Bitcoin, Ethereum, Dogecoin are still in the red

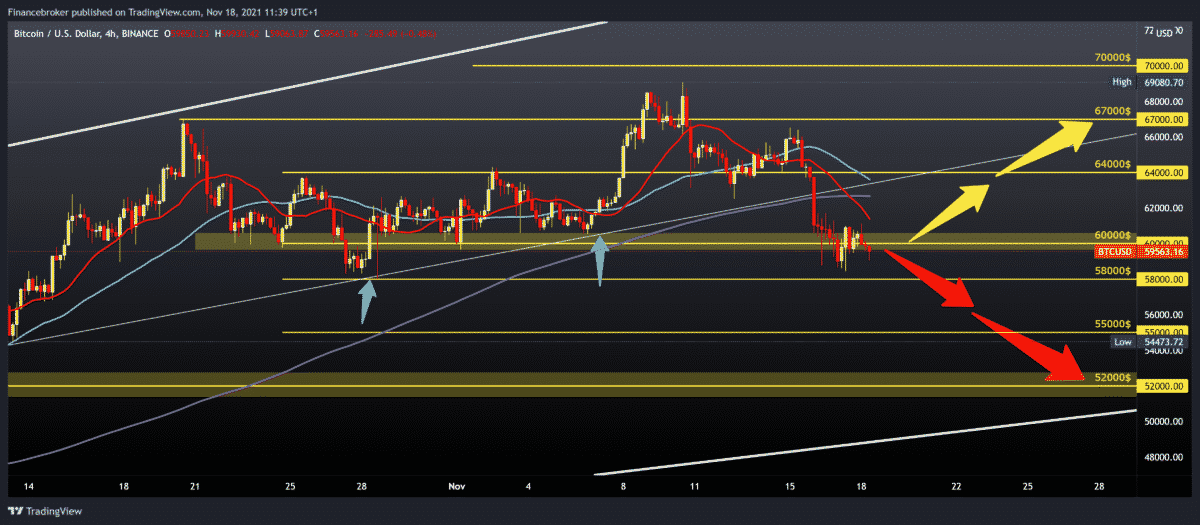

Yesterday Bitcoin had a consolidation of around $ 60,000 during the day, and today the bearish pressure intensified, and the price dropped again below the current $ 59,450. Now we need to pay attention to the support zone around $ 58,000, and a breakthrough below would open up space to $ 55,000.

Bullish scenario:

- We need a new positive consolidation above $ 60,000, and further price growth above $ 62,000 would increase optimism for continued recovery.

- We have resistance in moving averages in the $ 63,000- $ 64,000 zone, and we need a break above.

- Our next resistance zone is the previous high, around $ 67,000.

Bearish scenario:

- We need a break below the previous low at $ 58,000.

- The drop in price below will bring us down to the lower support of $ 57,000, then to the 55,000 psychological level.

- Our maximum bearish target is the lower trend line in the zone, around $ 52,000.

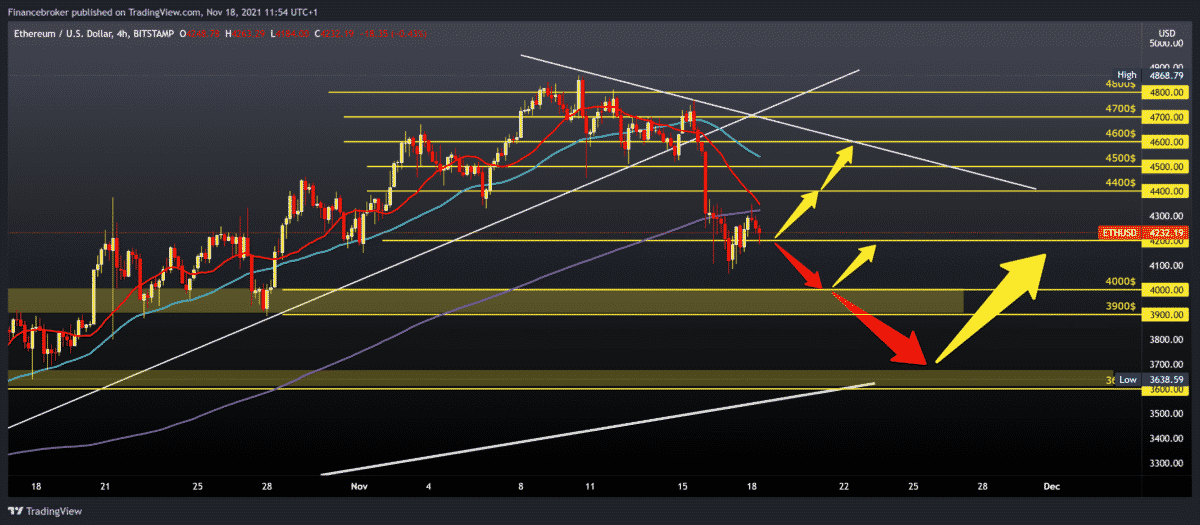

Ethereum chart analysis

The price of Ethereum once again met with resistance in the zone around $ 4300. We now have a new price drop at $ 4,200. The added pressure on the chart creates the MA200 four-hour moving average. Consolidation above $ 4,400 would increase optimism for continued price growth.

Bullish scenario:

- The price must remain stable above the $ 4200 zone to solidify the bullish sequel.

- We need to climb above the MA200 moving average to $ 4400.

- Up here, we get additional support in the MA20 moving average, and after that, we can expect the price to rise until the next resistance to $ 4500.

- Our main target and resistance is the upper trend line around $ 4600. The break above us can lead to a new historical high.

Bearish scenario:

- We need a break below previous support at $ 4100.

- A further price drop requires support in the $ 3900-4000 zone, and a break below us could lead to an area on the lower trend line of $ 3600-3700.

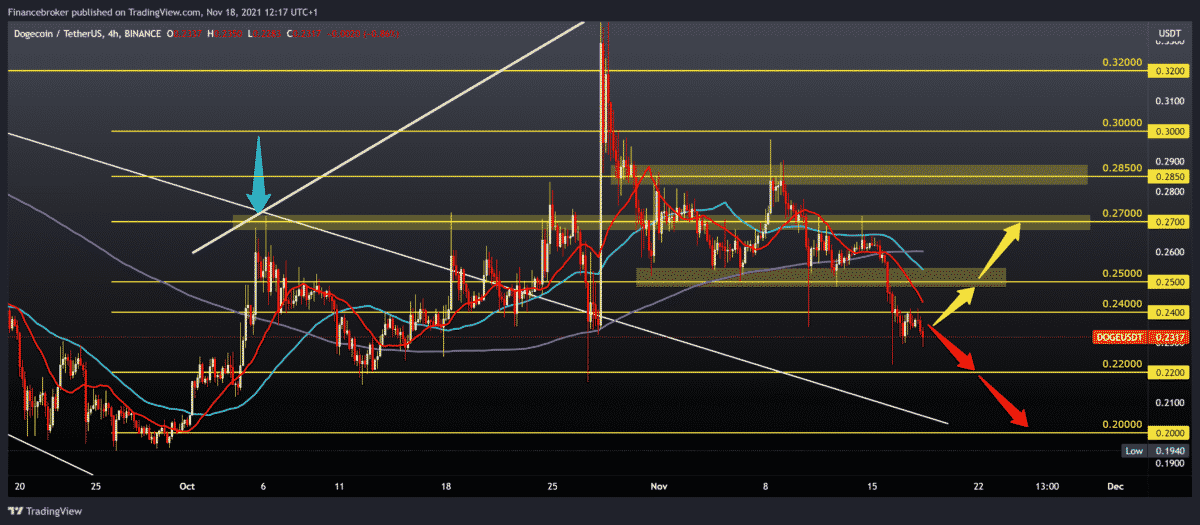

Dogecoin chart analysis

The price of Dogecoin is still consolidating around 0.23000, and based on the picture on the chart, and we can see that the bearish pressure is still in force. We will likely see a withdrawal to the 0.22000 October support zone.

Bullish scenario:

- We need a positive consolidation that will move the price above 0.24000, and such a move would add additional support with the MA20 moving average.

- The next potential resistance zone is at 0.25000 with MA50 and MA200 moving averages, and the break above us returns to the area of October resistance at 0.27000.

Bearish scenario:

- We need to continue negative consolidation and a break below 0.23000.

- The first lower support is at 0.22000, then the next around 0.20000 October minimum.

Market news

US Deputy Treasury Secretary Adevala Adejemo is not upset that the growth of digital currencies such as bitcoin poses a threat to the dominance of the US dollar. Adeje is optimistic that the American economy’s current path by signing the law on infrastructure will help keep the dollar’s dominance intact.

As our economy grows, it is an opportunity for global economic growth, and as it happens, the dollar will stay to remain the dominant currency in the world.

The finance minister says that, despite the potential benefits of digital currencies, the risks with their adoption and use are too significant. However, he believes the risks can be reduced by working with regulators in other countries to reduce the chances of being used for illegal transactions.

“We know that digital funds can be used by those who want to illegally transfer money through the system in a way that does not touch the dollar and that we cannot see so easily. “But we think that in the end, working together with countries around the world, we can address this risk by urging digital asset creators to adhere more carefully to anti-money laundering rules,” he said.

Another clear major threat to the use of digital currencies, including the Central Bank’s digital currencies, is the circumvention of sanctions imposed by the US government.

According to the International Monetary Fund, about 110 economies are actively developing the CBDC, and Russia is among them. The Kremlin has announced plans to launch a pilot test for its digital ruble in 2022, after which it will decide whether to launch a new form of money officially.

-

Support

-

Platform

-

Spread

-

Trading Instrument