Bitcoin, Ethereum, Dogecoin on current daily supports

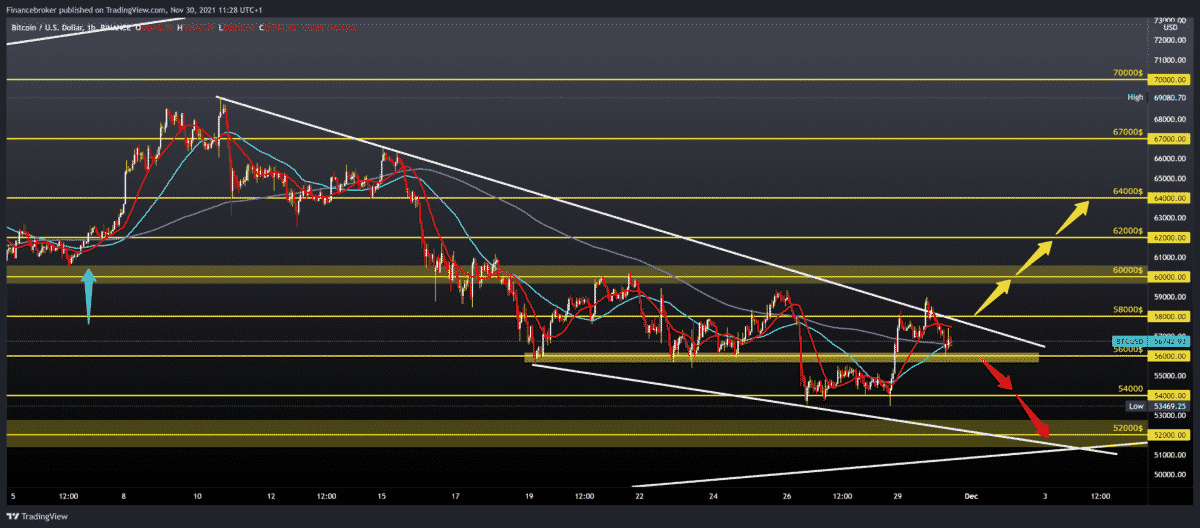

Bitcoin made a break above the zone at $ 58,000 yesterday, climbing to $ 59,000. He didn’t linger much upstairs, and we saw a new pullback to support at $ 56,000. We are now consolidating just above that support by testing moving averages in the $ 56800-57000 zone. The price is still not ready for stronger bullish progress.

Bullish scenario:

- We need a new positive consolidation and a new break above $ 58,000 and moving averages.

- Then below, we have to climb above 59000 $ to test the $ 60,000 level.

- A further break leads us to the first resistance at $ 62,000, while the next one is in the $ 64,000 zone.

Bearish scenario:

- We need negative consolidation below $ 56,000 and moving averages.

- Then we can expect a further price drop to the previous support to $ 54,000, and we expect a maximum pullback to $ 52,000 and support on the lower trend line.

Ethereum chart analysis

Ethereum chart analysis

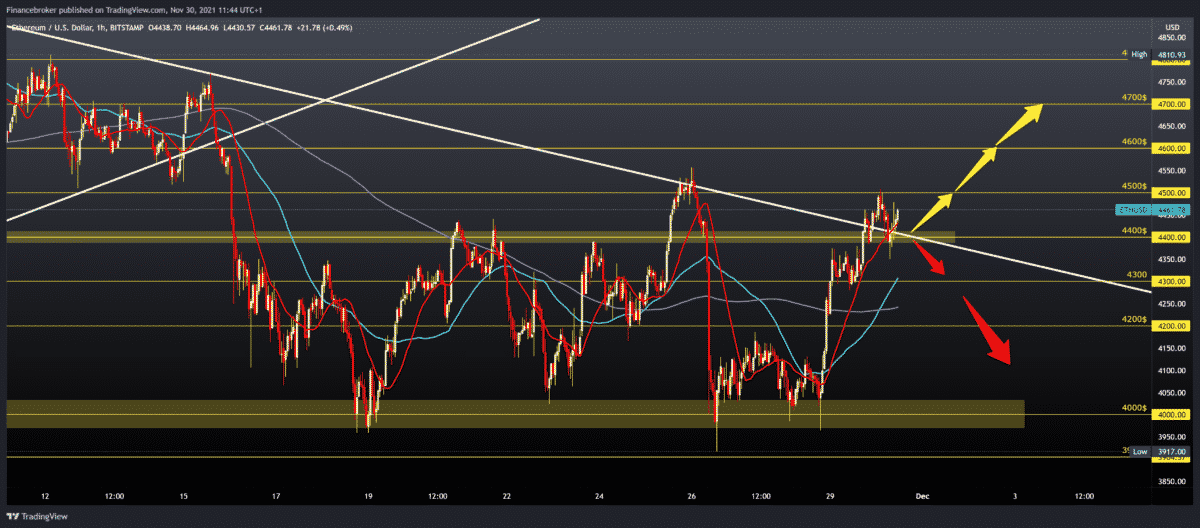

Ethereum tested the $ 4500 level yesterday, then made a shorter pullback to $ 4400. She found new support at $ 4400 and again headed to a new test of $ 4500 and a possible break above.

Bullish scenario:

- We need a continuation of this positive consolidation and a beak above $ 4,500.

- Then the first next resistance is at the $ 4560 previous high. Continued price growth may lead us to the next resistance at $ 4600, and the next resistance is in the zone around $ 4700.

Bearish scenario:

- We need a new negative consolidation and a price withdrawal below $ 4400 and below the upper trend line.

- In the zone around $ 4300, the first potential support and MA50 moving average are waiting for us.

- A further price pull directs us to the next support to the MA200 moving average at $ 4240, then to $ 4200.

- Our large support zone is at the $ 4000 level, which can be an obstacle to the bearish trend.

Dogecoin chart analysis

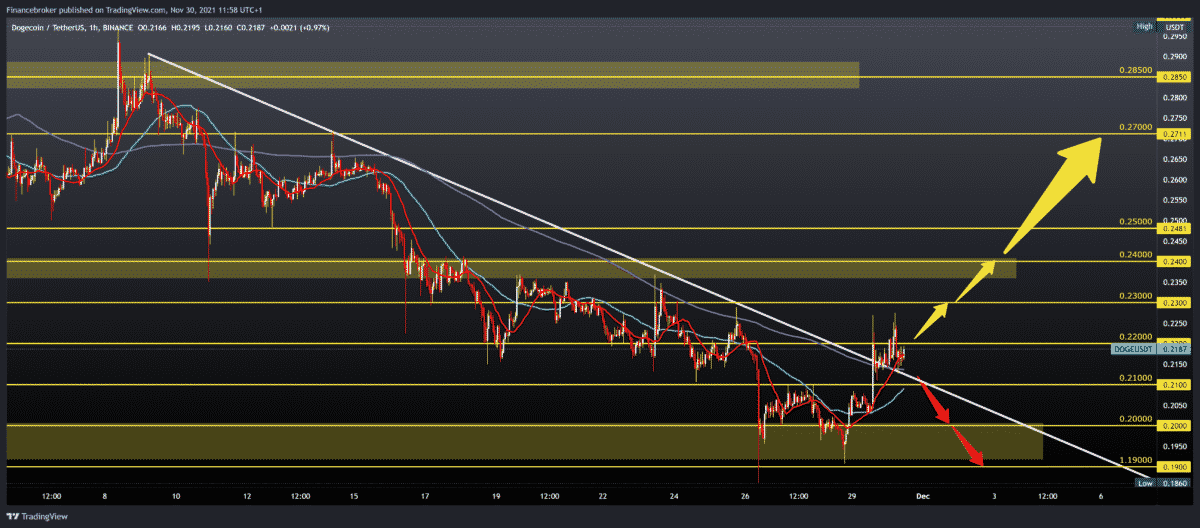

The price of Dogecoin made a break above the upper trend line yesterday, stopping this bearish trend. With the support of moving averages and the trend line, we can expect further price recovery and growth towards previous higher highs.

Bullish scenario:

- We see that the price of Dogecoin has current support at 0.21500 with the support of an MA200 moving average.

- If this consolidation continues, we can expect a break above 022000 first, and then a potential test of 0.23000 levels.

- The next first resistance is at 0.24000 and then 0.25000 psychological level.

- By going above 0.25000, we could say that Dogecoin has shied away from bearish influence.

Bearish scenario:

- We need negative consolidation and price withdrawal below 0.21000, trend line, and all moving averages.

- Further bearish impulse lowers us to 0.20000 level, and the break below us drops us to the zone of November lows around 0.19000.

Market news

Billionaire investor Mike Novogratz has informed that Federal Reserve Chairman Jerome Powell could slow down the cryptocurrency market in his second term. He said Powell could “act more like a central banker than a guy who wants to be reelected.”

President Joe Biden nominated Powell for another term as Fed president last week. Powell oversaw the largest monetary stimulus in U.S. history to help the economy cope with the Covid-19 pandemic and the ensuing crisis.

Mike Bailey, director of research at FBB Capital Partners, clarified Powell’s second term’s impact on the crypto industry. For stubborn crypto bulls, another Powell term may provide some confirmation bias because investors often see cryptocurrencies as protection against loose Fed policies.

President of the financial advisory firm Bone Fide Wealth Douglas Boneparth said general uncertainty about how markets will react without additional Fed support.

-

Support

-

Platform

-

Spread

-

Trading Instrument