Bitcoin – Up or Down?

- The price of bitcoin has been moving sideways for the seventh day.

- Analysts and traders are assessing the impact they could have after the Federal Reserve continues to tighten monetary policy.

Bitcoin chart analysis

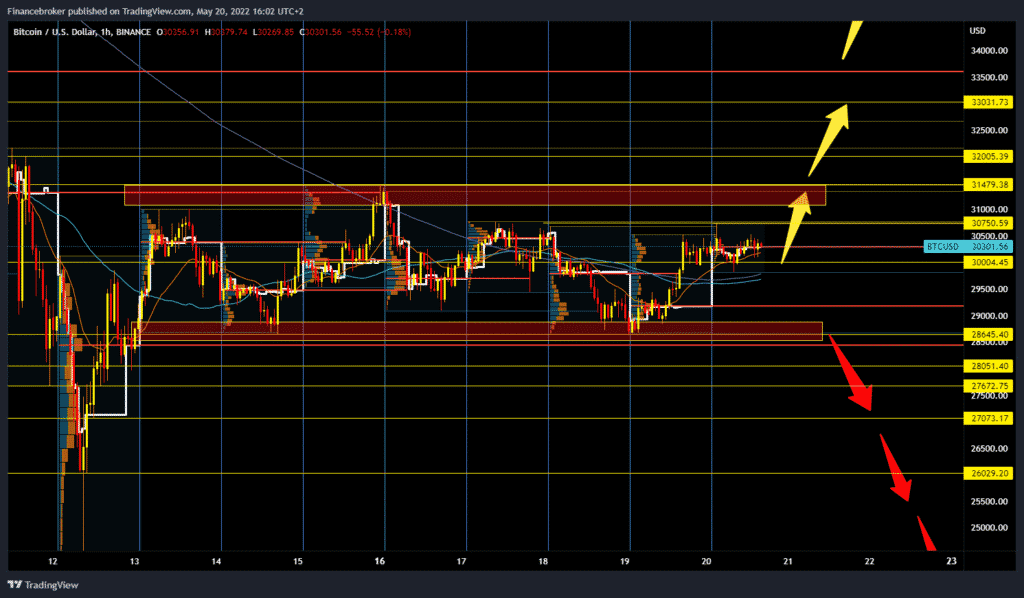

The price of bitcoin has been moving sideways for the seventh day. In the range of 29000-31500 dollars. Yesterday, Bitcoin dropped again from 29,000 dollars, and today it continues towards the upper resistance zone. We can now expect the bullish trend to continue to the upper zone and test the resistance for a potential break above. Should the price break above, our next bullish targets are $ 32,000 and $ 33,000. Conversely, we need negative consolidation and pullback to the lower support zone for the bearish option. Potential bearish targets below this support zone are $ 28,650, $ 28,000, $ 27,000 levels.

Market overview

Analysts and traders are assessing the impact they could have after the Federal Reserve continues to tighten monetary policy. On Tuesday, U.S. Federal Reserve Chairman Jerome Powell reiterated a promise by financial authorities that he would continue to increase pressure on activities related to financial conditions until inflation begins to show signs of weakening. The cryptocurrency bitcoin fell below $ 30,000 together with stock exchanges.

During the same period, other cryptocurrencies followed the decline of bitcoin. Polkadot lost its value by about 6%, and Ethereum, Avalanche, XRP, and Binance also lost their regular value. Other cryptocurrencies like Tron were among several crypto assets that managed to trade in the green zone with positive sentiments about the stablecoin network, USDD.

Powell said on Tuesday that the Fed remained committed to reducing inflation while being able to use aggressive measures to ensure a strong economic situation. At the Wall Street Journal event, Powell said that what everyone should see is that inflation is on the way to being clear and long-lasting, and therefore they will continue to move their interest rates until they see inflation at 2%.

The Fed chairman further added that restoring price stability is among some of the unconditional needs to achieve price stability. There is something that the financial government needs to do because the economy does not really work for workers or businesses or even for someone who is facing price instability. That is the real bottom for the economy. The U.S. Federal Reserve has previously pledged to keep inflation under control.