Bitcoin on glass legs, Chart analysis for May 18, 2021

A May 17 report said $ 98 million left Bitcoin investment products last week, up 0.2% of total assets under management. Although a small percentage, this represents the largest outflow we have recorded, CoinShares noted. Amid turbulent market conditions for Bitcoin, institutional investors appear to have amplified the accumulation of Ethereum and other alternative cryptocurrencies. The report identified inflows into $ 48 million in cryptocurrency investment products when Bitcoin is excluded.

CoinShares also notes that May is shaping up as the first month in which the volume of investment for institutional ether products has surpassed the volume of Bitcoin products. Investment strategist Raoul Pal suggested that traders should probably buy Bitcoin fall as its price falls to two-month lows. Raoul Pal wants Bitcoin investors to mobilize their trades against Elon Musk. The macro investment strategist advised traders to accumulate or preserve their holdings in Bitcoin (BTC) just as the leading cryptocurrency suffered a massive decline over the weekend and earlier this week.

The Bulls were under pressure after Elon Musk started rattling the cryptocurrency market. On May 12, the billionaire entrepreneur reversed his Tesla company’s decision to accept Bitcoin payments for its electric vehicles, citing environmental problems associated with the bitcoin mining industry. On the other hand, Pal suggested bitcoin traders to ignore the “weekend FUD” and focus on the strong technical setting of the cryptocurrency, which indicates a bullish breakthrough.

The US Federal Reserve will publish the minutes from its April 19 meeting. The central bank is expected to keep interest rates close to zero, buying government bonds and mortgages worth $ 120 billion a month – at least until 2023.

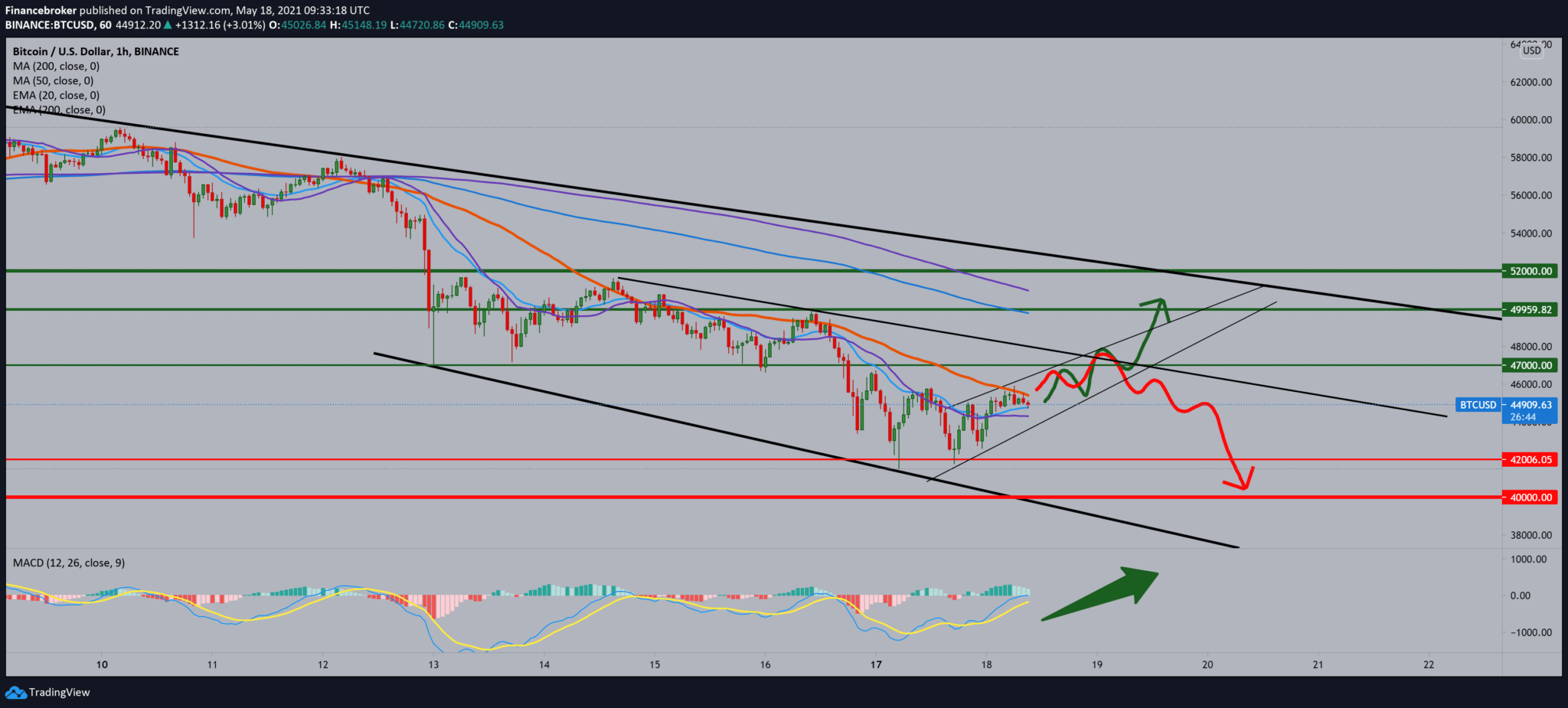

Following the chart on the one-hour time frame, we see that during the Asian session, the price of Bitcoin consolidates around $ 45,000. The price, for now, has solid support for moving averages MA20 and EMA20, while from the top, we are currently testing the MA50, which is a good resistance to Bitcoin to move to the bullish side.

If a break occurs, then we can expect the price to climb to $ 47,000 first, and then the potential to climb to the top of the trend line at $ 50,000. Bearish pressure is evident, and the price of Bitcoin can easily fall below $ 40,000 if we fall below moving averages. Looking at the MACD indicator, we see that the bullish trend is weakening. The movement of the indicator is currently sideways and can easily move into the bearish trend.

-

Support

-

Platform

-

Spread

-

Trading Instrument