than 70 million Americans – more than half of the total number of votes counted last time – have already voted with the remaining six days. President Donald Trump is still lagging behind rival Joe Biden, but he seems to have progressed in Florida. Markets are worried about the disputed elections, and they are also worried that the divided Congress will not pass a significant stimulus. New research at the national, state, and Senate levels will be closely monitored and could change the market later in the day.

-

Support

-

Platform

-

Spread

-

Trading Instrument