Bitcoin, Ethereum, Dogecoin Forecast: Critical Levels Alert

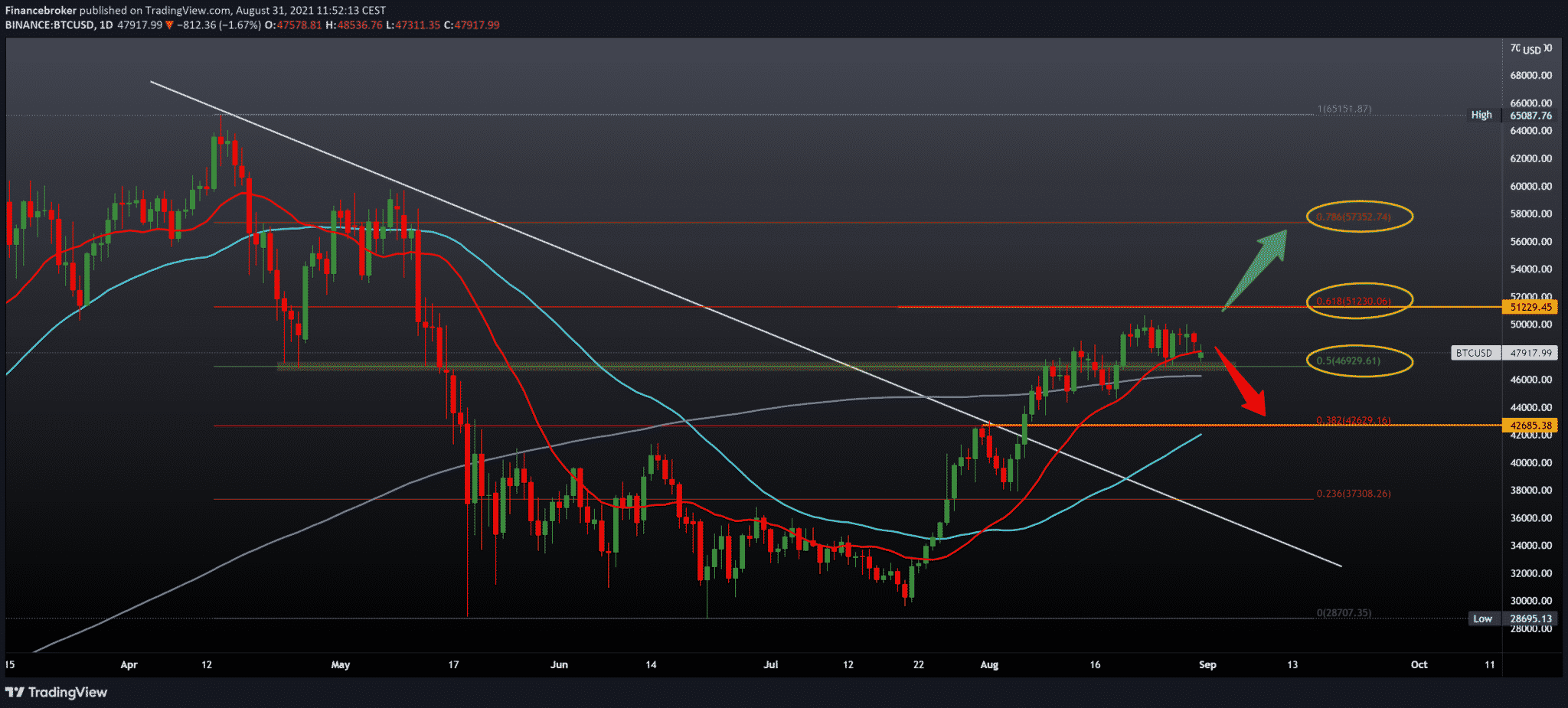

Looking at the daily time frame chart, we see that the Bitcoin’s price has taken a step backward, falling below $ 48,000. We are still in consolidation, which is above the 200-day moving average and about 50.0% Fibonacci levels at $ 46,930. For now, 61.8% of the Fibonacci level at $ 51,230 is strong resistance to the further continuation of the bullish trend. Just a break above the 61.8% level can give us a clear signal on the chart that we have come out of consolidation and continued the 78.6% Fibonacci level to $ 57,350. For the bearish scenario, we need further price instability and a pull below the 200-day moving average and 50.0% Fibonacci levels. after that, our target is 38.2% Fibonacci level at $ 42630. At this point, we can find potential support as we encounter a 50-day moving average.

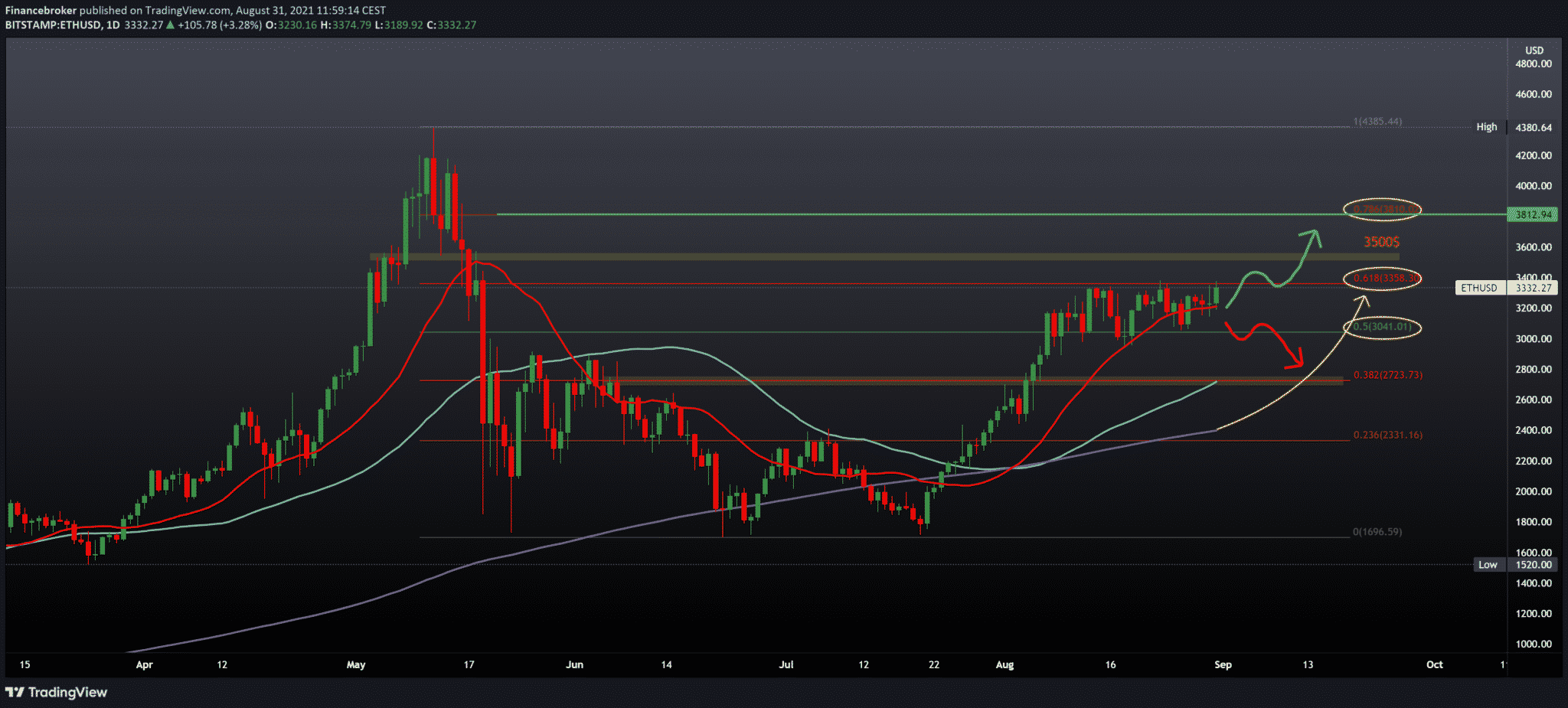

Ethereum chart analysis

Looking at the chart on the daily time frame, we see that the price of Ethereum is stable for now, and with current support is the 20-day moving average. We are still testing the 61.8% Fibonacci level at $ 3360, and again there is a possibility that the price will break and continue towards the 3500% zone and then up to 78.6% Fibonacci level at $ 3810. The price is consolidating around that resistance throughout August; maybe it will have more luck in September. For a possible bearish scenario, we need a price withdrawal below the 20-day moving average and 50.0% Fibonacci levels to $ 3040. If the price falls below that zone, it is highly likely to drop to 38.2% Fibonacci level to $ 2725.

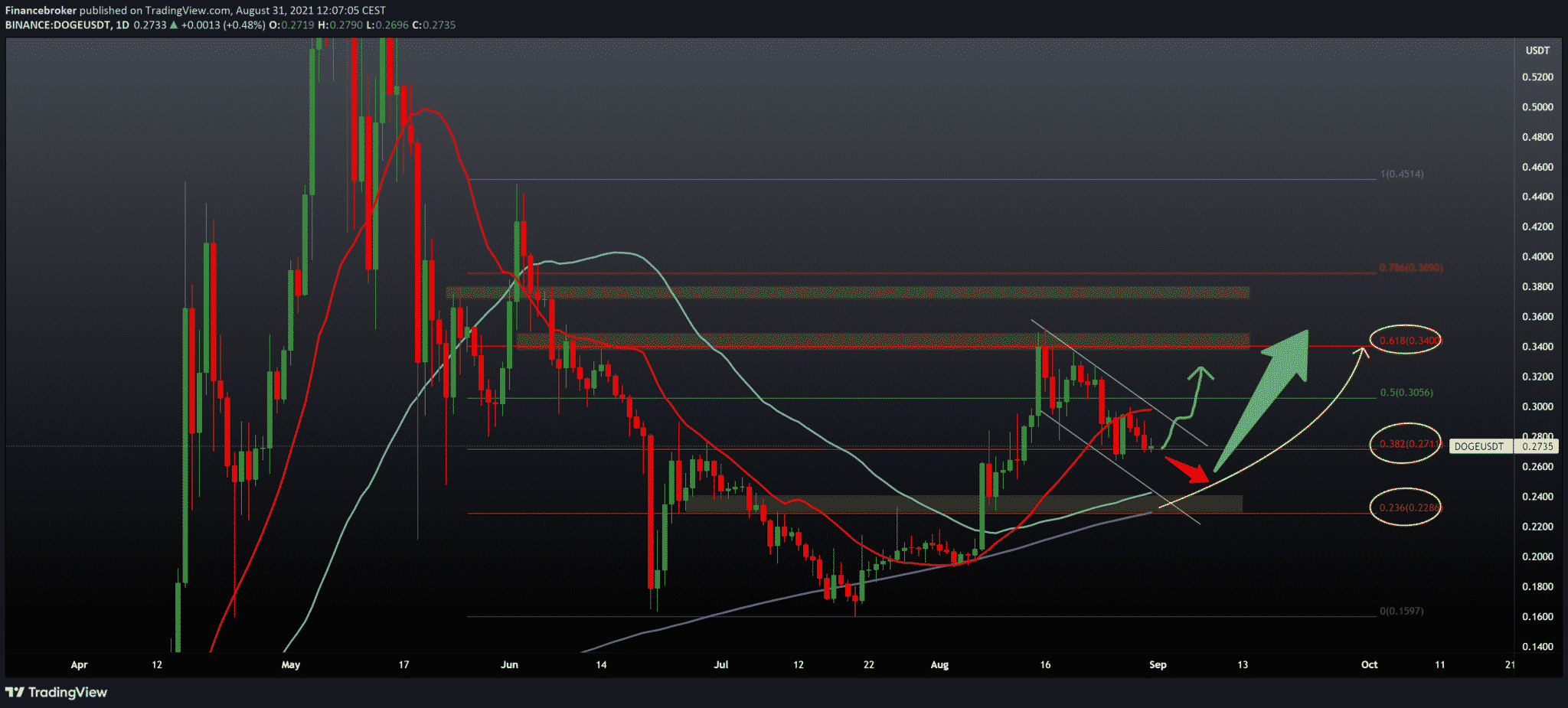

Dogecoin chart analysis

Looking at the chart on the daily time frame, we see that the price of Dogecoin is currently finding support at 38.2% Fibonacci level at 0.27100, after withdrawing from 61.8% Fibonacci level at 0.34000. We can say that we are still in this unfinished pullback and that the price of Dogecoin is likely to drop to a 50-day and 200-day moving average in the zone of about 23.6% Fibonacci level in the zone 0.22850 to 0.24000. Down at that level, more support awaits us than where we are now. If by any chance the price finds support here, to continue the bullish trend, we first need to break above the upper resistance line of this falling channel and jump above 50.0% Fibonacci levels to 0.30500. Only then can we expect to once again test the previous high at 0.34000 at 61.8% Fibonacci level.

Market overview

Amid preparations for El Salvador to officially implement the state bitcoin law (BTC) in early September, residents of El Salvador took to the streets to protest the adoption of the BTC as the official currency.

El Salvador’s anti-bitcoiners have displayed dissatisfaction with the government’s plans to approve Bitcoin as a legal tender, with thousands of protesters marching through the capital, San Salvador, last Friday.

Protesters – including retirees, veterans, disabled retirees, and workers – have expressed concern about the volatile price of Bitcoin. The audience was worried that the government would start paying their pensions in bitcoins instead of the US dollar.

“We know that this coin fluctuates drastically. Its value changes from second to second, and we will not have control over it, ”said a member of the Supreme Court of Justice workers’ union Stanley Quinteros, . El Salvadorans also expressed concern about the lack of knowledge and understanding of the technology needed to use cryptocurrencies like Bitcoin. Protesters held signs reading “We don’t want bitcoin” and “No” for money laundering corruption.

The latest anti-bitcoin protests in El Salvador have been accompanied by growing skepticism about the country’s bitcoin move. The Salvadoran Association of International Freight Carriers reportedly last week launched protests against bitcoin, allegedly asking the government to reconsider the mandatory acceptance of bitcoin in El Salvador.

As previously reported by Cointelegraph, Salvador President Nayib Bukele announced a law accepting Bitcoin as a legal tender together with the US dollar in early June. The law was later passed by the National Legislative Assembly. Its implementation was scheduled for September 7, and last week the president clarified that Salvadorans would be free not to use bitcoin if they do not want to.

-

Support

-

Platform

-

Spread

-

Trading Instrument