Bitcoin fell and the Ethereum Jumped by almost $100

- Early this morning, the price of Bitcoin fell again from 31,000 dollars to 30,000 dollars.

- The price of Ethereum continues its bullish trend from yesterday’s low to 1725 dollars.

- ETH fell during the crypto market crash in May and this led to a significant reduction in the market value of the first blockchain technology supported by smart contracts.

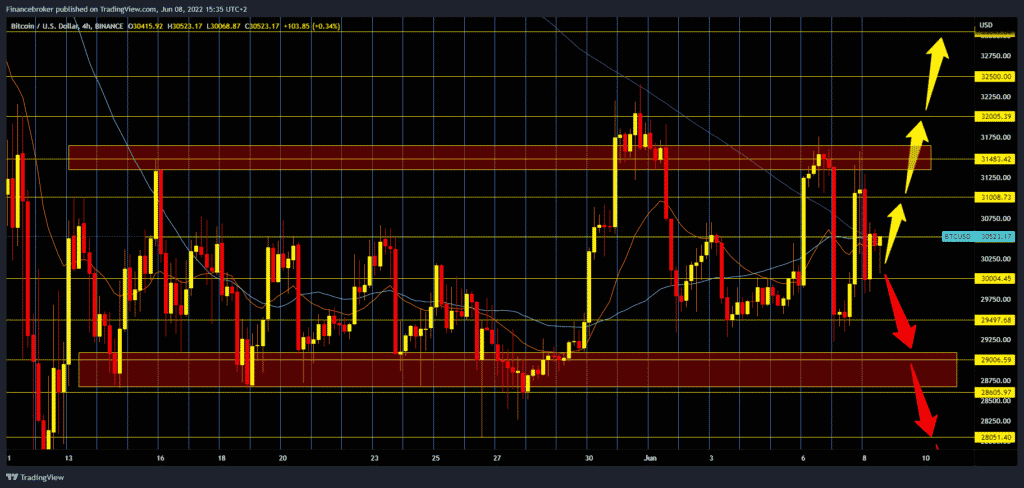

Bitcoin chart analysis

Early this morning, the price of Bitcoin fell again from 31,000 dollars to 30,000 dollars. After that, we see a recovery to the $ 30,500 level and then a new bearish pressure that once again directs the price towards psychological support at the $ 30,000 price. If we see a break below that support zone, our first target is a $ 29,500 level place yesterday’s support.

The price could drop again to a monthly support zone of $ 28,500-29,000 for another confirmation. We need a new positive consolidation and a turn towards the upper resistance zone of 31000-31500 dollars for the bullish option. After that, we need the price to stay in that zone in order to try to make a break above. Our next important level is the $ 32,000 level, our high since last week. If the price of Bitcoin manages to find support there as well, it could then recover up to the $ 35,000 level.

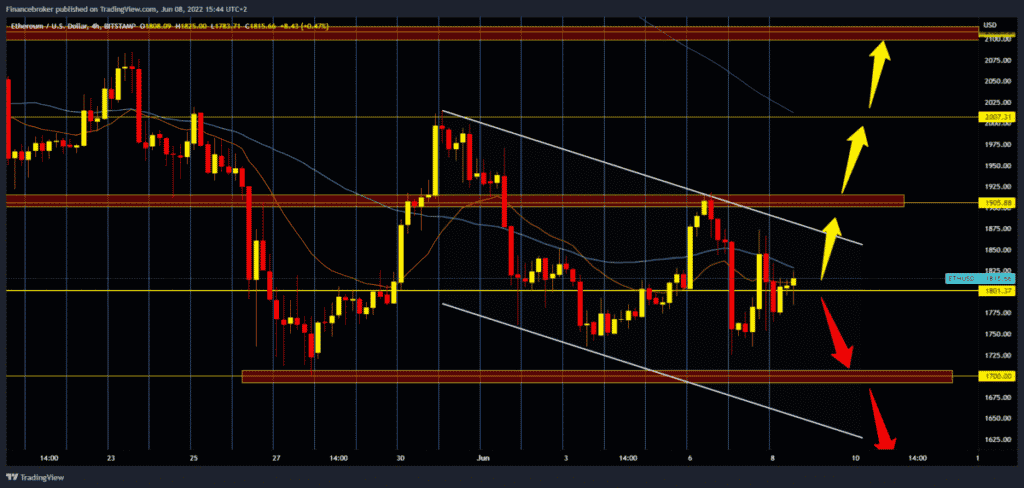

Ethereum chart analysis

The price of Ethereum continues its bullish trend from yesterday’s low to 1725 dollars. The price jumped by almost $ 100 and is now at $ 1,820. We could see a continuation towards the $ 1900 level, which would positively impact the development of the price recovery. By breaking the price above, Ethereum would then form a new higher high, which is a sign of a potential continuation to the $ 2,000 level. For the bearish option, we need a new pullback below the $ 1,800 level, after which the price of Ethereum would open space towards the $ 1,700 May support zone.

Market overview

Ethereum market capitalization

ETH fell during the crypto market crash in May and this led to a significant reduction in the market value of the first blockchain technology supported by smart contracts.

Ethereum remains the second-largest digital asset by market capitalization in June 2022. According to Be [In] Crypto research, ETH ended the fifth month of the year with a market capitalization of about $ 235 billion. This is a drop of 31% compared to the market value since May 1. ETH recorded an impressive trade volume of $ 1 billion, corresponding to a market capitalization of $ 15.3 billion in the region.

The wider sale of digital assets by owners in 2022, which deepened during the week of May 9-13, can be attributed to the fall in Ethereum’s market capitalization.

Some of the primary factors that led to the negative mood of the market include rising interest rates, inflation, and economic uncertainty that has deepened the entire financial system due to the unprovoked Russian invasion of Ukraine.