Bitcoin Forecast: New Sales at the Door

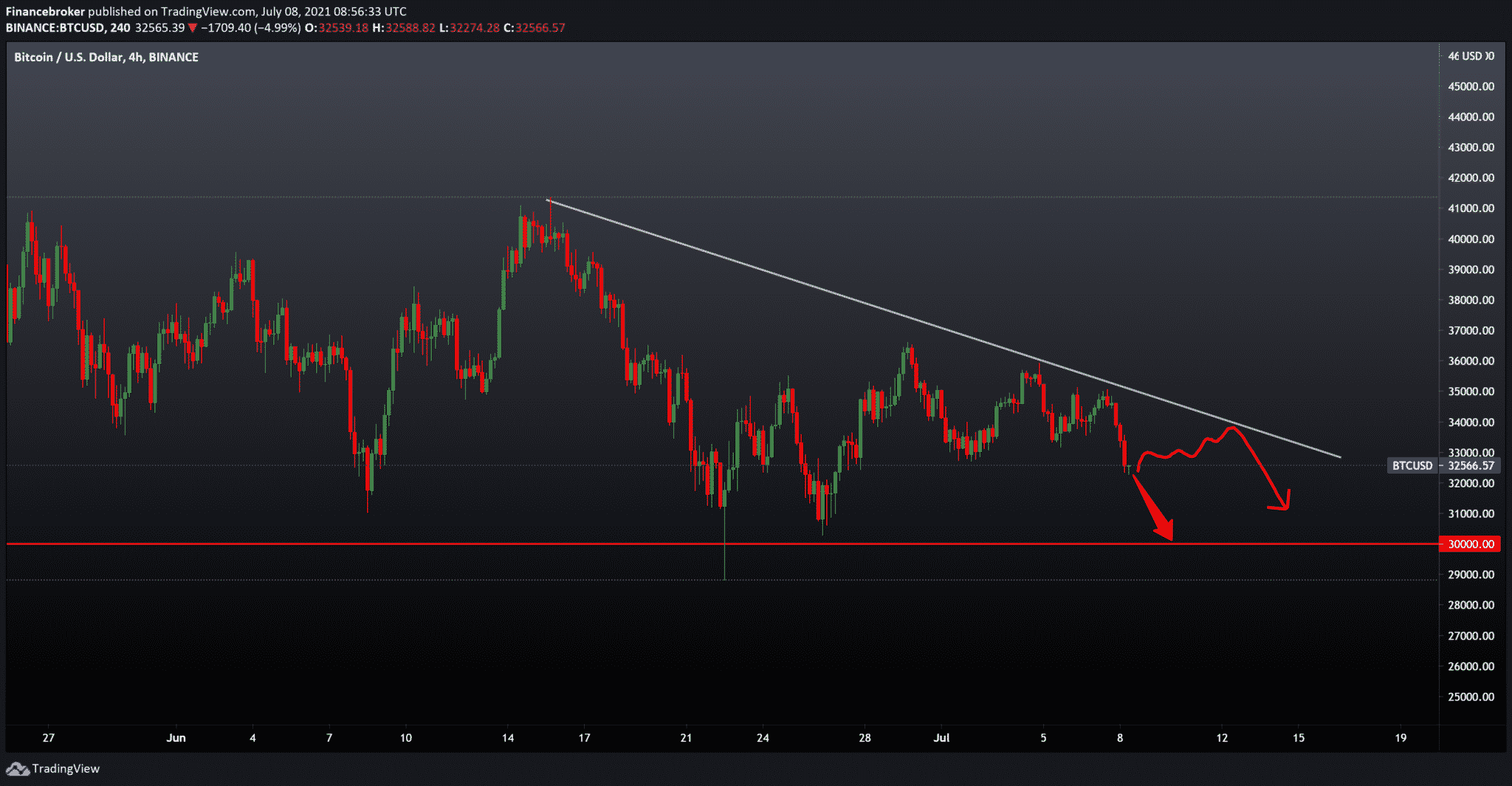

Bitcoin fell below $ 33,000 support this morning on July 8 as trading support eased. It did not keep the BTC price above $ 33,000. The move followed overnight, with about $ 35,000, while Bitcoin failed to break this key resistance. The pressure of short selling is returning to the market, and traders are looking at a re-test of $ 31,000 due to weak support.

Bitcoin risks reversing the bullish scenario that involves entering the next phase of the Vickoff distribution with the potential to go up – about $ 39,000. “I’m losing the range of 33 thousand dollars. I’m looking at 31-31.4 thousand dollars,” warned the popular trader Michael van de Poppe just before the fall.

China’s Central Bank

Visa and other large private payment networks see the potential for stable money. But China’s central bank believes they pose a serious risk to global financial systems. According to a senior official, China’s central bank is concerned about global financial risks associated with digital currencies, especially stable coins. Fan Yifei, the deputy governor of the National Bank of China, expressed concern over the allegedly serious threat to stable coins. Such threats include Tether. It can be a huge peril to global financial systems and settlement systems, CNBC reported on Thursday.

The official stressed that the pace of development of private payment systems is very alarming. Moreover, the PBoC is working against monopolies and disorderly capital expansion. Fan also said that the Chinese government has already taken some measures to limit the spread of global stable coins. The Deputy Governor stressed that PBoC would apply the same restrictive measures against Alibaba Ant Group to other entities in the payment services market.

As previously announced, the Chinese state stopped Ant’s IPO in the amount of 37 billion dollars last November. This led to the launch of an antitrust probe in Alibaba. Mu Changchun, head of digital currency research at PBoC, later said that China’s central bank is a digital currency designed to provide a reserve for large retail payment services, such as Alipay and WeChat Pai, as its key target. According to Fan, the Chinese digital yuan system has so far gathered more than 10 million users. In addition to warning about stable coins, Fan also criticized other major cryptocurrencies. They include Bitcoin and ETH, saying such digital currencies have become speculative tools and pose potential threats to global financial security and social stability.

-

Support

-

Platform

-

Spread

-

Trading Instrument