Bitcoin, Ethereum, Dogecoin Forecast: Positive Movements

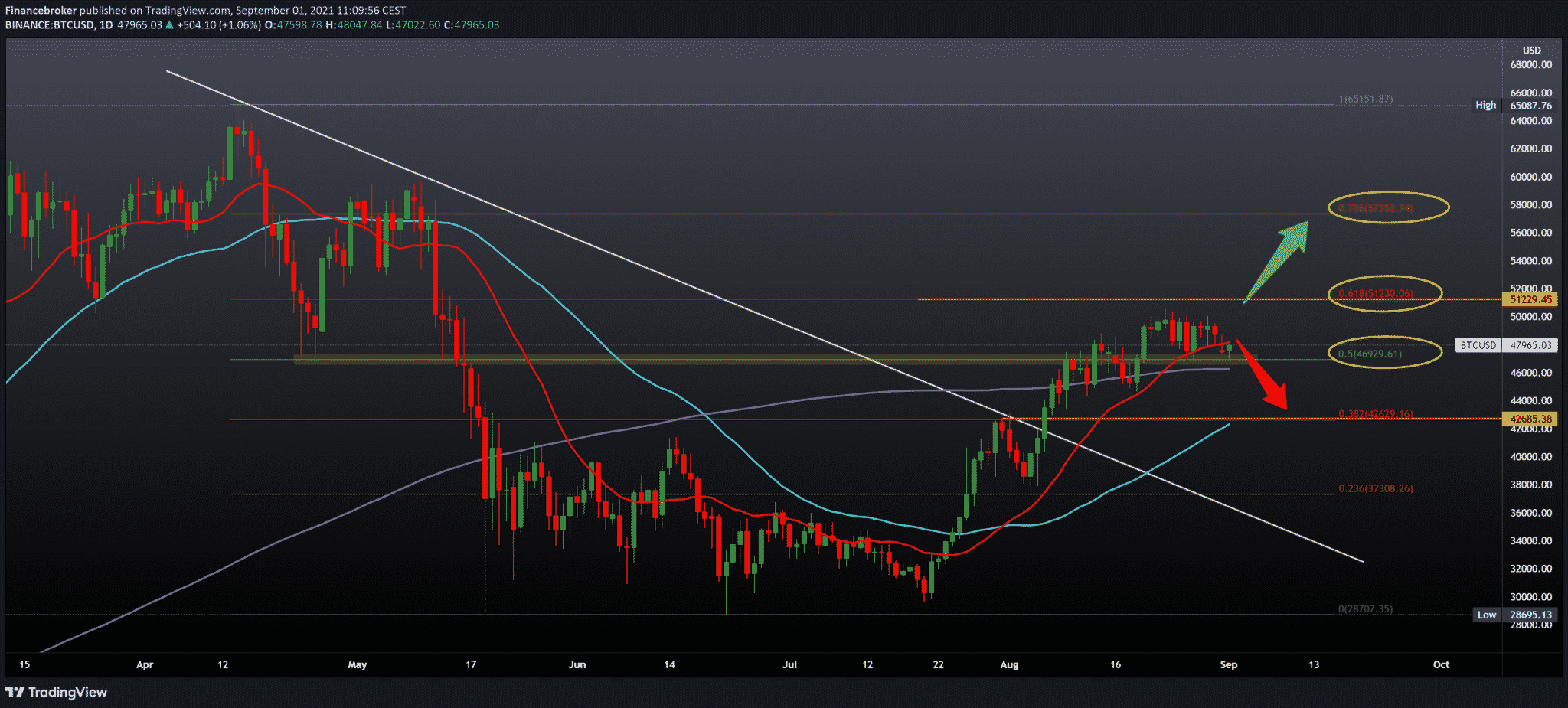

Looking at the chart on the daily time frame, we see that the price of Bitcoin has not made any major shift compared to yesterday. Today we have a slight price increase. Moreover, we still have support at the 50.0% Fibonacci level at $ 46930, along with a 200-day moving average. If the price continues to remain above this support zone, then we can expect a further slight increase in the price to 61.8% Fibonacci level at $ 51,230. For the bearish scenario, we need to lower the price below this support zone. The next support below awaits us at 38.2% Fibonacci level at $ 42,630. The trend is generally neutral. Thus, it is difficult to predict the potential continuation of price movements in the coming periods.

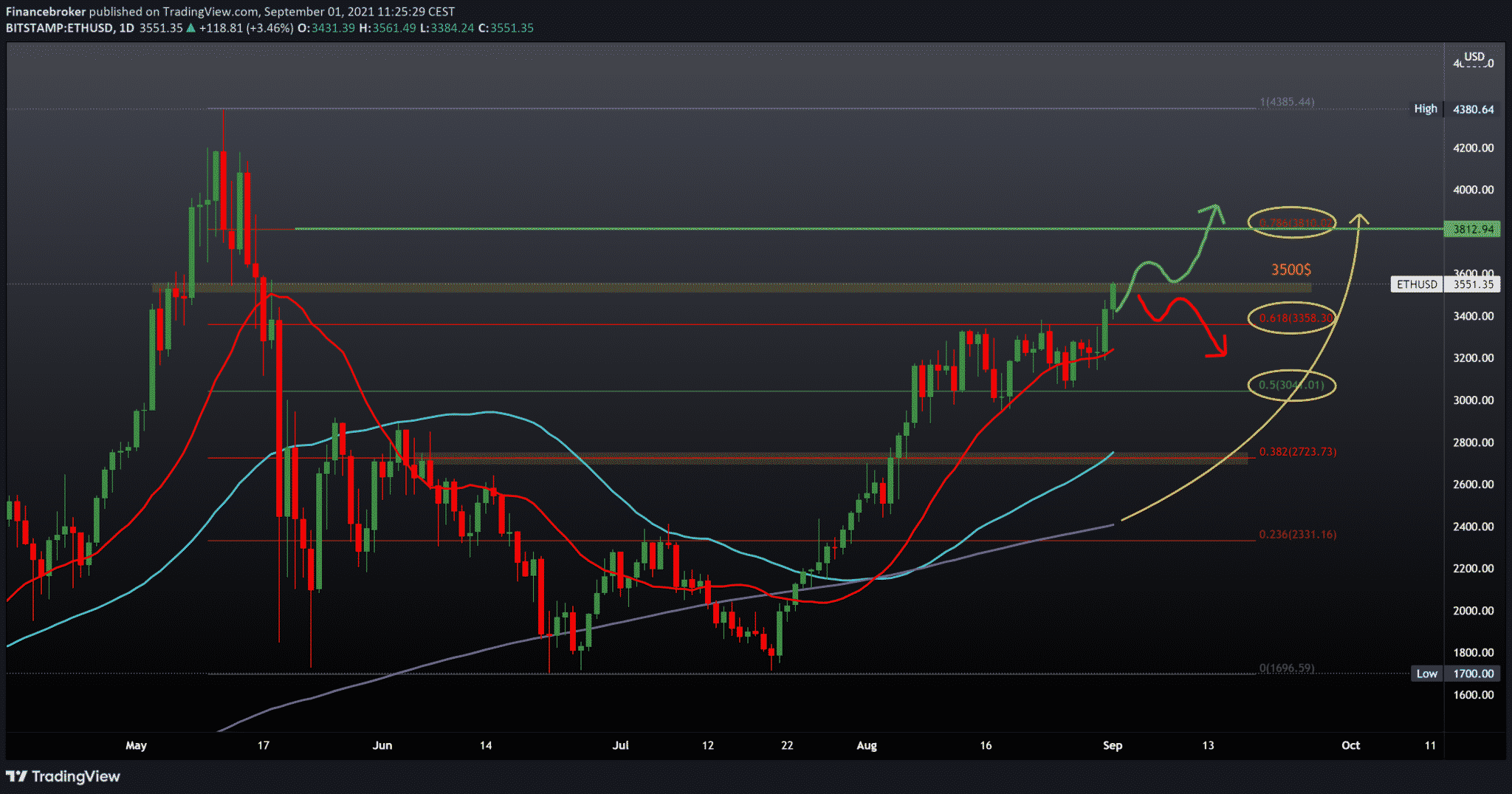

Ethereum Chart Analysis

Looking at the chart on the daily time frame, we see the price of Ethereum made a big break above this consolidation, climbing to $3550. We were last here on May 18th. $3500 is the psychological level that can resist continuing towards the 78.6% Fibonacci level at $3810. We can say that this is a great success and optimism for the owners of Ethereum that we will see further price growth. For a potentially bearish scenario, we need a price pull below the 20-day moving average and 61.8% Fibonacci levels at $3360. By falling below, we return again to the previous support zone at 50.0% Fibonacci level at $3040.

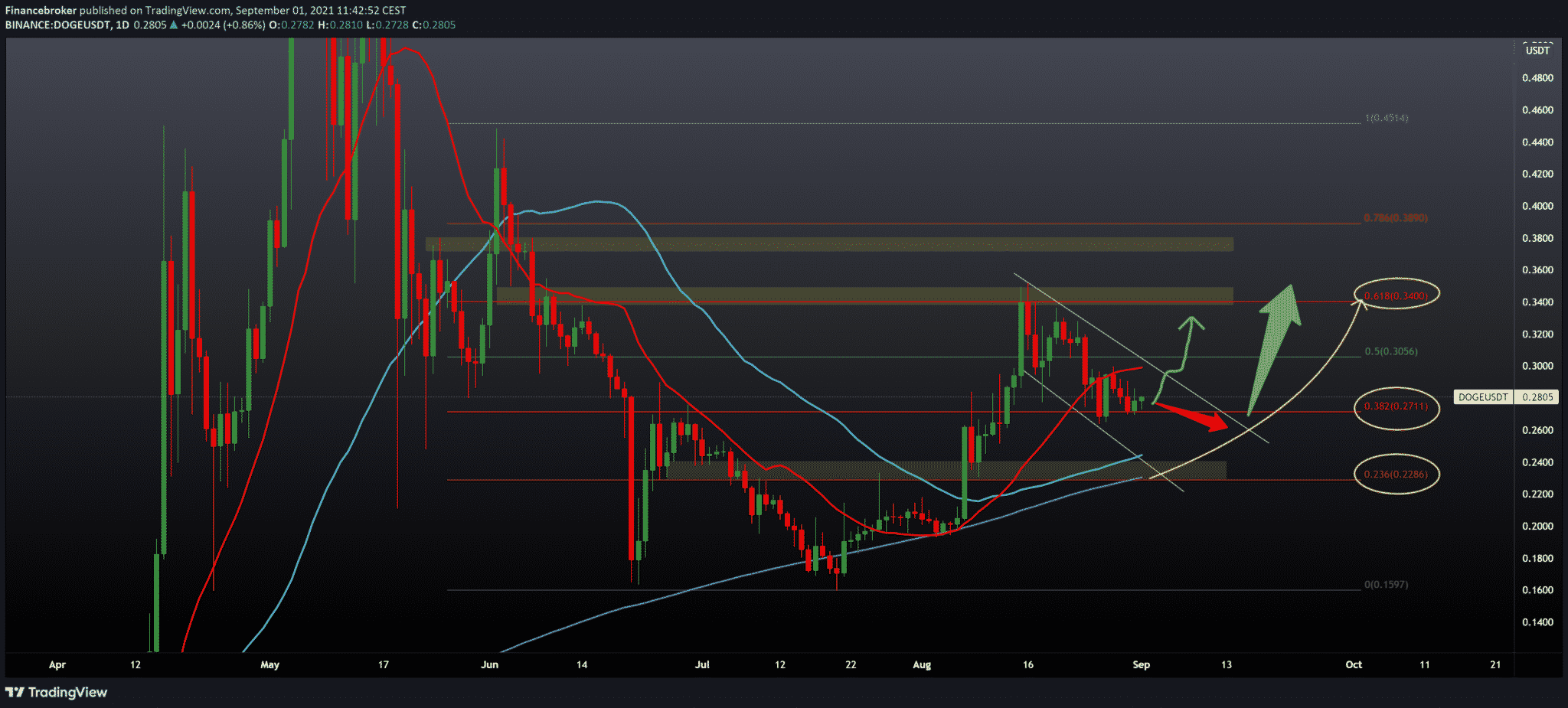

Dogecoin Chart Analysis

Looking at the daily time frame chart, we see that Dogecoin found support at 38.2% Fibonacci level at 0.27100. Yesterday was a positive day for the price of Dogecoin. Today we continue on the same side, and we can expect a further continuation of the bullish trend to 50.0% Fibonacci level at 0.30550. For a stronger bullish signal on the chart, we need a jump above the 50.0% level and a 20-day moving average to consider retesting the previous high to 0.35000. For the bearish scenario, we need a price drop below 38.2% Fibonacci level, with a tendency to visit the 50-day and 200-day moving average zone in the 0.22000-0.24000 zone.

Market Overview

Donald Trump is not a supporter of crypto assets; he stated this several times. On Tuesday, the former billionaire president spoke about digital assets during an interview with Fox Business “Varney & Co.”

“I like the U.S. dollar currency of the United States,” Trump told host Stuart Varney as harsh comments flowed against the crypto crypts. Investing in crypto-assets “is potentially a disaster waiting to happen,” he added.

Fox Business reported that Trump believes cryptocurrencies have “hurt the U.S. currency” and that “we need to invest in our currency.”

In June, Trump labeled Bitcoin a “scam,” blaming it for diluting the dollar. He then stated:

“The major currency of the world should be the dollar. And I don’t think we should have all the bitcoins of the world out there. Let’s regulate them very, very highly. This takes away the advantage of the dollar and the importance of the dollar.”

Trump said, “maybe it’s fake,” about Bitcoin and crypto, which seems to be his response to anything a man disagrees with.

The USD has not performed well at all in the last year. According to the Wall Street Journal Dollar Index, it’s in the same place it was at this time last year. The index measures the value of money against 16 foreign currencies.

The USD is the world’s reserve fiat currency. But it is far from being stable. It could also be considered a “potential disaster” if various factors are taken into account.

Conclusion

Since the Covid pandemic in early 2020, the Federal Reserve has printed billions of dollars for stimulus and quantitative easing packages. The more money injected into the monetary system, the lower the value of each dollar. Combine that with interest rates at zero and inflation at 5.4%, which doesn’t bode well for Trump’s precious money.

It was announced last month that the Fed’s balance sheet, is assets and liabilities, is $ 8 trillion and will continue to grow. Most of these liabilities are dollar bills that the central bank puts into circulation to buy assets in bonds and mortgage-backed securities. This is around $120 billion a month.

Recovery from the pandemic will take many years, maybe decades. So, the catastrophe waiting to happen could be caused by fiat currencies and monetary manipulation by the central bank.

-

Support

-

Platform

-

Spread

-

Trading Instrument