Bitcoin, Ethereum, Dogecoin Forecast: Pressure on the Prices

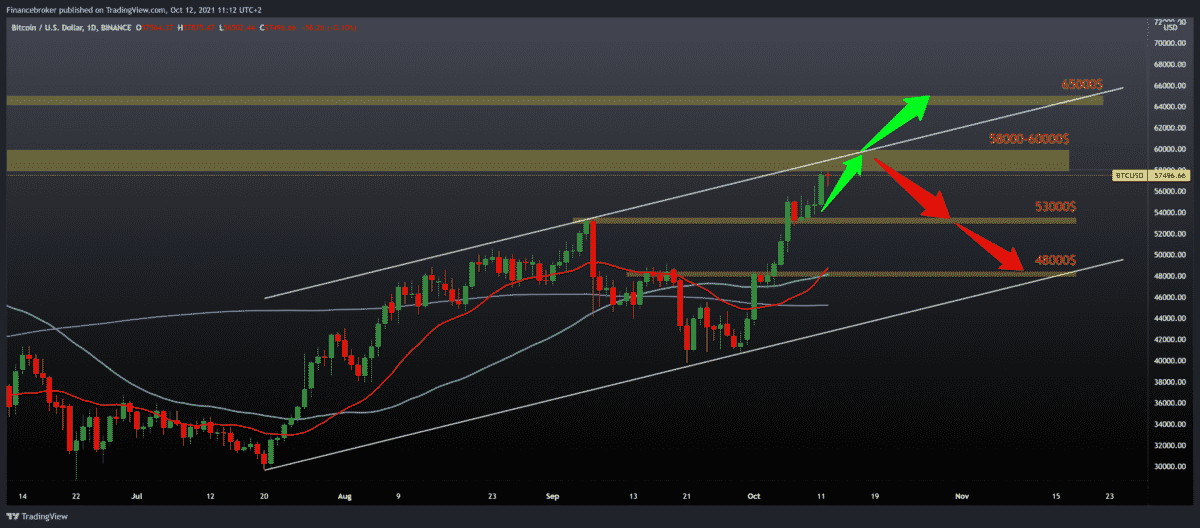

Looking at the BTCUSD chart on a daily basis, we see that yesterday’s price advanced to $ 58,000, and today the Bitcoin price is consolidating around $ 57,500 for now. We are entering a potential resistance zone of $ 58000-60000. There may be some price withdrawal within this growing channel. To continue the bullish trend, we need further price growth above the upper resistance line and a positive consolidation that will pull the price above $ 60,000, with the goal of climbing to the previous high of $ 65,000.

For the bearish scenario, we need negative consolidation, which would direct the price towards the channel’s bottom line. Our first support is at $ 53,000. If it doesn’t give us enough support, then we’ll go down to the bottom support line in the $ 48,000-50,000 zone.

Ethereum chart analysis

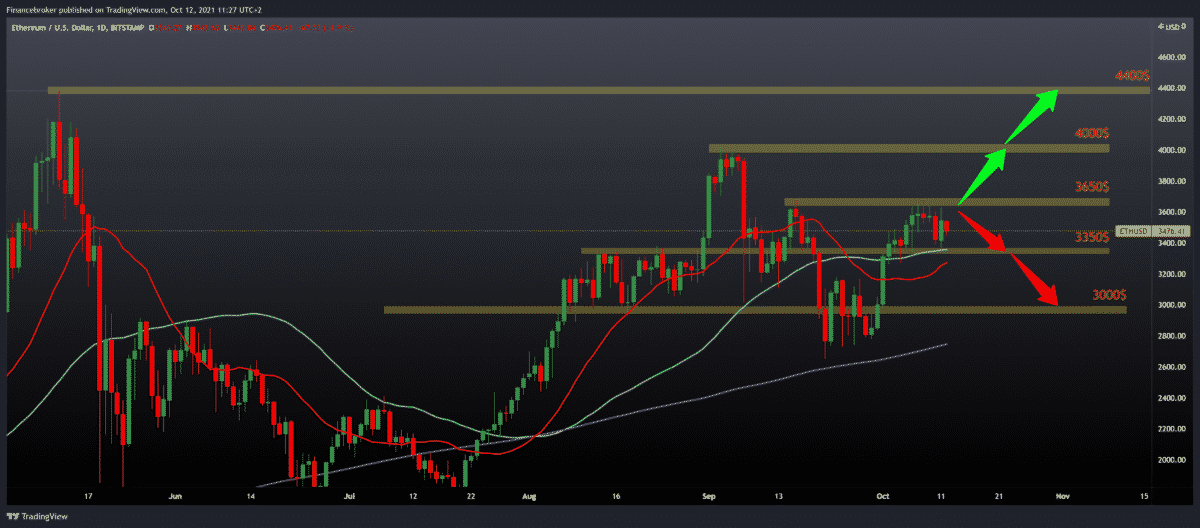

Looking at the ETHUSD chart, we see that the price is still under pressure at around $ 3600. We need a break above this resistance zone to continue up to the next resistance zone at $ 4000. Today we have a withdrawal to the current $ 3475. Moreover, we have support in the 20-day and 50-day moving average in the $ 3350 zone.

If the pressure on the price increases, we can see further withdrawal and break below the moving averages to the next lower support at $ 3200. Stronger psychological support awaits us at $ 3000, and our 200-day moving average is at $ 2800.

Dogecoin chart analysis

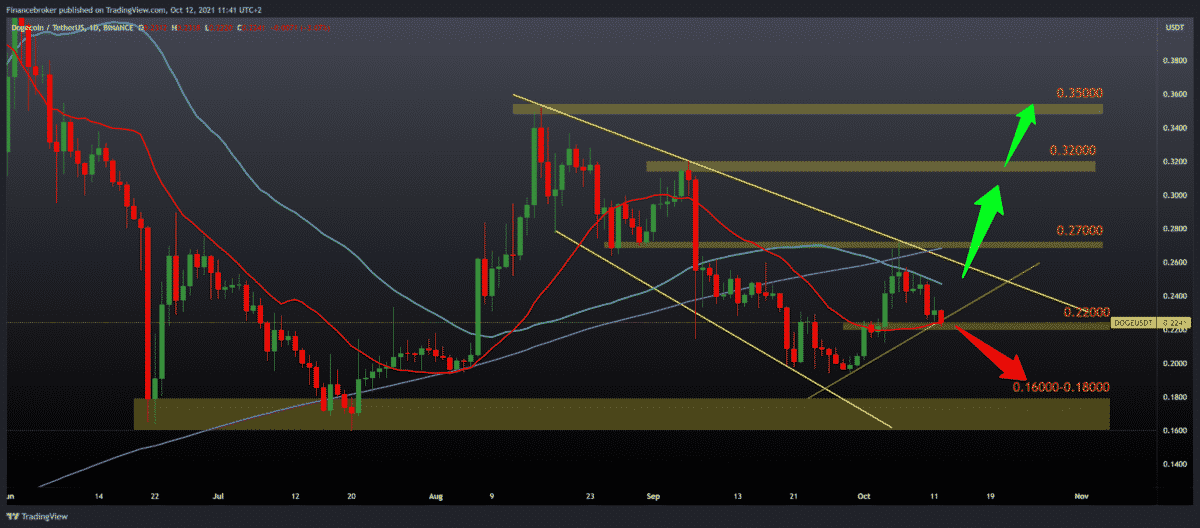

Looking at the Dogecoin chart on the daily time frame, you can see that the price is still under pressure. After touching the upper trend line, the price dropped to the current 0.22400. Here we are now looking for support on the 20-day moving average and the site of last week’s previous consolidation. If the support does not last, we expect the price to continue falling in the last consolidation zone at around 0.20000. For the bullish option, we need positive consolidation. It will again raise the price in the area of the upper resistance line. A break above this line and a 200-day moving average will give us stronger and more confident support on the chart to visit previous highs.

Market overview

According to Bloomberg, the founders and supporters of the exchange at a shareholders’ meeting unanimously voted for Huobi to leave his home country. After China’s Central Bank announced the same day that all crypto transactions and services were banned in the country. The stock market, which was the last remaining Chinese cryptocurrency giant, was not surprised. It has since continued to make moves to finalize exit from the country.

In that context, they suspended the registration of new accounts and initiated the removal of their services to existing Chinese customers with the intention of not having operations in China until the end of the year. According to exchange co-founder Du Jun, they turned their attention to global expansion. This is because all their hopes of reaching an understanding with the government had already failed.

“In the past, we have communicated with regulators to check if there are still ways of doing business legally in China. But this time, there is no room for discussion. Our strategy now is to become global,” Jun told Bloomberg.

While crypto businesses and the crypto industry in China have struggled under targeted surveillance, the adoption of cryptocurrencies is rising elsewhere on the Asian continent. According to the Chainalysis report, the Central and South Asia and Oceania region is currently the fourth largest cryptocurrency market. After transactions of about $ 572 billion, the volume of transactions in the area has increased by 706% in the last year. Thus, making it one of the fastest-growing cryptocurrency economies and a leader in terms of overall adoption.

-

Support

-

Platform

-

Spread

-

Trading Instrument