Bitcoin, Ethereum, Dogecoin are Slowly Decreasing

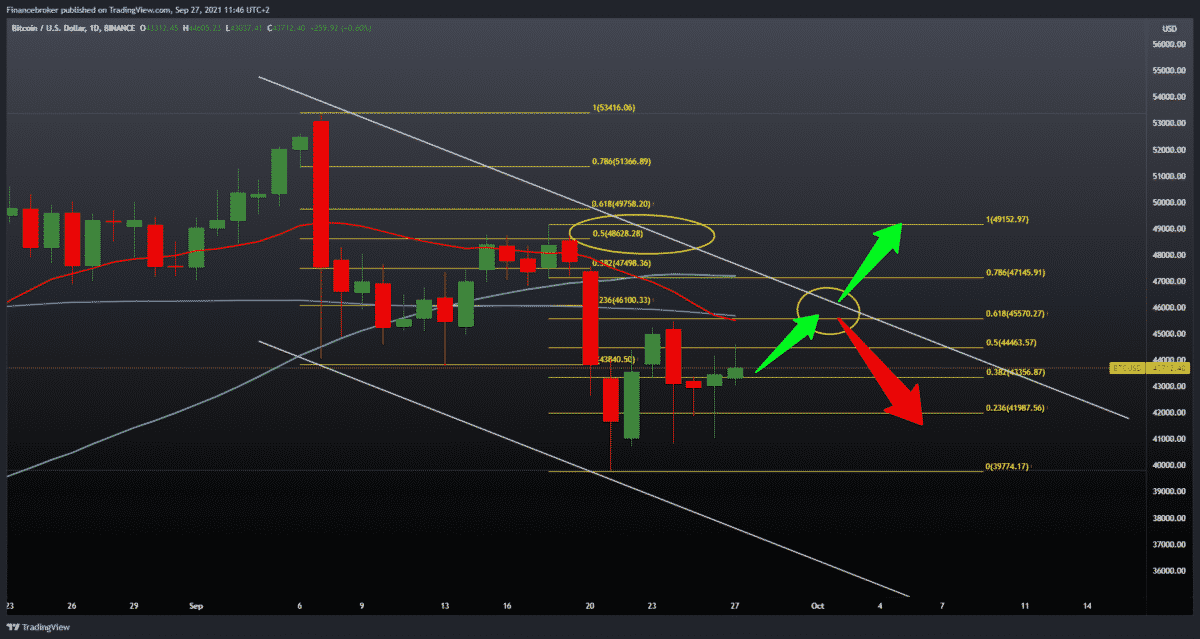

Looking at the BTCUSD chart on the daily time frame, we see that the price has found support at $ 43,000, after last week’s price drop to $ 40,000 due to new restrictive measures from China. To continue on the bullish side, we need further price growth above $ 44,500 and 50.0% Fibonacci levels. The previous high at $ 45,450 is our first target in this new bullish attempt. At 61.8% Fibonacci level, we have more resistance because that’s where we meet the MA20 and MA200 moving average.

In the long run, we are still in a downward channel, and just a break above the upper resistance line and a break above the previous high at $ 49,150 can give us more optimism to embark on a longer-term bullish trend. For the bearish scenario, we expect that the price will not exceed the resistance in moving averages and 61.8% Fibonacci level. After that, we need a negative consolidation, which directs the price towards the previous low to $ 40,000. The break below us is descending to new levels on the chart.

Ethereum chart analysis

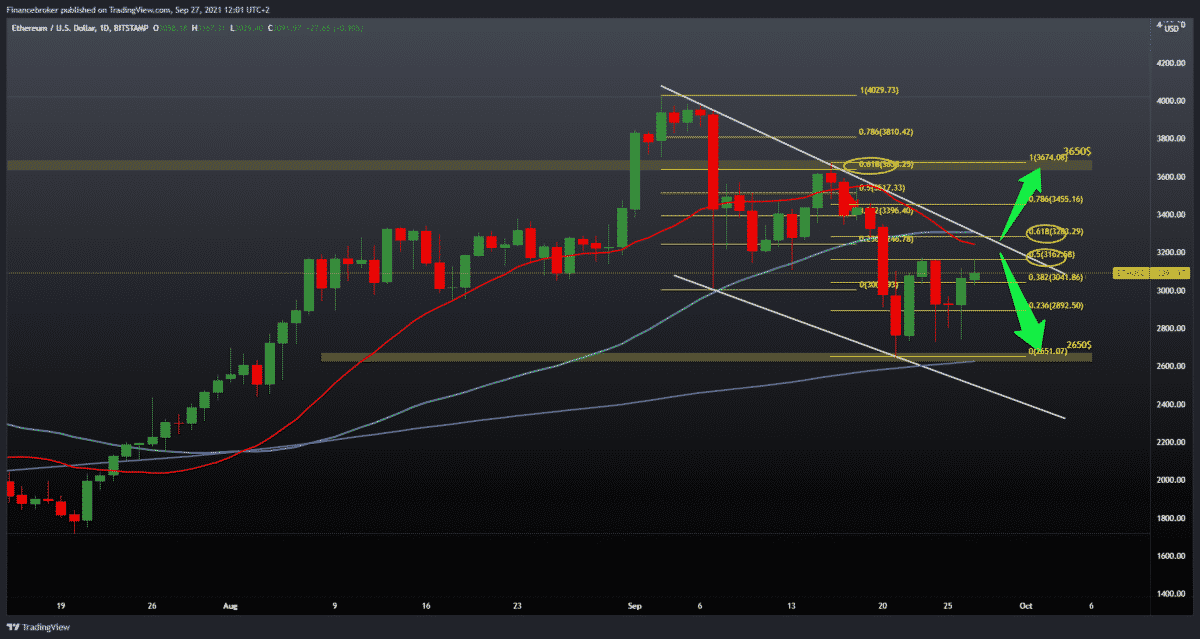

Looking at the ETHUSD chart on the daily time frame, we see that it managed not to make a break below the 200-day moving average. After declining from the moving average, the price makes a pullback and moves to higher levels to the next resistance on the chart. The broader picture is that we are still in a falling channel and that we need a jump above the upper channel line and a break above the 20-day and 50-day moving average, to say with greater certainty that we are slowly returning to a longer-term bullish trend.

A price break above these resistances leads us to test the previous high at $ 3650. For the bearish scenario, we need a new price withdrawal below the 200-day moving average. A break below $2650 takes us into a further price drop in the July price range of $ 1600-2650.

Dogecoin chart analysis

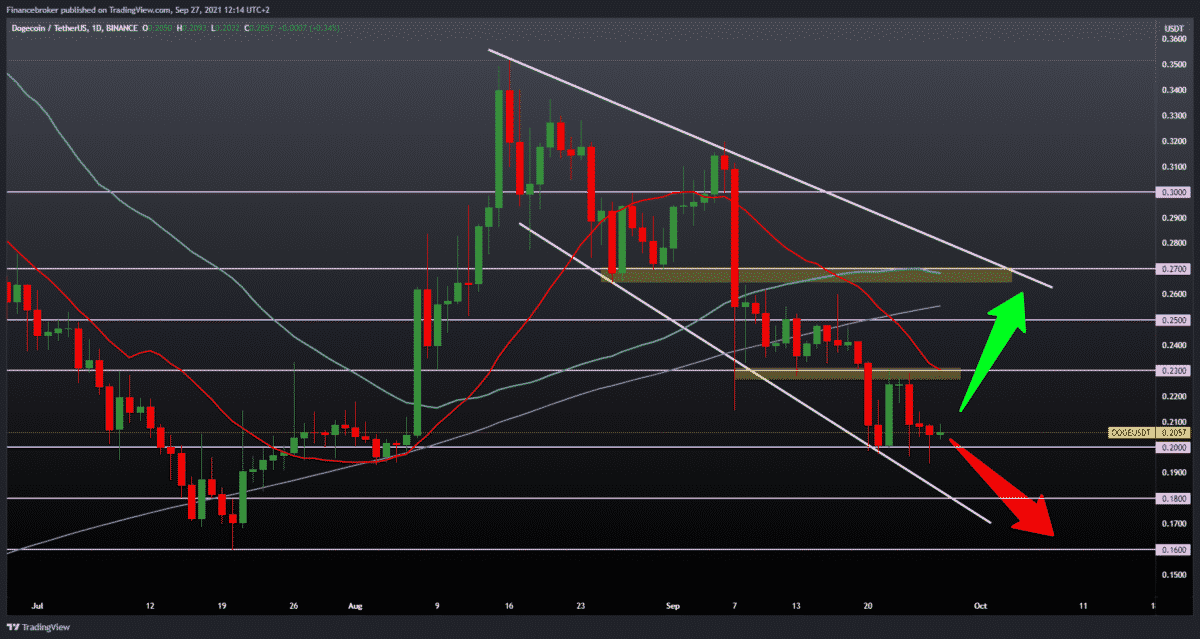

Looking at the Dogecoin chart on the daily time frame, we see that the price is still under a lot of pressure as we are still testing low at 0.20000. The break below may open the door to 0.15000, but we have other potential supports before that. Our first target for the bearish scenario is the previous low from July 20 at 0.16000. If the price makes a positive consolidation at this level, we can expect the price to recover first to 0.23000 on the resistance in the 20-day moving average.

After that, our next resistance is at 0.25000 with a 200-day moving average. Our maximum target, for now, is the upper resistance line in the zone around 0.27000.

Market overview

Last Friday, China stepped up the suppression of cryptocurrencies, making all transactions related to cryptocurrencies illegal in the country. The reaction of investors was evident because the crypto market fell immediately after the news.

But Bitcoin whales seem to care little about China’s recent ban. This is not the first time that China has used its dominant position to shut down cryptocurrencies. It has been trying since 2017, but the crypto market continues to strengthen each time with greater investor participation. At the same time, it’s not just bitcoin whales that have accumulated in large numbers.

Wes Fulford, chief executive of investment adviser Viridi Funds, said Bitcoin had shown greater resilience to Chinese FUD compared to other altcoins. In a note last Friday, Fulford said:

“We see crypto markets falling in prices. However, the reaction is significantly less than the previous bans. Mainly because the market already appreciated the risk of China banning cryptocurrency transactions.”

Tim Frost, CEO of Yield App, said the move was entirely expected. As China continues to encourage its use of the digital yuan, it is more likely to ban public cryptocurrencies from all sides. He further noted:

“China has made its intentions very clear: Like all authoritarian regimes, it wants hugely tight control over all financial activities in the country and wants zero competition for its central bank digital currency.”

Fortunately, more and more countries and jurisdictions are now accepting cryptocurrencies.

-

Support

-

Platform

-

Spread

-

Trading Instrument