Bitcoin, Ethereum, Dogecoin in red on Dec 8, 2021

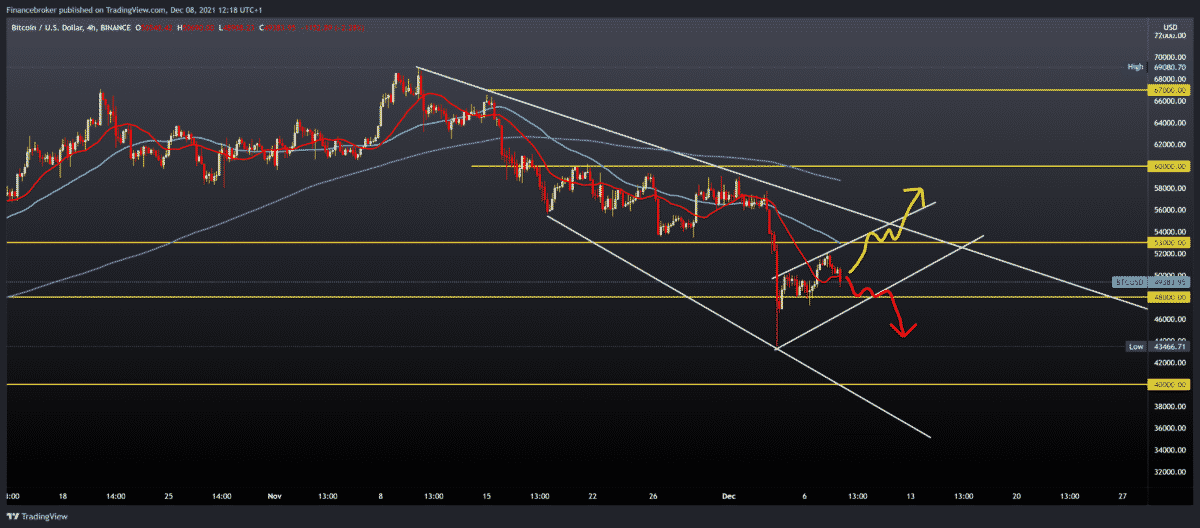

The price of Bitcoin is slowly recovering after last week’s fall to $ 43,466. Yesterday we managed to climb to $ 52,000, but after that, there was a pullback to the current $ 48,955. At $ 48,000, we can expect support for further price recovery.

Bullish scenario:

- We need continued positive consolidation with the support of the MA20 moving average.

- We need to climb above $ 50,000 to get above the psychological price barrier.

- Then our next resistance is at $ 53,000 with an MA50 moving average resistance.

- The break above us leads to the next resistance zone and potential consolidation around $ 58,000.

Bearish scenario:

- We need a further continuation of this brief negative consolidation to support $ 58,000.

- The break below this support opens the door for us to revisit the previous low at $ 43,466.

- Further negative pressure would probably send the $ 40,000 lower psychological level to the price.

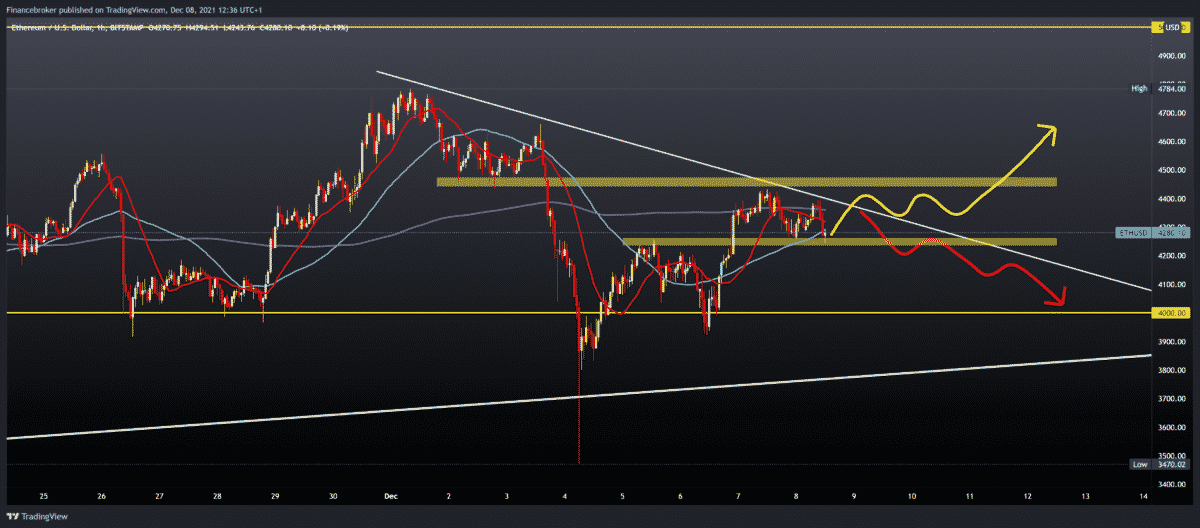

Ethereum chart analysis

The price of Ethereum is slowly continuing to recover from last week’s drop to $ 3470 and is now at the current $ 4278. Our current resistance is at $ 4,400 with the MA200 moving average, and we need a breakthrough above to continue with the Ethereum price recovery.

Bullish scenario:

- We need positive consolidation above $ 4,250 with the support of moving averages to make the price break above $ 4,400.

- It is also crucial for us to climb above the upper trend line.

- After that, we can expect the price to be $ 4500, and with further positive consolidation to continue further towards the previous high at $ 4785.

Bearish scenario:

- We need negative consolidation and further lowering the price below $ 4,250.

- After that, the next support is in the $ 4000 zone, and if it doesn’t last, then we can expect a return visit to the previous low at $ 3470.

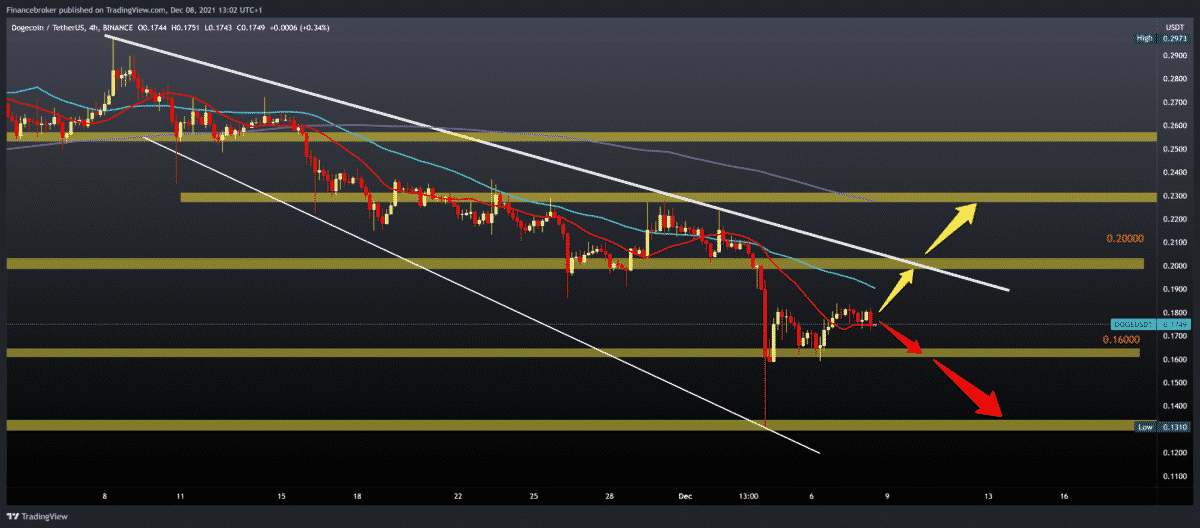

Dogecoin chart analysis

The price of Dogecoin is also recovering from falling to 0.13100 and is now consolidating around 0.17500. We have support in the zone at 0.16000 and with the MA20 moving average, but bearish pressure is still present on the chart. We need better consoles to strengthen current support and help the price recover.

Bullish scenario:

- We need better positive consolidation and a jump in prices above 0.18000.

- After that, we get support in the MA20 moving average and the zone around 0.19000 additional support in the MA50 moving average.

- Our target zone is 0.20000, and the upper trend line can increase bearish pressure.

- The price break above opens the door to the next resistance in the zone at 0.23000 with resistance in the MA200 moving average.

Bearish scenario:

- We need to continue this negative consolidation by testing the support zone at 0.16000.

- Then a break below this zone can bring us down again to last week’s low at 0.13100.

Market overview

David Solomon, CEO of Goldman Sachs, gave his opinion on the bitcoin vs. blockchain dilemma. For Solomon, bitcoin is not as necessary as advances in technology that the implementation of blockchain and other new book-based tools can bring to the traditional world of finance. The CEO further stated that he does not personally own Bitcoin or Ethereum.

He argued that the true value of bitcoin lies in the technology that drives it, blockchain, and how it can affect the future of the world of finance. Solomon said he “strongly believes” in the disruption, these technologies are causing and that Goldman Sachs is also trying to participate in this revolution through its service app.

Solomon also said that, in his opinion, bitcoin is not important in the banking industry. The impact of new technologies that bitcoin and other cryptocurrencies have brought is key to modernizing existing banking platforms. Solomon emphasized:

I don’t think bitcoin is really the key thing. The key thing is how blockchain or other technologies that have not yet been developed can accelerate the pace of digitalization of how financial services are provided. However, he stated that as a speculative asset, it is important for Goldman Sachs to offer bitcoin to its customers to enable them to bet on the market behavior of the currency.

-

Support

-

Platform

-

Spread

-

Trading Instrument