Bitcoin, Ethereum, and Dogecoin are still in negative territory

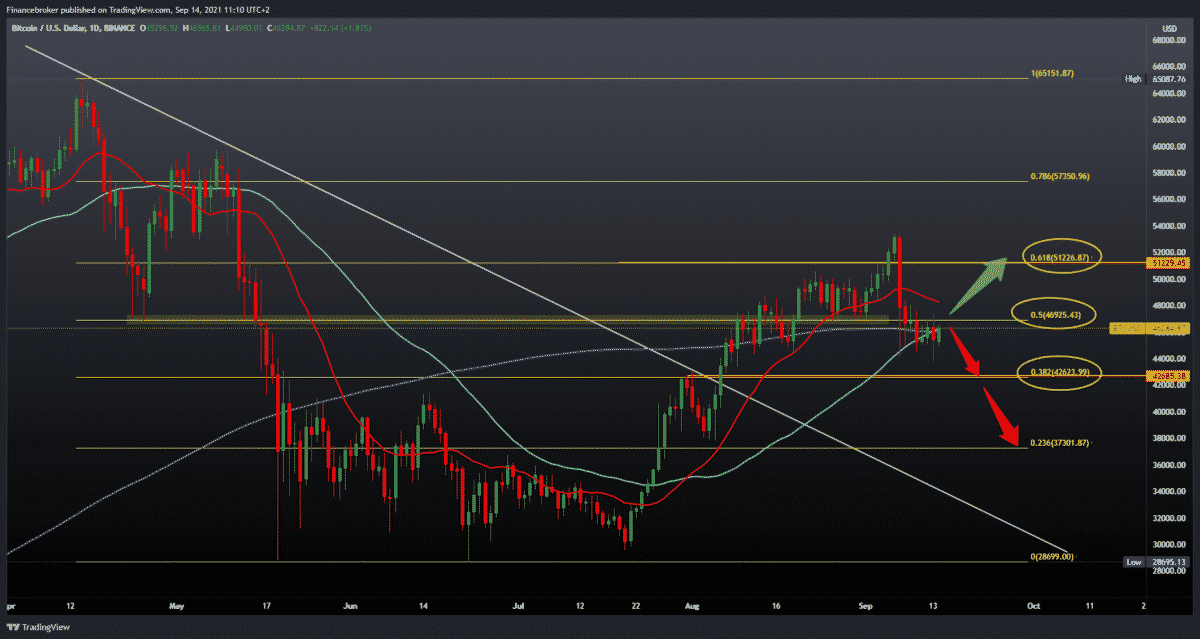

Looking at the daily time frame chart, we see that the Bitcoin price dropped to $ 43,650 yesterday. Today, we have a more positive situation, and we are currently at $ 46,300. We are still under the pressure of moving averages, and we are monitoring the situation around the 200-day moving average. For the bullish scenario, we need further price progress above 50.0% Fibonacci levels and a 20-day moving average of $ 48,000. First, our upper target is at 61.8% Fibonacci levels at $ 51,230. For the bearish scenario, we need continued negative consolidation that could lower the price of Bitcoin to 38.2% Fibonacci levels to $ 42,630. If the bearish trend continues below this support, we can find the next one at 23.6% Fibonacci level at $ 37,300.

Ethereum chart analysis

Looking at the daily time frame chart, we see that the price is currently slightly recovering with the current support of the 50-day moving average. Our resistance is in the 20-day moving average and 61.8% Fibonacci level at $ 3360. If the price breaks that resistance, our next hurdle is at $ 3500, and above it, our next resistance is at 78.6% Fibonacci level at $ 3810. Negative consolidation leads us first below the 50-day moving average, and then we test the 50.0% Fibonacci level at $ 3040. A further price drop leads to 38.2% Fibonacci levels and a 200-day moving average to $ 2730.

Dogecoin chart analysis

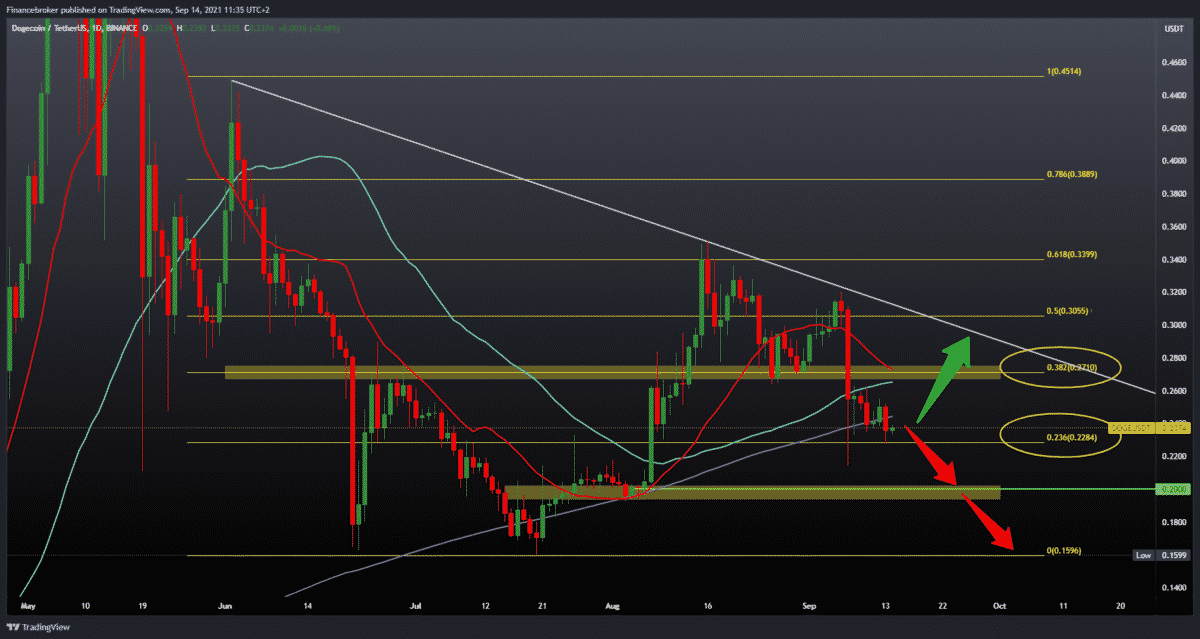

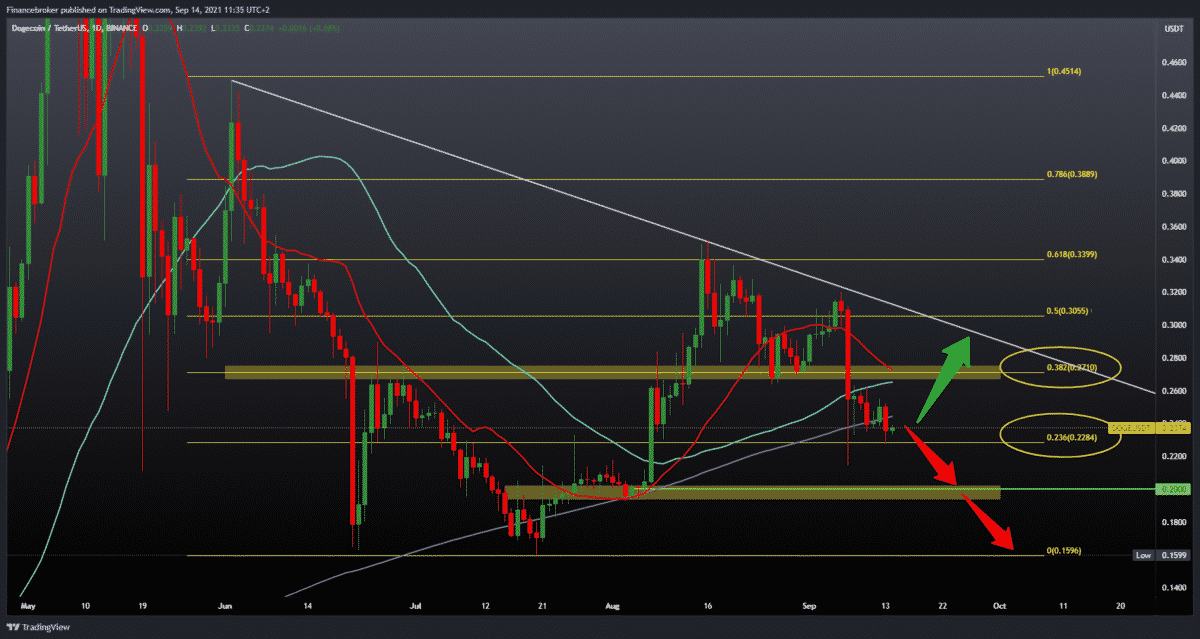

Looking at the daily time frame chart, we see that the Dogecoin price is still in negative consolidation and under the pressure of the 200-day moving average with the current support of 23.6% Fibonacci level 0.22850. Further negative consolidation may lead us to the support zone at 0.20000, while the maximum decline, for now, we can expect to the previous low at 0.16000. if positive consolidation occurs and the price is directed to higher levels. First, we need a break above the 38.2% Fibonacci level at 0.27100, and once again, we will test the upper resistance line.

Market overview

While the cryptocurrency market is moving down and most altcoins are going through a massive correction of 15-20%, data from the chain provided by Glassnode suggest that the bull market is not over because big players or so-called “whales” are not selling their coins but accumulating them. . More signals provided by recent analytics suggest that the market still has little gas in the tank.

During the recent sell-off, when the price of Bitcoin fell by almost 20%, the financing of permanent futures contracts was briefly negative but then quickly recovered back to the positive zone. Positive funding rates indicate that most market participants are still on the rise. However, at the same time, according to the data, funding rates are still significantly lower than they were in April-May, suggesting that the current market is not heavily indebted and therefore less volatile.

One of the most important metrics that retailers should pay attention to during big sales is the age of the coins consumed in the market. When the whales decide to profit and leave the markets, the old coins will flow into the market. There is a lot of sales pressure with the old assets, which leads to a big return in April and June.

In a recent sale, old coins were kept in wallets without switching to exchanges, indicating that long-term owners are unwilling to take a profit at the current price and prefer to stay away.

In addition to the previous sign, the total supply of long-term owners is also continuously increasing and reaches the level of September 2020. The current supply has reached 79.5%. The peak supply of long-term owners is correlated with the latest phases of the bear market. There was a reduction in supply.

-

Support

-

Platform

-

Spread

-

Trading Instrument