Bitcoin under increasing pressure

With China attacked cryptocurrency, the Biden administration is reviewing shortcomings in digital asset regulation. Iran is banning Bitcoin mining until September to conserve electricity, and Australia warns that traders who do not report cryptocurrency profits will face the consequences.

China’s suppression of cryptocurrencies could find criminals on the blacklists of social and financial services if they are caught. It has also stepped up efforts to end cryptocurrency mining in its Inner Mongolia region by introducing new penalties for those caught in illegal activity. According to a report by the South China Morning Post, officials have unveiled a new draft of rules that would apply tougher penalties for that caught mining Bitcoin and other cryptocurrencies. This would include putting offenders on a blacklist of social loans, which would prevent them from getting loans or even using the transportation system.

The new rules specifically mention data centers, industrial parks, telecommunications companies, internet companies, and even cyber cafes, noting that any such offender found to be operating mining equipment will have their work permit revoked from the local electricity trading scheme. And even for their companies to close completely. The draft rules will be publicly available until June 1; however, the region of Inner Mongolia has already been exposed to severe measures against cryptocurrency mining.

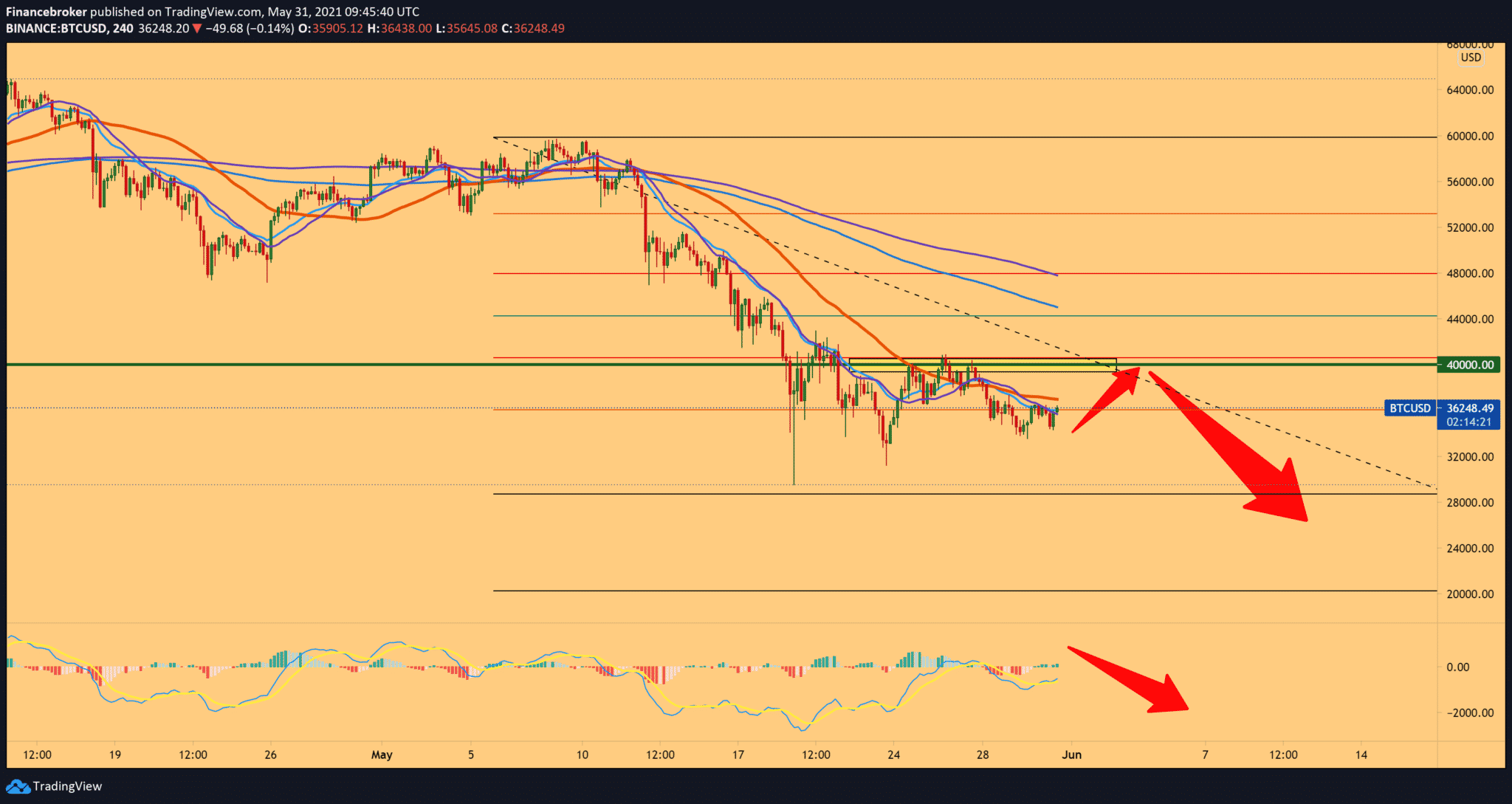

Bear signals are growing in crypto markets as tighter regulations and environmental concerns cast a dark shadow over Bitcoin. Bear signals are rising as the price of bitcoin drops to $ 35,000, and traders are ignoring the decline, expecting the price to change for the better. Bitcoin is currently struggling to keep its head above $ 40,000, as traders react negatively to double threats due to environmental concerns and the growing pace of regulation.

Over the past two weeks, we have seen many negative moves in the market. However, most institutional investors held fast and promised to keep their crypto. All of this has forced retailers to worry that Bitcoin could suffer a further decline.

PlanB, the creator of the inventory-flow model that predicts that BTC will reach $ 288,000 by 2024, recently stated this strong fact that no investor who holds Bitcoin for more than four years has ever suffered losses. We will see who will be right in the end in the coming months.

-

Support

-

Platform

-

Spread

-

Trading Instrument