Bitcoin, Ethereum, Dogecoin review of today’s changes

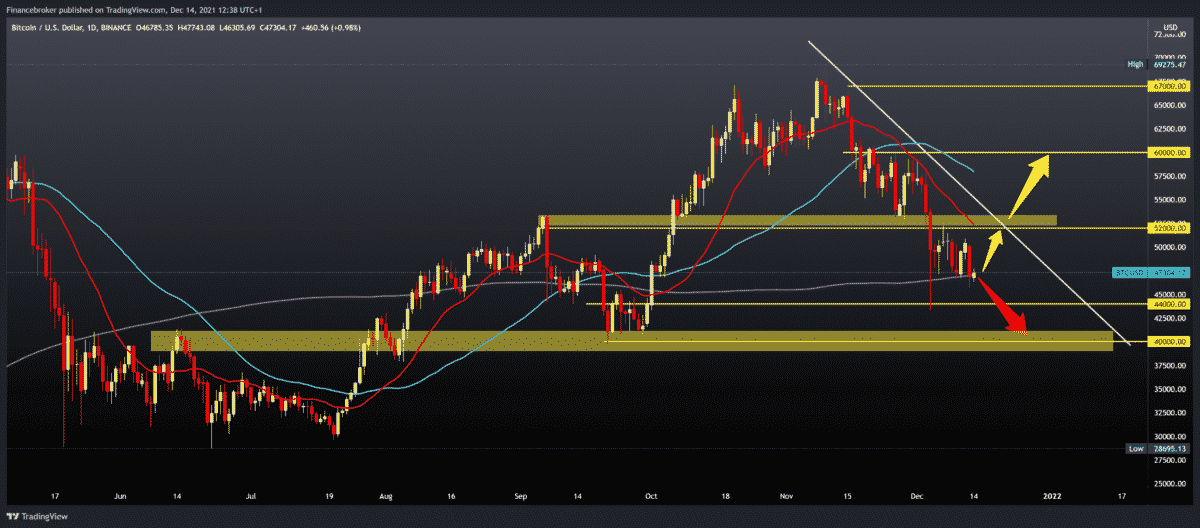

Looking at the Bitcoin chart on the daily time frame, we see that the price dropped from $ 50,000 to $ 46,700 yesterday. The price has fallen to the MA200 moving average, and now he supports us. A brief recovery has climbed us to the current 47,400, and with the new bullish consolidation, we could test the zone at $ 50,000 again.

Bullish scenario:

- We need a new positive consolidation that would direct us again to the previous resistance to $ 50,000.

- The break above climbs us to the next resistance at 52000, where additional resistance awaits us in the MA20 moving average.

- At the top, we have a trend line that is also an obstacle to the bullish trend.

- A further break above the trend line brings us to the psychological level at $ 55,000, and if we overcome that zone, then we come to the MA50 moving average at $ 57,500.

Bearish scenario:

- It needs to continue the negative consolidation, re-test the MA200 moving average, and break below.

- If Bitcoin falls below this support zone, it will drop further to the next one at $ 44,000-45,000.

- An extensive support zone awaits us in the $ 40,000 area.

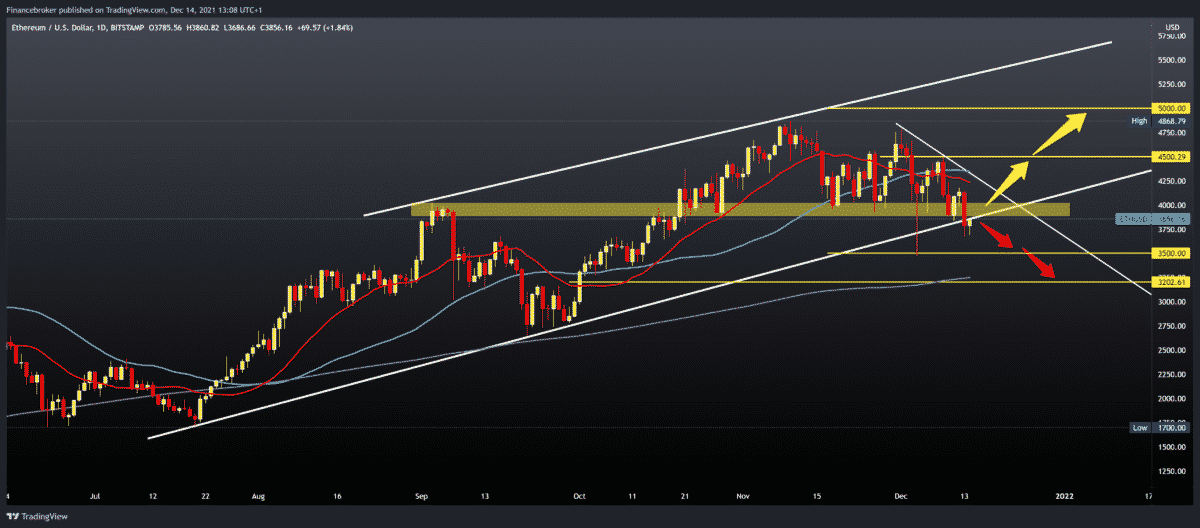

Ethereum chart analysis

Looking at the ETHUSD chart on the daily time frame, we see that the price fell from $ 4130 to $ 3670 yesterday. Today, the price is stable and records a smaller profit at the current $ 3840. We are now testing the bottom trend line and expect its support to continue the bullish trend.

Bullish scenario:

- We need a new positive consolidation and a price return above the lower trend line.

- Then we climb, looking for support at $ 4000, and with further consolidation, we move on.

- The next resistance is $ 4,200 with resistance to the MA20 moving average.

- And our first primary target is $ 4,500 last week’s high.

Bearish scenario:

- We need continued negative consolidation and a fall in the price below the bottom trend line.

- The break below directs us to the $ 3,500 previous December lower low.

- In the $ 3,200 zone, we come across a moving MA200 average that could repeat September’s support.

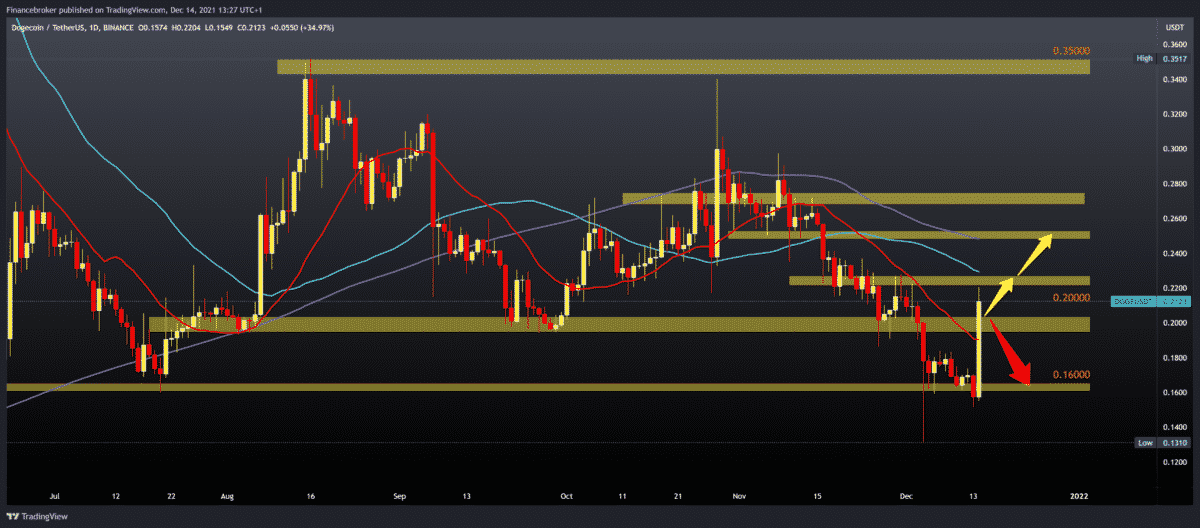

Dogecoin chart analysis

Looking at the Dogecoin chart on the daily time frame, we see that this morning’s price jumped from 0.15750 to 0.22000. “Tesla will make some goods that can be bought with Doge and see how it goes,” Musk wrote on Twitter. This news launched a 20.0% price of Dogecoin, now we are looking at what the consolidation will be like and whether we will continue on the bullish side.

Bullish scenario:

- We need a further continuation of this bullish impulse, and the price stays above 0.20000.

- Dogecoin has received the support of the MA20 moving average, and in the zone around 0.22000, the next MA50 moving average is waiting for us.

- The price break above directs us to the next resistance at 0.25000 with the MA200 moving average.

- If the price manages to overcome all these obstacles, then we can say that we have escaped the bearish pressure.

Bearish scenario:

- We need negative consolidation and a return of prices below 0.20000.

- Additional support at this level is our MA20 moving average.

- We are looking for the next bearish target and support in zone 0.18000, then at 0.16000.

Market overview

When Satoshi introduced bitcoin in 2008, it introduced a new and liberating concept, a decentralized payment system that can be used by anyone, anywhere, and for everyone. It did not require an intermediary or exchange rate to function and created a single globally used currency for any transaction, but then greed stood in the way.

The use case he was supposed to deliver has faded somewhat. Instead of focusing on the payment method’s initial intention, the focus shifted to bitcoin as an investment vehicle, the value of trade, digital gold. Dr. Merav Ozair is a leading blockchain expert and FinTech at Rutgers Business School.

Some of the first bitcoin adapters were evangelicals, motivated by the financial crisis of 2008, who truly wanted to create a difference in the world and create a new kind of global financial system. However, most were speculators who sniffed out the opportunity to make money. Bitcoin began to be traded on crypto exchanges as a financial instrument, which is subject to high price volatility due to the activity of trading with speculators. But it moved further away from its economic use – the method of payment – and became a more speculative financial instrument.

For bitcoin to adapt globally as a payment method, it must be scalable enough to support such activity. But blockchain technology that enables bitcoin is still struggling, and developers are constantly looking to find a solution for a decentralized blockchain that is secure and scalable. Speculators have an advantage until a scalable solution is found and bitcoin cannot deliver its initial use case. When speculators dictate value, volatility increases, making it harder to adjust bitcoin as a payment method.

-

Support

-

Platform

-

Spread

-

Trading Instrument