Bitcoin, Ethereum, Dogecoin Daily View of Price Movements

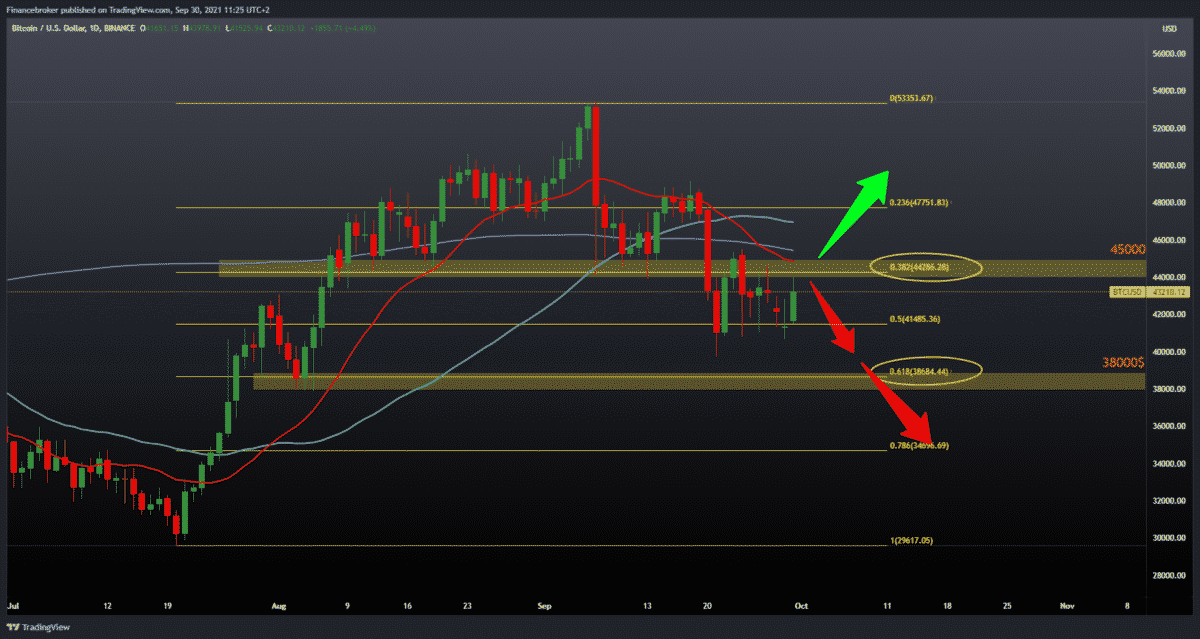

Looking at the BTCUSD chart on the daily time frame, we see that the price after yesterday’s quiet day and consolidation around $ 41,300 today made a positive move towards higher levels at the current $ 43,250. Support at 50.0% Fibonacci level at $ 41485 lasted, and we did not continue in the bearish trend; in contrast, we see a bullish momentum that separated us from this support. Now we need a break above the 32.8% Fibonacci level at $ 44285, and after that, we would enter the moving average zone of $ 45000-47000.

Above this zone, our next target and potential next resistance is our previous high at $ 49,000. For the bearish scenario, we need a BTCUSD price drop below $ 40,000. Below we have the next support at 61.8% Fibonacci levels at $ 38,685. At this level, we can expect possible support because we already received support to continue the bullish trend from the beginning of August.

Ethereum chart analysis

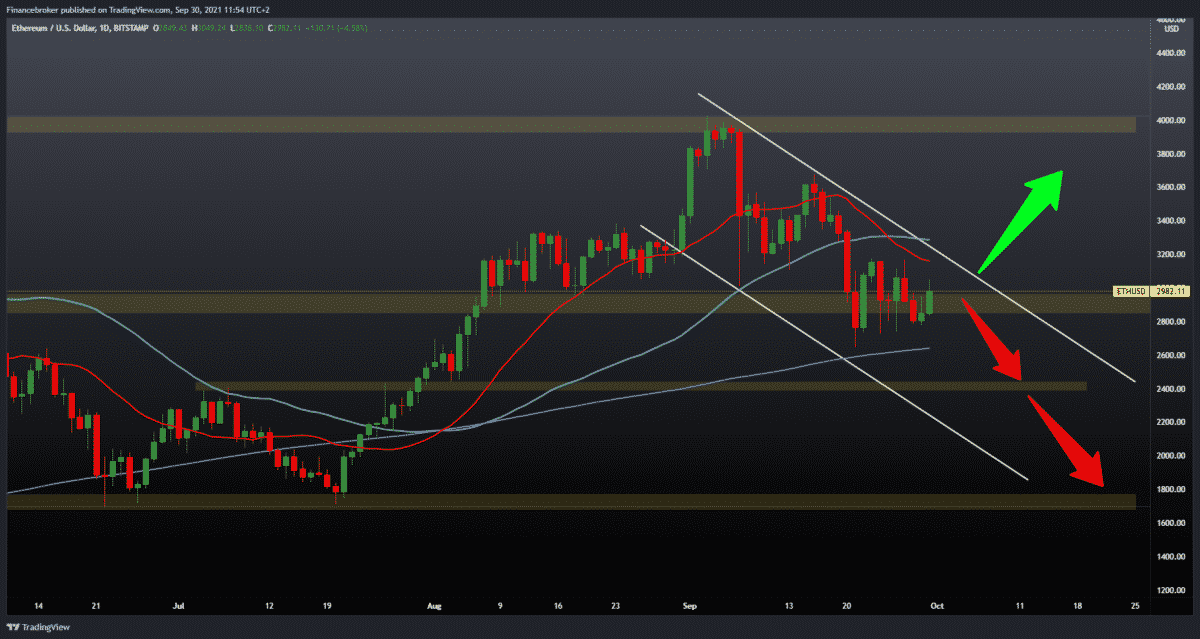

Looking at the ETHUSD chart on the daily time frame, we see that the price, supported by the 200-day moving average, has made a positive shift to the current $ 2973. We can say that we are testing the psychological level at $ 3000 and that to continue on the bullish side, we need a break above the 20-day and 50-day moving average and above the upper falling line of resistance. By going beyond these resistances, we can say that we are returning to a more definite bullish trend.

For the bearish trend, we need a price withdrawal below the 200-day moving average. After that, we must monitor the price movement on the lower potential supports. Our first support is at $ 2400, the place of the bullish impulse break from July. Further below the next support is our psychological level at $ 2000, and then the previous low from July to $ 1700.

Dogecoin chart analysis

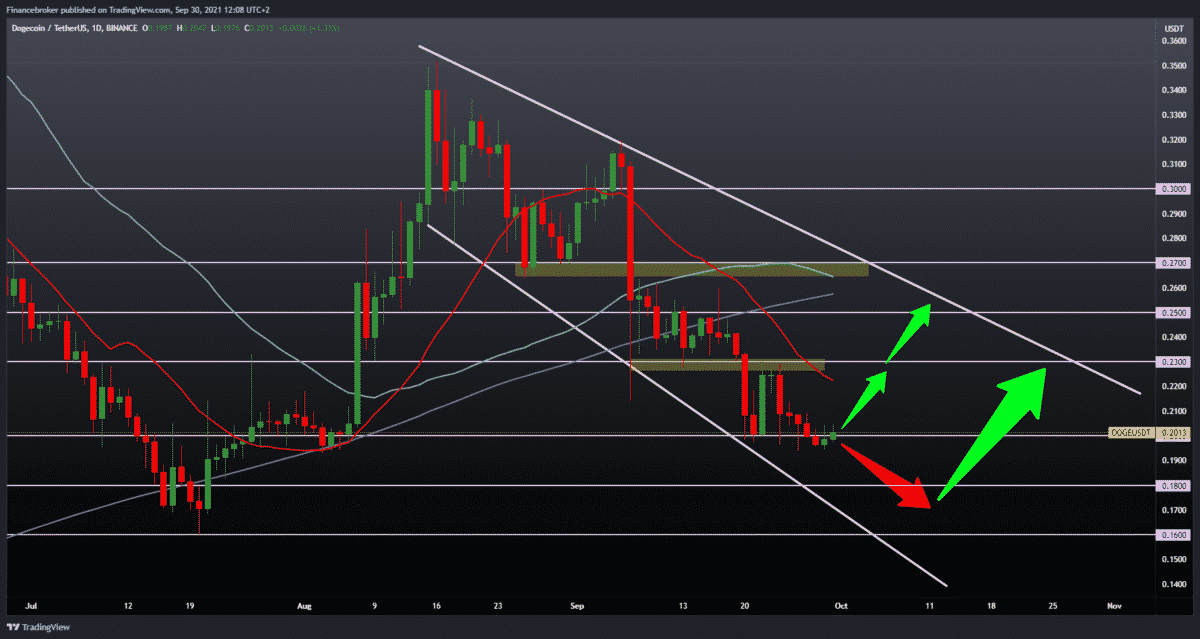

Looking at the Dogecoin chart on the daily time frame, we see that the price stabilized yesterday at 0.20000. Today we have a slight increase that can introduce us to a new bullish trend. For further continuation, we need a price jump above the 20-day moving average with the subsequent stabilization in the zone around 0.23000.

The next resistance above is expected in the area 0.25000-0.27000, with a 50-day and 200-day moving average. We need a rejection from the 20-day moving average and a harmful consolidation that will again point to lower support levels on the chart for the bearish scenario. Our main bearish target is low from July to 0.16000.

Market overview

The cryptocurrency market suffered another shock last week after the National Bank of China announced that all crypto activities in the country were illegal. This new restriction also banned foreign exchange offices from operating in the country. As a result, most cryptocurrencies have suffered double-digit losses as organizations offering cryptocurrencies have withdrawn from China.

While China’s latest crackdown on the crypto market has dealt a blow, experts say investors are overestimating its importance. One such expert is Stéphane Ouellette, executive director of FRNT, a platform of institutional capital markets focused on the crypto crisis. He explains that in 2013, China effectively promulgated a crypto law by banning banks from processing crypto transactions.

Ouellette added that crypto markets tend to decline and grow more than traditional markets. Financial media increase investor concerns by amplifying the impact of adverse developments in the emerging market.

While investors in the crypto crisis continued to wait for the BTC to fall further, the cryptocurrency was quite unpredictable. It presented a lower limit range between mid-May and August between $ 29,000 and $ 39,000. However, the market has recovered, and $ 40,000 seems to be the new threshold of the leading cryptocurrency. Ouellette further stresses that prices could fall and break this level, especially if the stock market does poorly.

According to Tendayi Kapfidze, chief economist at the US bank, cryptocurrencies are highly correlated with the stock market. He added that the stock market’s direction is similar to the crypto market, but the effects are intensified in most cases. With this in mind, Kapfidze urged investors to understand their risk by investing in a growing class of crypto assets.

-

Support

-

Platform

-

Spread

-

Trading Instrument