Bitcoin, Ethereum, Dogecoin See New Growth Over the Weekend

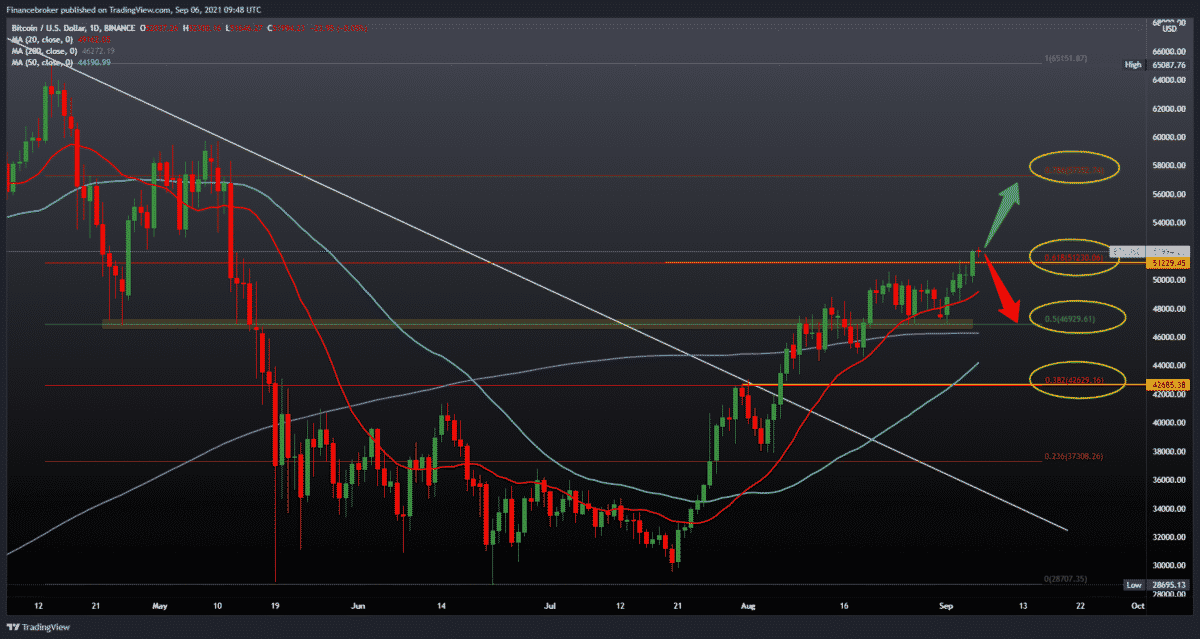

Looking at the chart on the daily time frame, we see that the price of Bitcoin managed to break above 61.8% Fibonacci levels, climbing to $ 52,000. We can now expect further price growth to continue towards the next 78.6% Fibonacci level at $ 57,350. If by any chance we see that there is instability on the chart, then we can expect a price pull. This is so the price consolidates before the next stronger bullish or bearish momentum. We still have great support at 50.0% Fibonacci level and in the 200-day moving average. For now, we are considering the continuation of the bullish trend and the further continuation of the growth of the price of Bitcoin.

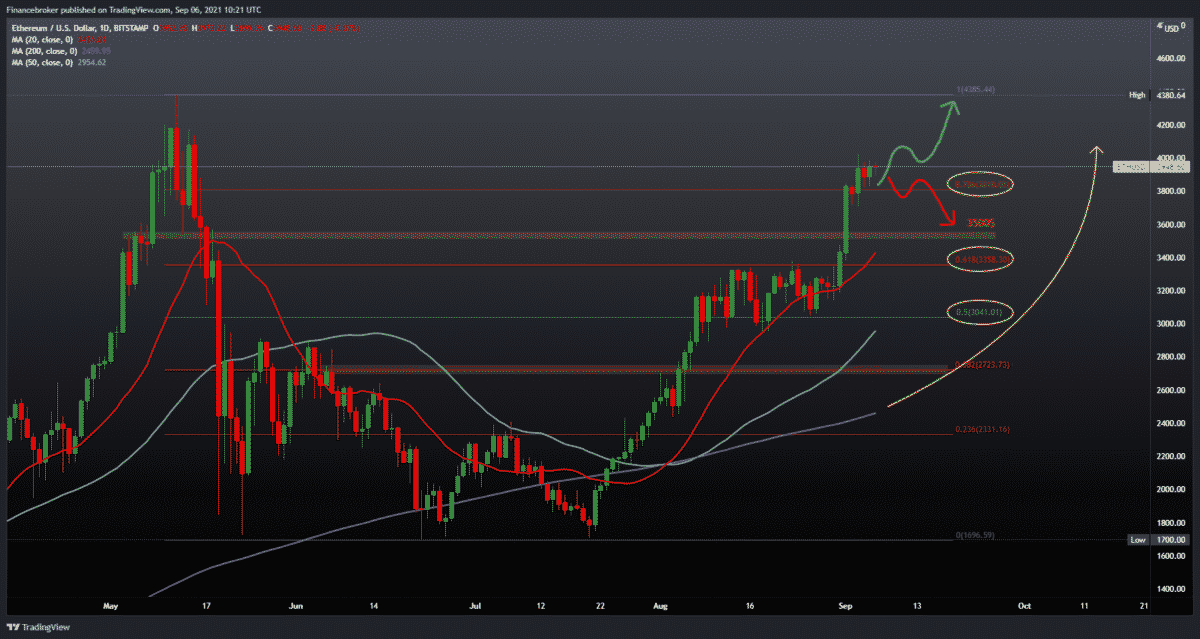

Ethereum Chart Analysis

Looking at the chart on the daily time frame, we see that the price is getting closer to its previous high at $ 4380. We are now at the current $ 3950 and see the price consolidate above 78.6% Fibonacci levels at $ 3810. If consolidation continues to be positive, we can expect further growth towards the historical maximum. For a potentially bearish scenario, we need a price withdrawal below the 78.6% Fibonacci level, intending to go down to the $ 3,500 psychological level. In comparison, our greater support is lower consolidation in the zone below the 61.8% Fibonacci level. We are generally looking at the bullish side and continuing towards higher prices on the chart.

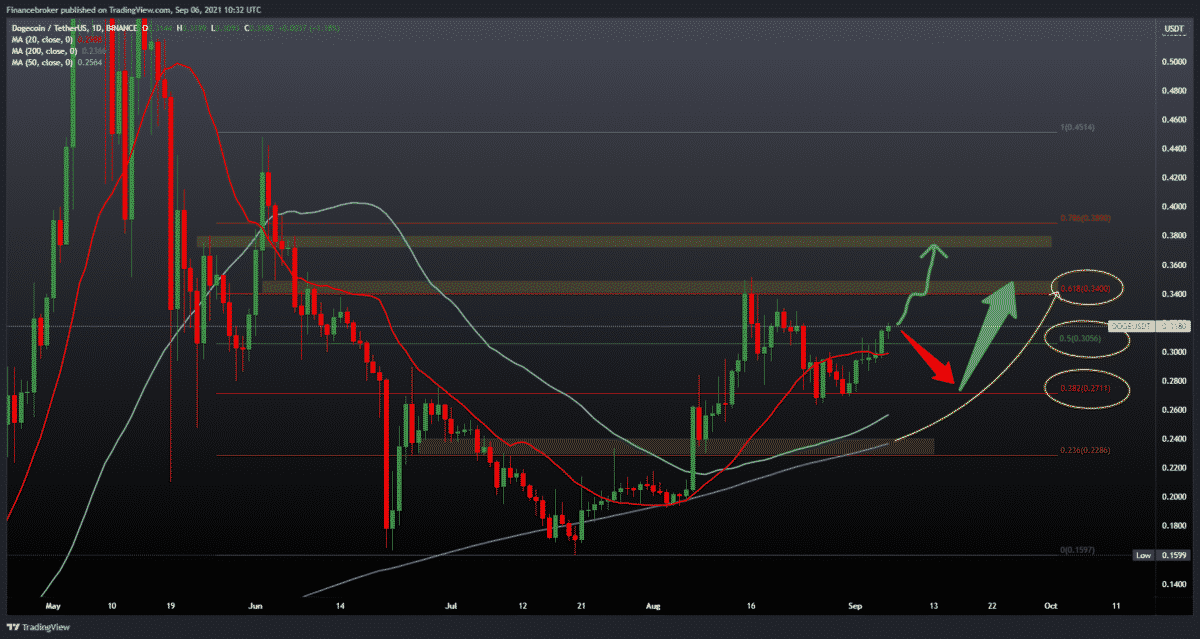

Dogecoin Chart Analysis

Looking at the chart on the daily time frame, we see that the price of Dogecoin is in a bullish trend, continuing above the 20-day moving average in order to reach the previous high at 0.35000. We need a price withdrawal and negative consolidation below the 20-day moving average for the bearish trend. This can direct the price towards a 38.2% Fibonacci level with potential support in the 50-day and 200-day moving average. For now, we have made a break above the 50.0% Fibonacci level. And we are looking towards the 61.8% Fibonacci level at 0.3400. There we can expect potential resistance or consolidation at that level.

Market Overview

The meeting at a vehicle warehouse in Houston served as a meeting place for oil producers and bitcoin miners last week about the possible possibilities of crypto mining on the spot. More than 200 investors attended the conference to discuss an alliance that would permit oil producers to manage their stocks more efficiently, and miners could use direct energy sources that would otherwise be consumed.

The meeting, which took place at a vehicle warehouse in Houston, served as a meeting place to explore these opportunities. Oil holes that are not large enough to install pipelines in their operations typically burn the pockets of natural gas encountered.

Conclusion

Bitcoin mining can provide a better solution. Natural gas can be used as energy generators that would power micro mining operations in each well. This combination would benefit both miners and producers. Moreover, it would be useful to the environment as well. Particularly since it can avoid burning this gas to release it into the atmosphere.

Hayden Griffin Haby III is the result of the merging of these two worlds. He is an oilman who is also a bitcoin miner. Haby said that when he realized the return of the bitcoin mining operation, he just had to jump into bitcoin. He emphasized:

When I heard that you could make this much money on gasoline instead of just burning it in the atmosphere, thanks to this whole bitcoin mining thing, I couldn’t look away.

One of the key goals of Texas oil companies is to capture a number of entrepreneurs in bitcoin mining who still want to relocate their operations after being kicked out of China. Alejandro de la Torre is one of the miners still delivering mining platforms from China to the US. He stated that these miners were waiting for delivery to the ports on several Pacific ships.

However, many of these contracts are made in secret and are not disclosed to the public. Some jobs are protected by non-disclosure agreements. Other players in the space simply don’t want to talk about their relationships. This is mainly because that would give competitors an advantage.

-

Support

-

Platform

-

Spread

-

Trading Instrument