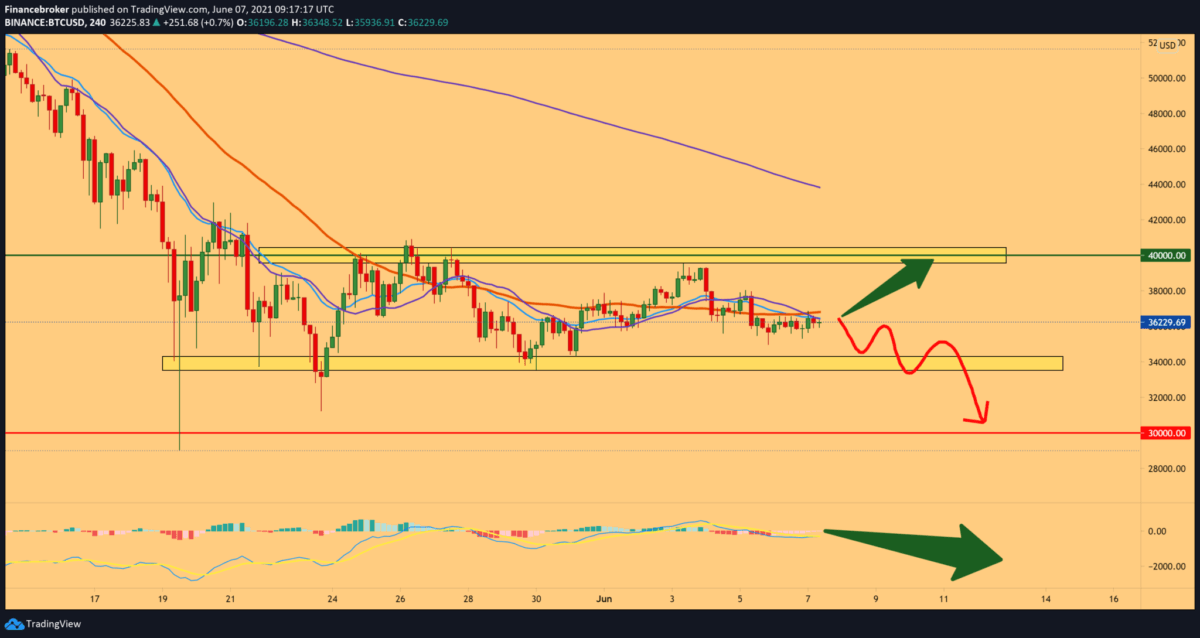

Bitcoin started another week below 40,000

After the fall of the FUD from China over the weekend, the adoption of Bitcoins as a means of paying is major news from El Salvador and Paraguay, and that is an unexpected first for this Monday. The world may welcome its first two “bitcoin nations” in history.

Inflation is still being discussed in a city in the United States, and the Minister of Finance, Janet Yellen, revealed that it is for higher rates. Speaking to Bloomberg over the weekend, Yellen expressed support for President Joe Biden’s latest giant spending package and pledged that this should be trusted even if it resulted in higher inflation.

If we ended up with slightly higher interest rates, that would actually be a plus for the social and Fed perspective, she said for this publication. Higher interest rates aim to improve the attractiveness of Bitcoin as a means of deflation, but hand in hand with them is the sharp rise of the US dollar this month – something that traditionally always puts pressure on BTC/USD.

After Strike gateway payments began to penetrate the country seriously, President Naiib Bukele formally announced that he would send a law to parliament to make Bitcoin a legal tender. If it succeeded, El Salvador would be the first country on Earth to adopt something similar to the “Bitcoin standard effectively.” Bukele confirmed his plans during a video address at last week’s Bitcoin Conference 2021 event in Miami, where Strike CEO Jack Mallers outlined the plans.

Markets were not encouraged by this news. The cause of concern is the short trades on the main Bitfinek stock exchange. As the popular Twitter account, Fomocap noted on Monday, the increase in short positions coincided with a great deal of volatility, which usually negatively impacted. “Bitfinek’s sudden move in shorts always means something. It will fall from November 25 to May 19, “he warned. This would reinforce existing fears that Bitcoin has not yet completed its bearish withdrawal. The opinion is divided, as Cointelegraph reported – some are waiting for a return of $ 20,000, while others are convinced that such levels of falling bitcoin prices are out of reach. As noted by analyst William Clemente, the miners’ condition has decreased by 5,000 BTC compared to a week ago, which is a big turnaround.

On June 3, 3,012 BTC left the largest mining pool, Poolin, which was the largest single outflow in 2021. Another 2,501 BTC moved a day later. However, analyst Lek Moskovski admitted that the funds might not have been sold in the end. “This is not a single for sale, even if it records 3k such outflows this day,” he tweeted.

-

Support

-

Platform

-

Spread

-

Trading Instrument