Bitcoin, Ethereum, Dogecoin are Currently Unstable at the start of the week

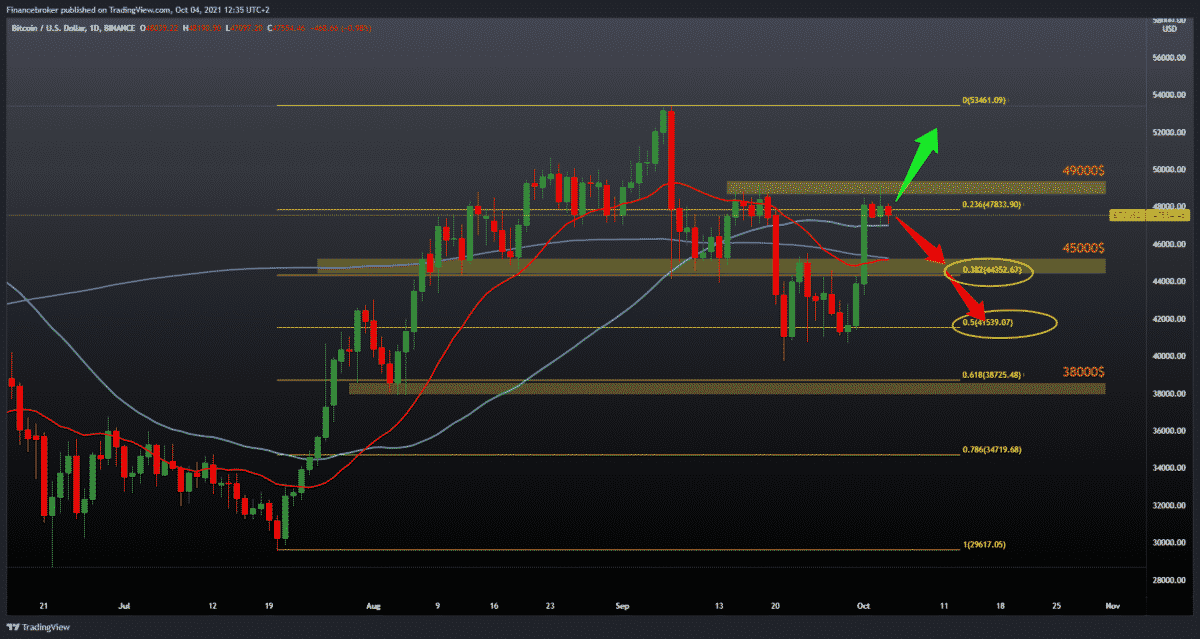

Looking at the BTCUSD chart on the daily time frame, we see that we now have consolidation at $ 48,000. We are currently testing the 23.6% Fibonacci level. In fact, we have added support for the bullish trend in moving averages from the bottom. We need a new momentum that will drive the price and push it above to revisit the previous high at $ 53,460.

For the bearish scenario, we need a price withdrawal below $ 45,000. Additionally, we need to see moving averages and below 38.2% Fibonacci levels at $ 44,350. After that, we can expect to re-test the previous support zone of $ 40,000- $ 42,000 at a 50.0% Fibonacci level.

Ethereum chart analysis

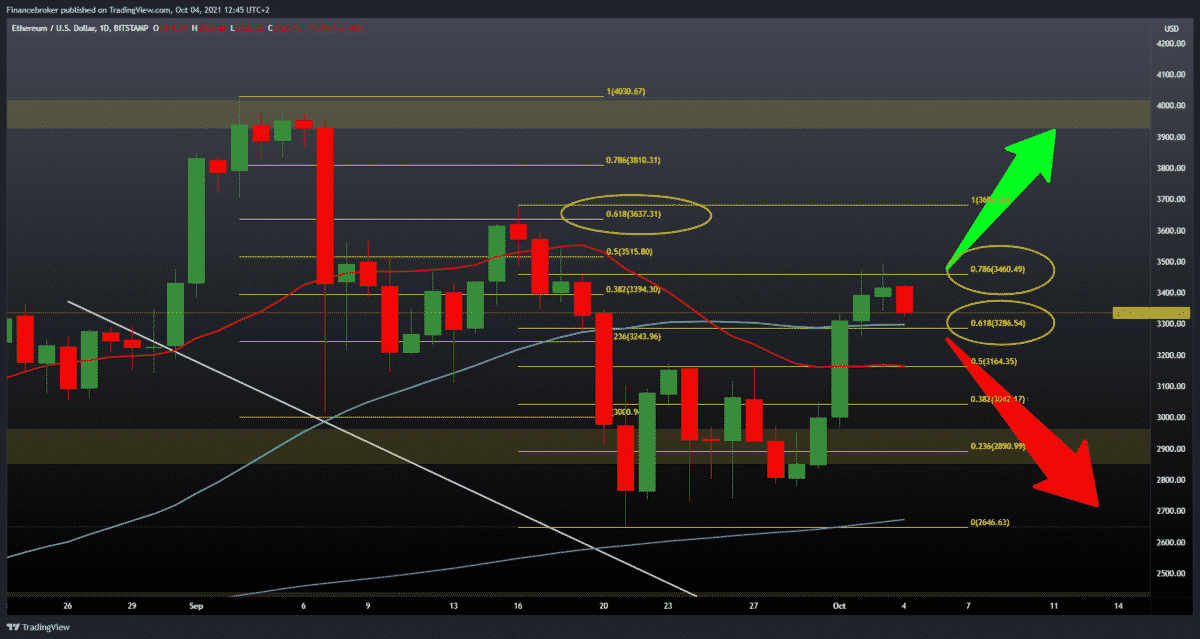

Looking at the ETHUSD chart on the daily time frame, we see that the price encountered resistance at 78.6% Fibonacci level at 3464%. We have a withdrawal to the current $ 3340 and testing the 50-day moving average at 61.8% Fibonacci level. If the pullback continues, the next lower support is on a 20-day moving average at 50.0% Fibonacci level at $ 3167.

To continue bullish, we need a positive consolidation that will turn up again. So, we need a break above 78.6% Fibonacci level to be safer on the bullish side. From the resistance above, we are waiting for the previous high at $ 3682, and if we skip the care, we will have higher resistance at $ 4030.

Dogecoin chart analysis

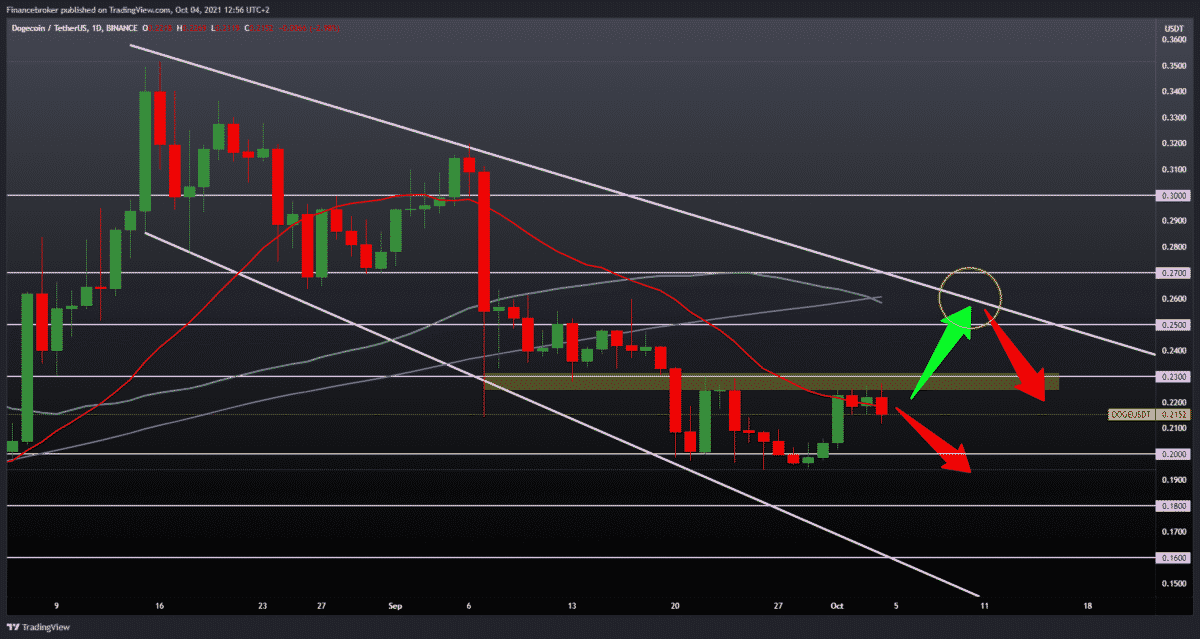

Looking at the Dogecoin chart on the daily time frame, we see that the price has met resistance at 0.23000 for the last four days. Today we have drop prices from that level to the current 0.21500. There is a tendency to go down to around 0.20000 and test the previous low at 0.19400.

For the bullish trend, we need a break above 0.23000 with the support of a 20-day moving average. Only if this happens can we expect the price to rise to 0.25000 zones, approach the upper trend line, and test the 50-day and 200-day moving average. If possible, to price goes above and continues the bullish trend to visit the previous high at 0.32000.

Market overview

The Nasdaq-listed crypto exchange Coinbase has been meeting with members of Congress to discuss the regulation of the cryptocurrency it plans to propose, CEO Brian Armstrong said. In addition, the company met with more than 30 crypto companies, four large law firms, and three trading groups regarding its cryptocurrency proposal.

Armstrong first revealed that his company is preparing a draft regulatory framework to submit to lawmakers in an interview with Techcrunch Disrupt 2021 on Sept. 22. He said he expects to begin distributing a regulatory proposal for cryptocurrencies this month.

The CEO revealed that he had been repeatedly asked for a proposal for a regulatory framework for cryptocurrencies. This is because regulators often seek industry feedback when creating new rules.

He said during the interview: When I go to DC, I meet a lot of people in government. They usually ask us, “Well, do you have a draft? Do you have a proposal for something we could try to look at to arrange this at the federal, state level?

The head of Coinbase said he prefers the federal framework instead of having to deal with independent rules and agencies from state to state. He was quoted as saying:

We have a proposal that we want to publish. That could help create at least one idea on how to move forward. But it will take a lot of people.

In Conclusion

Coinbase recently ran into problems with the SEC because of its credit product, which the Commission considers security. The SEC has warned to sue the company if it continues with the Land product without registration. Thus, prompting Coinbase to abandon its plan to launch the product.

SEC Chairman Gary Gensler recently explained that crypto platforms that accept funds from investors and offer returns “should carefully consider securities laws and talk to the agency about registration.”

The National Bank of China, the country’s central bank, announced that all cryptocurrency transactions are illegal. Therefore, effectively banning digital coins.

“Business activities related to virtual currency are unlawful financial activities,” the bank said. It was added that cryptocurrencies, including Bitcoin and Tether, are not fiat currencies and cannot be circulated.

The digital yuan was conceived in 2014 and has already distributed about $ 30 million in digital currency.

It is a clear rival to unregulated cryptocurrencies. Moreover, it is also a government way to challenge WeChat and Alipay, two private giants that dominate the mobile payment market. China is not the only big economy looking at the central bank’s digital currency, even if China’s plans are far ahead of others. About 80 countries are researching the idea, and five nations have implemented digital currency so far.

-

Support

-

Platform

-

Spread

-

Trading Instrument