Bitcoin, Ethereum, Dogecoin on current supports

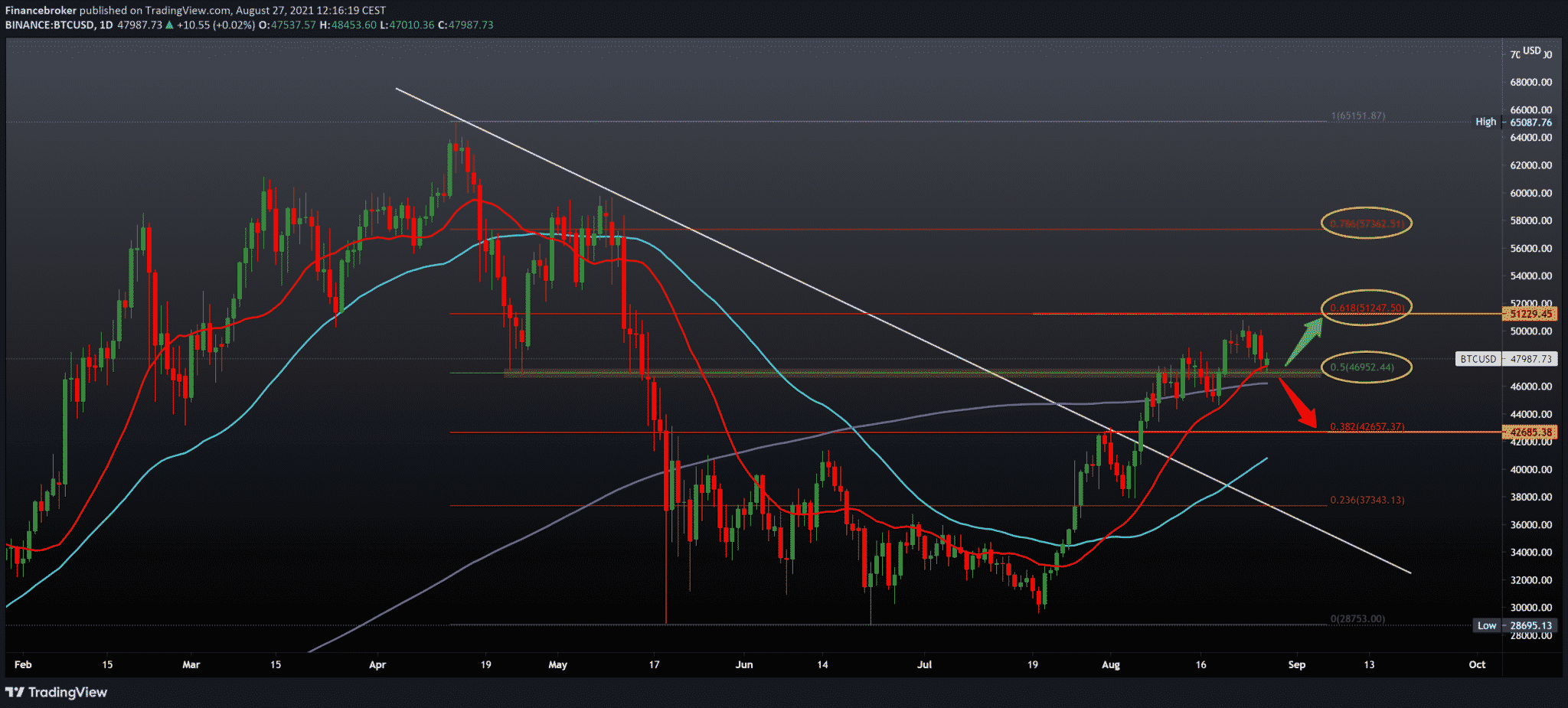

Looking at the chart on the daily time frame, we see that the price of Bitcoin has found current support at 50.0% Fibonacci level at $ 46,950. We need a break below this level and a 200-day moving average for a potential continuation on the bearish side. If the price makes that withdrawal, then our target is a 38.2% Fibonacci level at $ 42660. Additional support below can be obtained at that level with a 50-day moving average. We hope to see support for the bullish scenario and a new bullish boost that would lead us again to resistance at the 61.8% Fibonacci level at $ 51,250.

Ethereum chart analysis

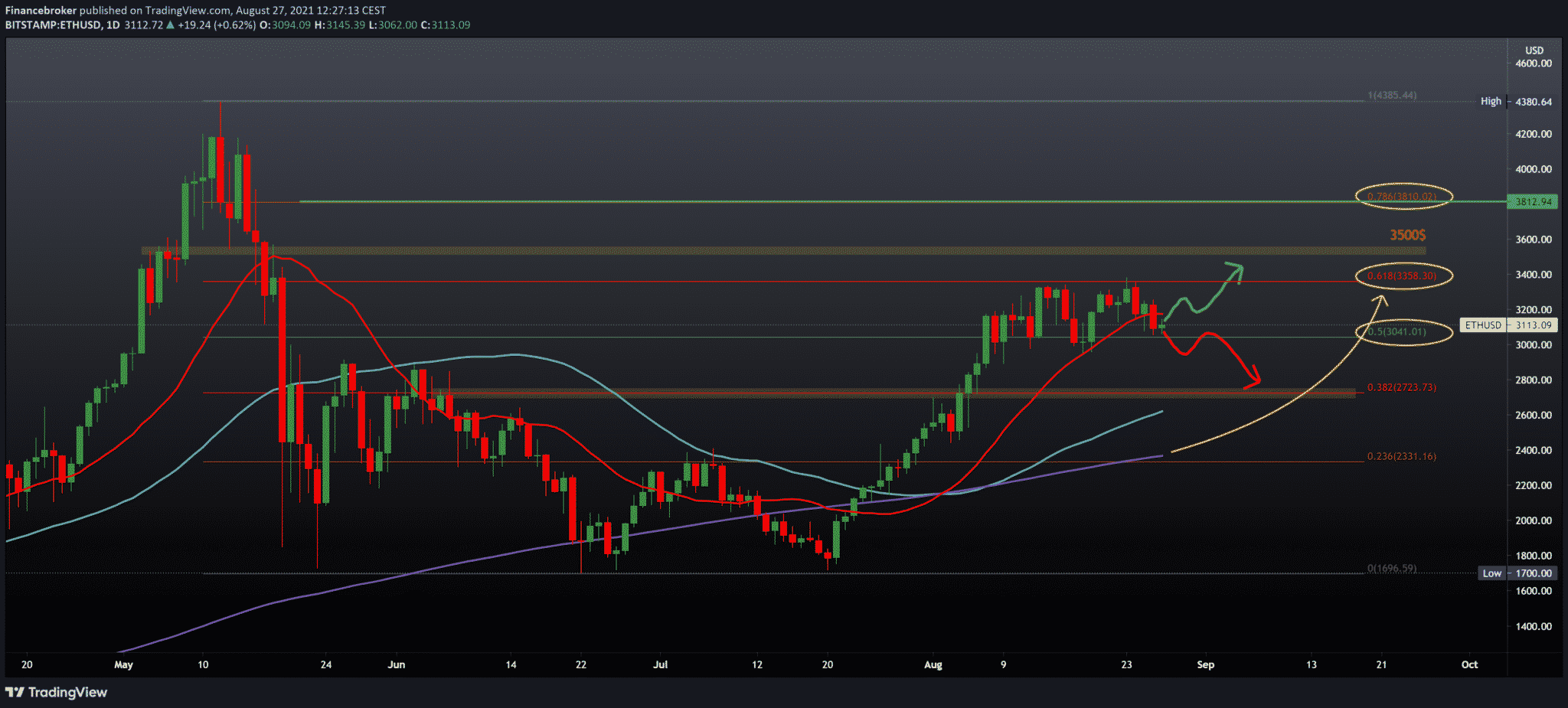

Looking at the chart on the daily time frame, we see that the price of Ethereum has found current support at 50.0% Fibonacci level at $ 3040. There is still high resistance at $ 3360 at 61.8% Fibonacci level. A fall in the price below the 50.0% level would clearly signal that we will see a further price increase towards the 38.2% Fibonacci level at $ 2725. Of the moving averages, the 20-day moving average is on the bearish side, and it puts pressure and directs the price towards a 50-day moving average that will match the 38.2% Fibonacci level. For the bullish scenario, we need better support at the current position, as well as a break above the previous high to $ 3360. Only then can we expect further price growth towards the previous historical high above $ 4000.

Dogecoin chart analysis

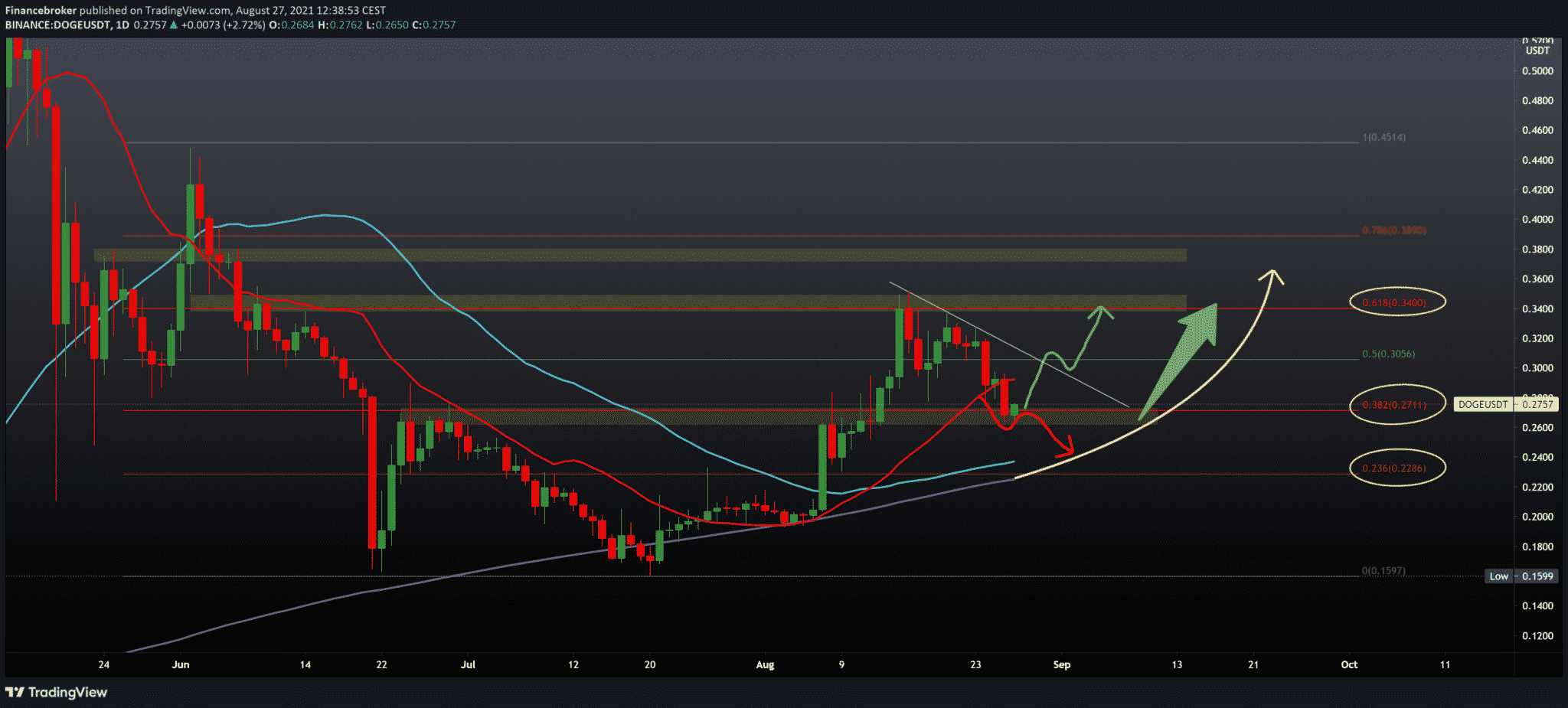

Looking at the Dogecoin chart on the daily time frame, we see that the price is currently at 0.27500, and that support has been found at 38.2% Fibonacci level. This zone coincides with the previous highs that were an obstacle in previous price attempts to make a break, and now that zone is our potential support zone. If Dogecoin finds support here, we need to jump above the upper resistance line and 50.0 Fibonacci levels to 0.30550 to continue the bullish trend. We need to continue to pull the price below this potential support zone for the bearish scenario, aiming for a 200-day moving average at 0.23000 at a 23.6% Fibonacci level.

Market overview

The Cuban Central Bank has announced that it will establish rules to regulate the use of cryptocurrencies in commercial transactions and the licensing of service providers in the sector.

In an official resolution called Resolution 215, published in Gaceta Oficial, the Cuban Central Bank (BCC) said it could approve “the use of certain virtual assets in commercial transactions and license virtual property service providers for financial, exchange and payment or payment activities.”.

The bank added: “Financial institutions and other legal entities may use virtual assets only among themselves and with individuals to conduct monetary and trade operations, exchange and exchange transactions, as well as to settle monetary obligations.”

However, this can only be done with the approval of the Central Bank, which also explained that a virtual asset is understood as “a digital display of value that can be traded or transferred digitally and used for payments or investments.”

Furthermore, the BCC noted that “persons assume civil and criminal risks and liabilities arising from the business of virtual assets and service providers operating outside the banking and financial system, although transactions with virtual assets between these persons are not prohibited.”

The bank also warned that cryptocurrencies involve the risk of being used to finance criminal activities due to the anonymity of registered users.

Eduardo Sanchez, a Cuban blockchain expert, said: “It will be important for the government to regulate and maintain sovereignty over the financial system.”

“The Cuban context shares the same risk with any other crypto market in the world – instability, security, capital flight, financing of criminal activities,” he added.

The Central American nation of El Salvador also recently announced that it would recognize the use of bitcoin to encourage the deposits of its citizens living abroad.

-

Support

-

Platform

-

Spread

-

Trading Instrument