Bitcoin Falls To $36,400, Following Ukraine-Russia Tension

Ukraine has pushed the Russian ruble to a near 6-year low against the dollar, causing Bitcoin prices to fall.

Bitcoin fell to a new low on February 22. The rapid drop came after the anticipation of the fallout from Russia’s invasion of Ukraine sparked further market woes.

BTC/USD touched $36,400 overnight on Bitstamp on Tuesday, the lowest level since February 3, data showed.

Markets were volatile as President Vladimir Putin delivered an almost hour-long speech on the state of the conflict in Ukraine. Putin eventually recognized the two breakaway republics in the eastern part of the country. He then ordered Russian troops to cease Ukrainian territory formally.

The Russian ruble fell in sync, breaking above 80 against the dollar and hitting a 2016 all-time low of 85.6. Western sanctions are expected later in the day, leading to further losses.

One unexpected winner was gold, which avoided losses to cement its safe-haven status – unlike bitcoin.

Year-to-date, at the time of writing, XAU/USD is up over 6%, while BTC/USD is down 23%.

Investments in gold-backed exchange-traded funds (ETFs) increased in February.

As such, Russia became the focus of BTC traders who watched with dismay as the dark clouds gathered over Asian markets on Monday.

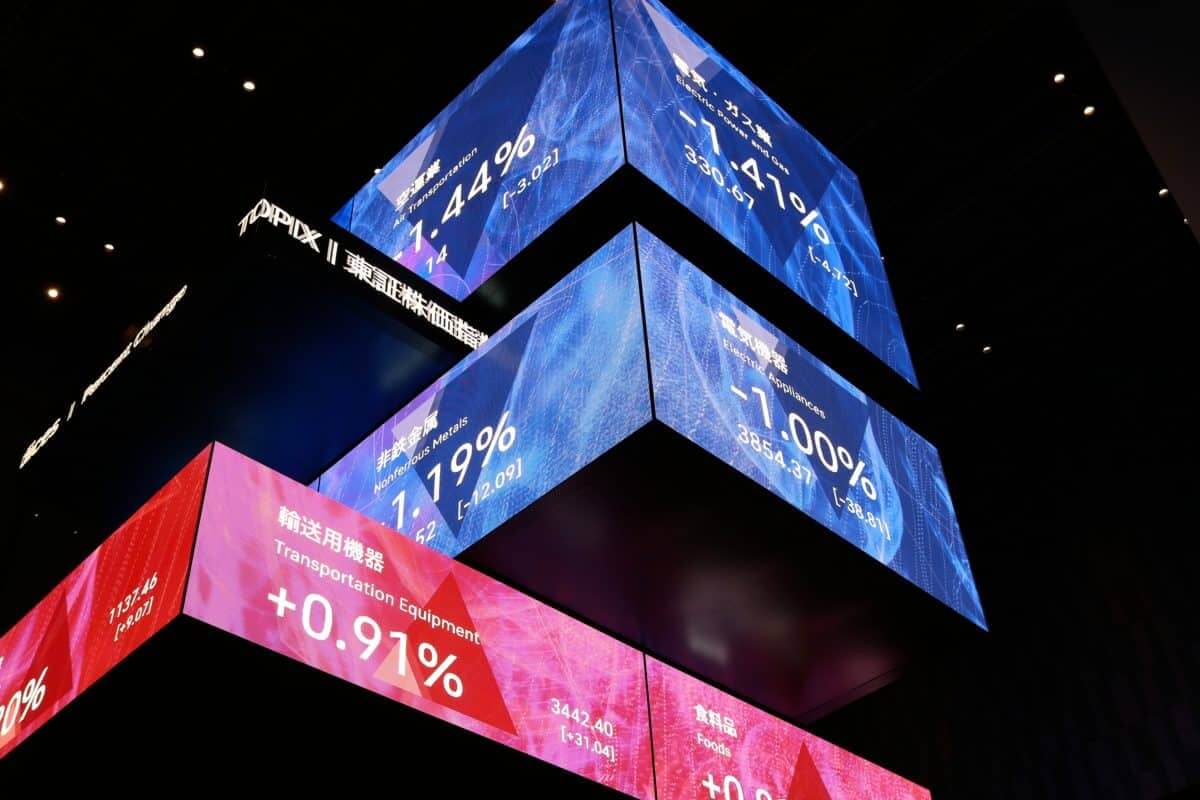

Japan Exchange Group Warns Of Fraudulent Crypto Trading Platforms

Japan Exchange Group (JPX), the Tokyo Stock Exchange and Osaka Stock Exchange owner, has warned the public that companies are misleading Japanese investors by selling crypto assets under the JPX brand.

JPX issued an alert after receiving reports of continued attempts to lure unwary investors into trading Bitcoin and cryptocurrencies on a platform mistaken for one of JPX or one of its affiliates.

The company highlighted that the fraudulent companies in question were replicating the JPX name, logo, and URL in various forms on their platforms and marketing plans, including JPEX and Japan Exchange iterations.

JPX has yet to open up crypto trading to Japanese investors. However, the company is already leading numerous initiatives to test traditional finance blockchain and distributed ledger (DLT) technology.

According to JPX, the above initiatives aim to improve data transparency and data collection efficiency through blockchain technology. Additionally, the company has started testing and research with 33 Japanese financial institutions to discuss the possibility of applying blockchain or DLT to their existing capital market infrastructure.

Japan’s cryptocurrency adoption program has suddenly increased efforts to defraud new investors. Earlier this month, it was reported that the Japanese government was planning a proposal to make it easier for registered cryptocurrency exchanges to list digital assets on the local retail market.

If passed, the proposal would allow certain assets to be listed on exchanges registered with the Financial Services Authority (FSA) without lengthy review.

Kazakhstan Likely To Lose Bitcoin Hashrate Leading Position

According to industry experts, Kazakhstan, one of the largest Bitcoin (BTC) mining locations globally, could lose its BTC hash rate lead in the next hash rate distribution update.

According to the Cambridge Bitcoin Electricity Consumption Index (CBECI), as of August 2021, Kazakhstan has more than 18% of the global BTC hash rate, second only to the United States.

The massive exodus of Chinese miners has partly contributed to the surge in BTC mining capacity in Kazakhstan. Before China’s BTC hash rate fell to zero in August 2021, it accounted for more than 75% in 2019.

However, while many Chinese BTC mining giants such as Canaan and BTC.com will relocate to Kazakhstan in 2021, the country could eventually lose its share of the hash rate for several reasons. This could take Kazakhstan out of the top three BTC mining countries in the next CBECI update.

Bitcoin mining in Kazakhstan will eventually decline, mainly due to unsustainable electricity subsidies.

Another reason Kazakhstan could lose its lead in BTC mining is its reliance on the oil and gas industry.

Some Chinese crypto mining giants have already shown signs of a possible reversal in Kazakhstan’s expansion. BIT Mining, one of the largest BTC mining companies, has moved operations from China to Kazakhstan in 2021. However, the company is canceling some of its crypto holdings in Kazakhstan anytime soon.

Cardano’s Daily Volume Surges, But ADA Price Plummets

According to Messari, on-chain activity on the Cardano blockchain has exploded. Cardano is now second only to Bitcoin in 24-hour transaction volume, surpassing Ethereum in the process.

Cardano (ADA) currently has a 24-hour trading volume of $17.04 billion. With $18.85 billion in Bitcoin and $5.25 billion in Ethereum, it is in second place, close to the top.

Cardano’s trading volume has increased in recent weeks due to the decentralized exchange SundaeSwap (DEX) launch. The launch’s hype caused blockchain congestion for days due to the influx of transactions.

Regardless of SundaeSwap’s impact on the network, Cardano’s total number of transactions increased by 480% from 5.5 million on March 30 last year to nearly 32 million on February 20.

The conditions are ripe for Cardano’s rise as both Bitcoin and Ethereum have recently dropped their network activity. Bitcoin’s 24-hour trading volume is down 84% from its 3-month peak of $116 billion on November 25. Ethereum trading volume has been falling since December 4, when it hit a 3-month high of $21.29 billion. On February 19, it dipped 82% to a three-month low of $3.99 billion.

-

Support

-

Platform

-

Spread

-

Trading Instrument