Bitcoin, Ethereum, Dogecoin are still on the bullish side

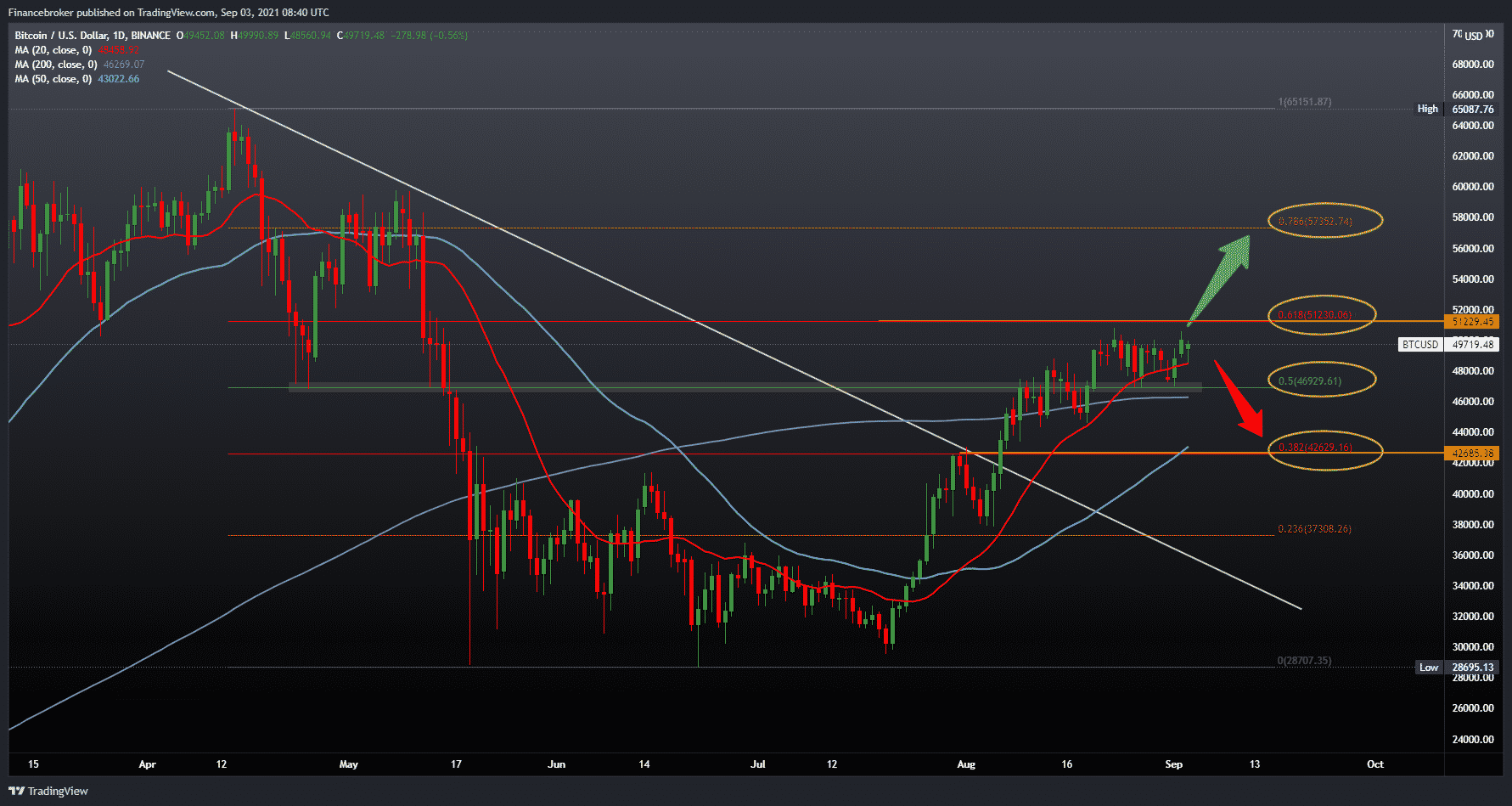

Looking at the Bitcoin chart on the daily time frame, we see that the price is stable above the 200-day moving average and 50.0% Fibonacci levels. We still expect the bullish trend to continue and the price to exceed the 61.8% Fibonacci level to $ 51,230. If the price went up to $ 52,500, then there would be an opportunity to visit the zone at $ 55,000. For the bearish scenario, we need a price withdrawal below 50.0% Fibonacci levels and 200-day moving averages. After that withdrawal, our target is a 38.2% Fibonacci level at $ 42,630. We are looking for additional support below in the 50-day moving average.

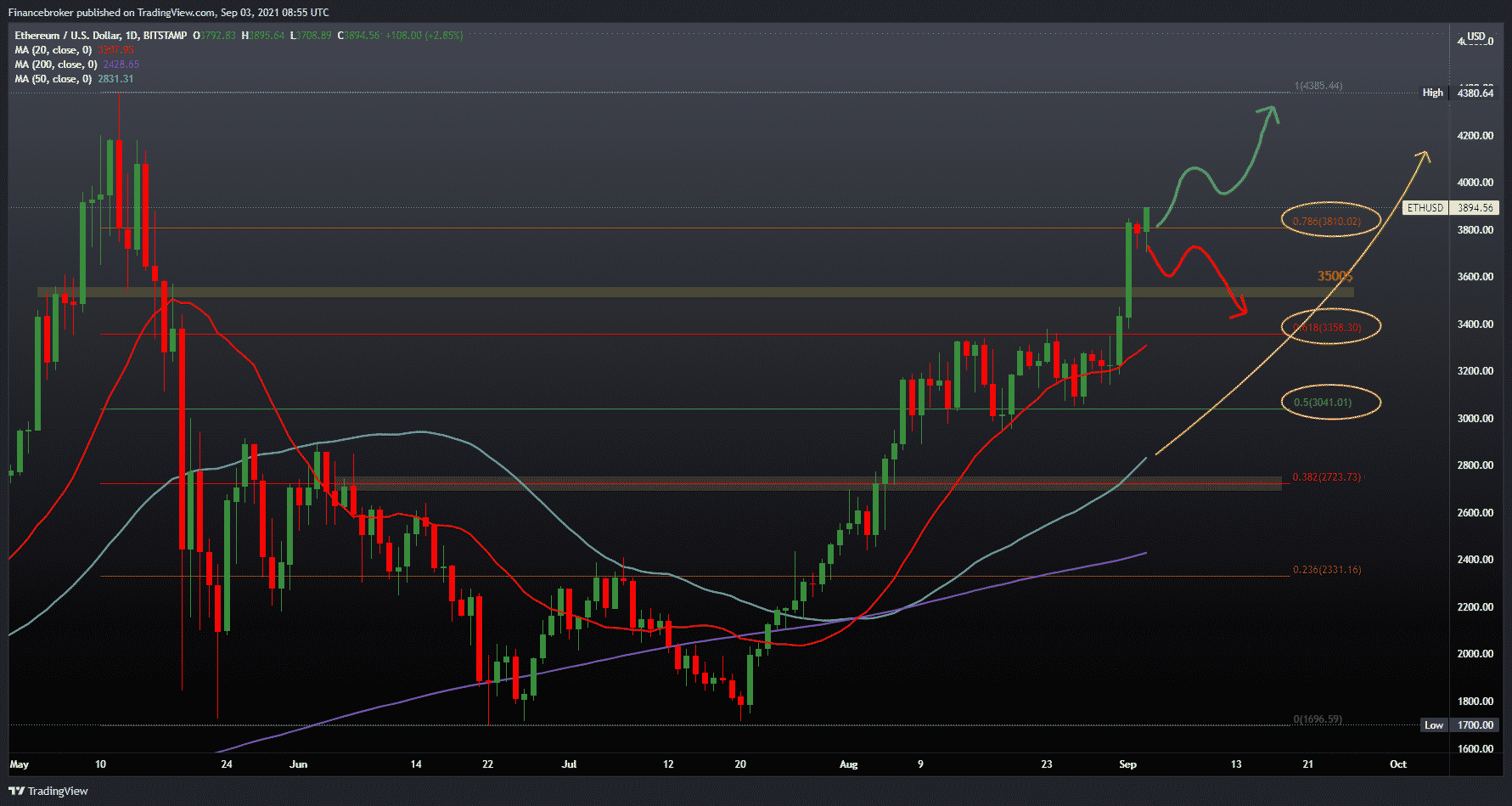

Ethereum chart analysis

Looking at the chart on the daily time frame, we see that the price of Ethereum continues to advance well above the 78.6% Fibonacci level at $ 3810. If the bullish momentum continues, then we can expect the price to reach the level of the previous historical high at $ 4380. Yesterday we had a consolidation at 78.6% level, and for now, today, we continue above at the current $ 3850. For the bearish scenario, we need a price pull below the Fibonacci support level. The first support below is $ 3,500, followed by the 61% Fibonacci level at $ 3,360, a breakpoint outside the previous consolidation.

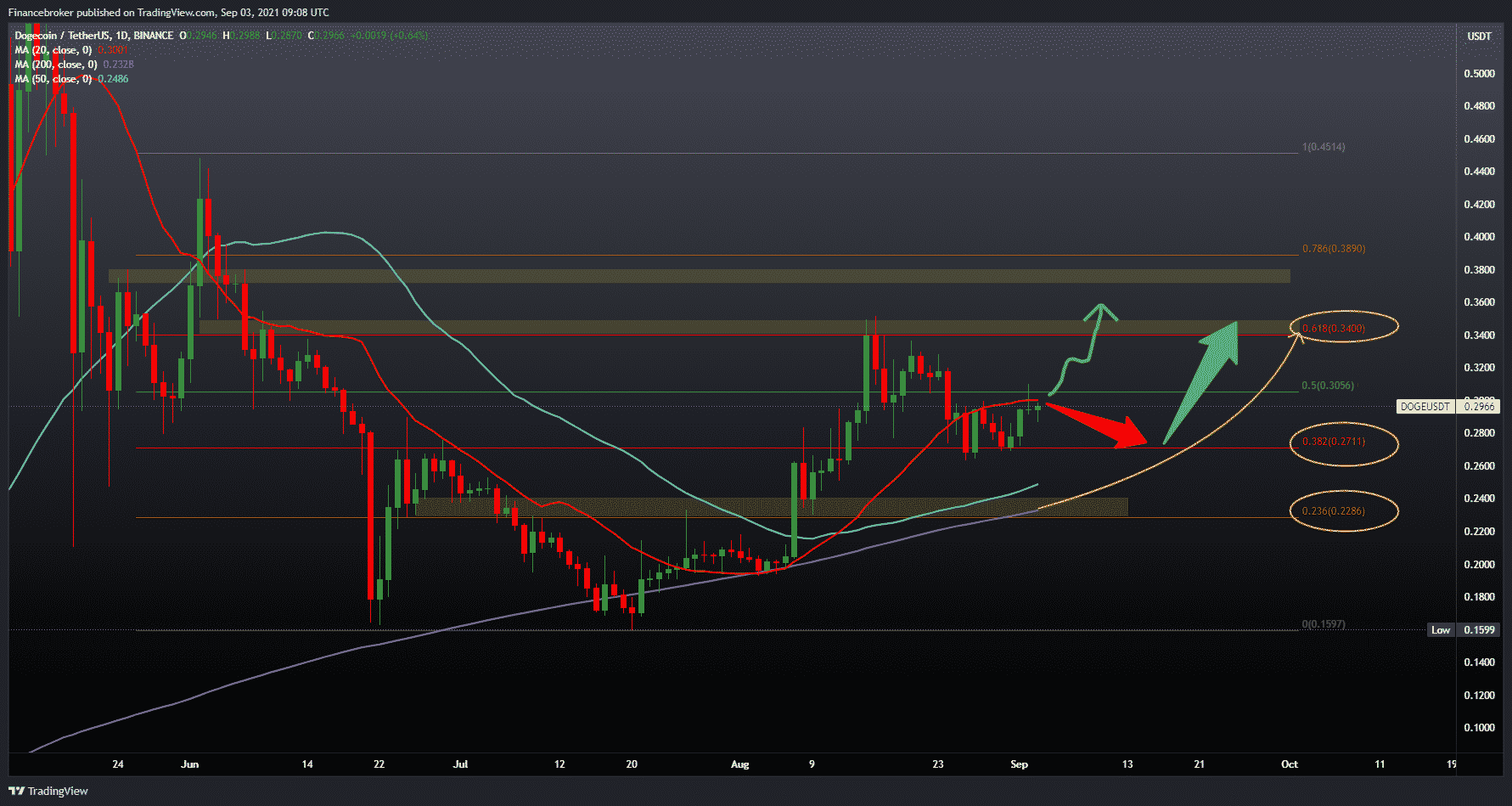

Dogecoin chart analysis

Looking at the chart on the daily time frame, we see that the price of Dogecoin has been moving in the 0.27100-0.30600 zone for the last ten days. In general, we have been in a bullish trend for the last three months and based on that we can expect a further recovery of the price above the previous high to 0.35000. To continue, we need to first break above 50.0% Fibonacci level to consider a price jump to 61.8% Fibonacci level to 0.34000. We expect prices to meet resistance in the 20-day moving average for the bearish scenario, which might lower the price below 38.2% Fibonacci levels to 0.27000. While stronger support awaits us down in the 50-day and 200-day moving averages.

Market overview

Fabio Araujo, a representative of the Central Bank of Brazil, spoke about the possible development of digital real estate in a public debate before the Committee on Science, Technology, Innovation, Communications, and Information Technology of the Senate of Brazil. Araujo clarified that Digital Real is still in the discussion phase, and they are determining the demand for such an instrument.

According to the institution’s representative, Fabio Araujo, the Central Bank of Brazil is still studying the creation of digital real estate. At a recent public hearing with the Senate Committee on Science, Technology, Innovation, Communications and Information Technology, Araujo said that the bank is still discussing society’s need for a digital currency central bank (CBDC). Araujo stated:

Our goal is to clarify the requirements that society places on Real Digital. After that, we will soon move to the testing phase with proof of concept and possibly an innovation lab, which should happen during 2022.

Araujo also revealed that the Central Bank of Brazil still has meetings with various parties to help design the Digital Real project. Senator Cunha, the senator who proposed the meeting, said the use of digital currencies was a necessary debate due to a lack of information on the subject. He emphasized:

We need to discuss this topic. Digitization is a reality in the lives of the population in various fields. However, there is still no clearer information on how this will happen in relation to money in circulation in Brazil.

CBDCs should not be confused with cryptocurrencies. The Central Bank of Brazil believes that cryptocurrencies are speculative assets and pose a high risk to individuals ’portfolios.

-

Support

-

Platform

-

Spread

-

Trading Instrument