Bitcoin, Ethereum, Dogecoin without strength and determination

Looking at the chart on the daily time frame, we see that the Bitcoin price has been calm for the second day and continues to consolidate and test the 200-day moving average as well as the 50.0% Fibonacci level at $ 46,980. We have additional support in the 50-day moving average. If the price manages to break below, then we continue to lower the price of the lower support to 38.2% Fibonacci level to $ 42,695. Our next lower support is at the previous low at $ 38,000. We need a positive consolidation above the 20-day moving average and a return again above 61.8% Fibonacci levels for the bullish scenario. Only then can we say that we are back in the bullish trend again.

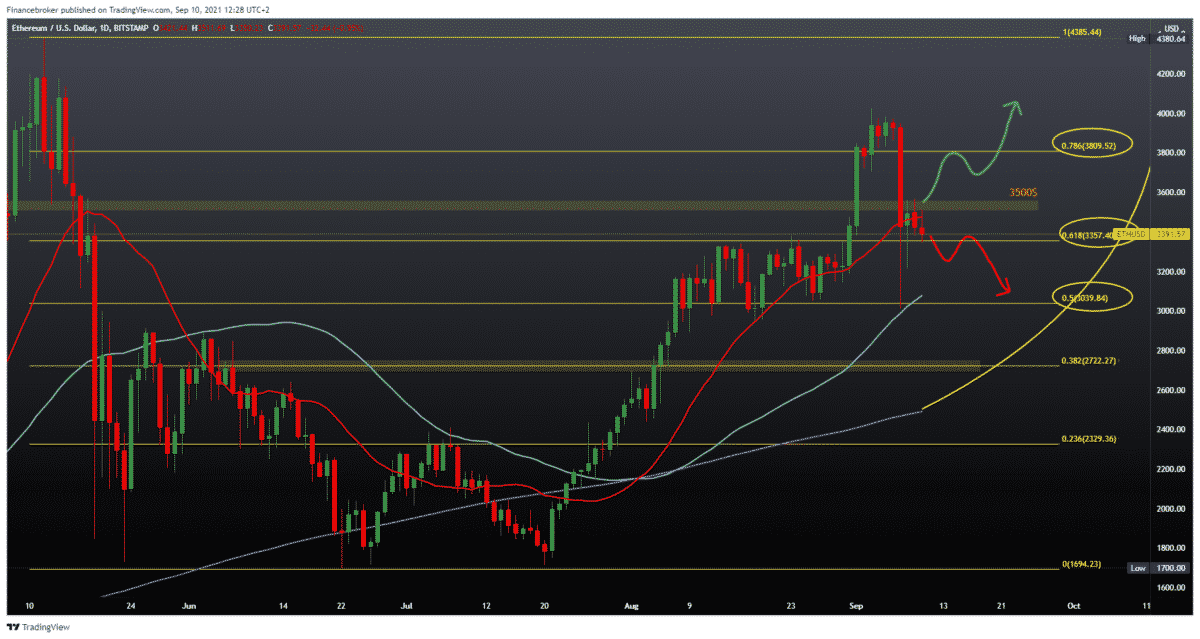

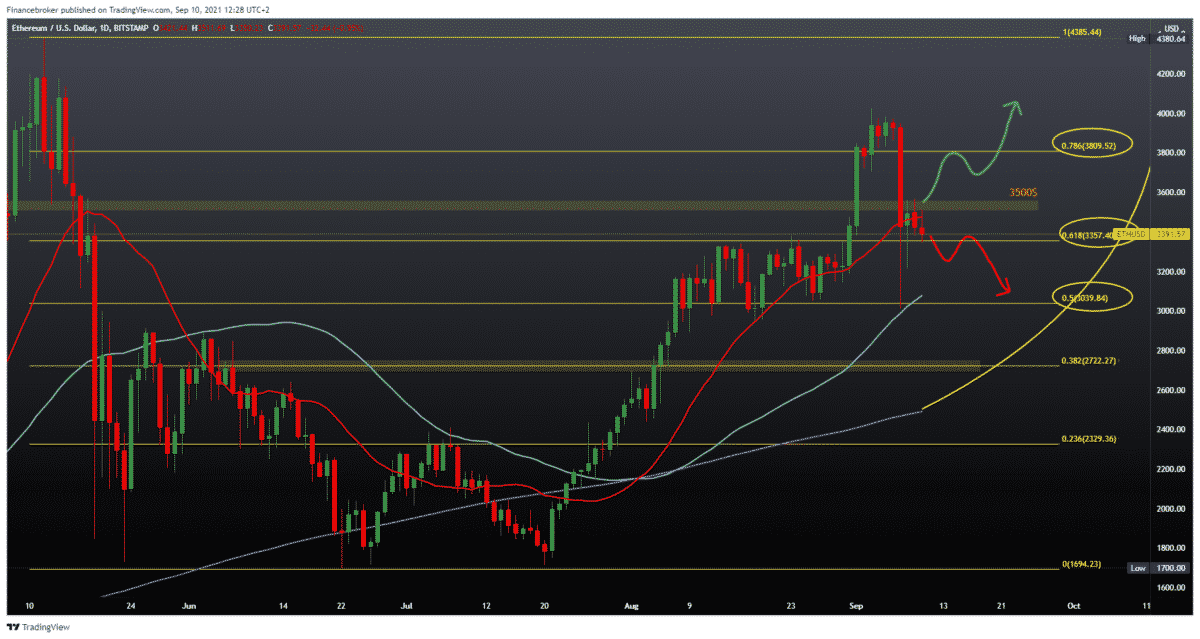

Ethereum chart analysis

Looking at the chart on the daily time frame, we see that Ethereum is still under pressure. We are currently testing the 61.8% Fibonacci level at $ 3360. Based on the current situation, we can expect to see a further price increase towards 50.0% Fibonacci level at $ 3040, a place where we encounter a 50-day moving average. For the bullish scenario, we need a positive consolidation that will push the price above $ 3,500 and redirect us towards the $ 4,000 psychological level.

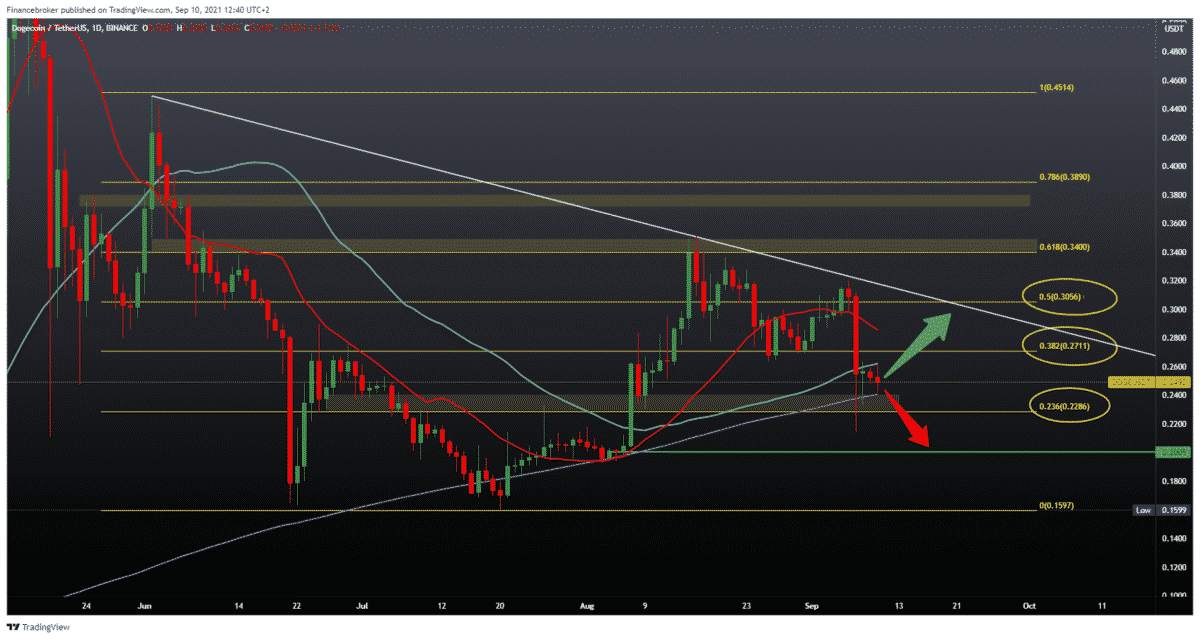

Dogecoin chart analysis

Looking at Dogecoin on a daily time frame, we see that the price is still testing the 200-day moving average as current support and obstacle to the bearish trend. If by any chance, we see a break below this support line, we can very easily see the price of Dogecoin in the zone 0.20000-0.22000. If the price finds support at the current level, we need a bar break above 38.2% Fibonacci level 0.27100 for a further potential continuation of the bullish trend. On the upper side, the downward trend line is an additional resistance, and the break above would definitely bring us back to the bullish side and increase the optimism that we can climb to new historical levels on the chart.

Market overview

Ukraine has been the fifth country to establish some basic rules for the cryptocurrency market in the last few weeks.

The Ukrainian parliament has almost unanimously adopted a law that legalizes and regulates cryptocurrencies. The law, which was passed in 2020, is now being signed by President Volodymyr Zelensky, CNBC reports.

Until today, the crypto market in Ukraine has functioned in the gray zone, where citizens have been allowed to buy and exchange virtual coins. Still, companies and stock exchanges dealing with cryptocurrencies have often been under the control of the financial police.

According to the Kiev Post, the authorities had a fighting stance when it came to virtual money, considering it an instrument for “fraud” and money laundering, searching companies associated with cryptocurrencies, and “often confiscating expensive equipment without any basis.”

By 2022, the country plans to open a cryptocurrency market for companies and investors, according to the Kiev Post.

The new law envisages certain measures of protection against fraud for holders of bitcoin and other cryptocurrencies. The deputies in the Verkhovna Rada also defined the basic terminology in the world of cryptocurrencies, such as the terms virtual property, digital wallet, private keys, etc.

Unlike El Salvador, which adopted bitcoin as a legal tender this week, the Ukrainian crypto law does not mean introducing bitcoin as a means of payment, nor does it put it on the same footing with the hryvnia, the country’s state currency.

Adopting Bitcoin as a legal tender in El Salvador earlier this week cheered the entire cryptocurrency community. While many believe this is an important milestone on the road to financial freedom, some have suggested that other countries should follow suit.

Even so, it is worth noting that the above-mentioned introduction did not escape criticism. Most proponents of traditional finance have criticized the move, including the IMF.

-

Support

-

Platform

-

Spread

-

Trading Instrument