BTC, ETH and Dogecoin Under Bearish Influence

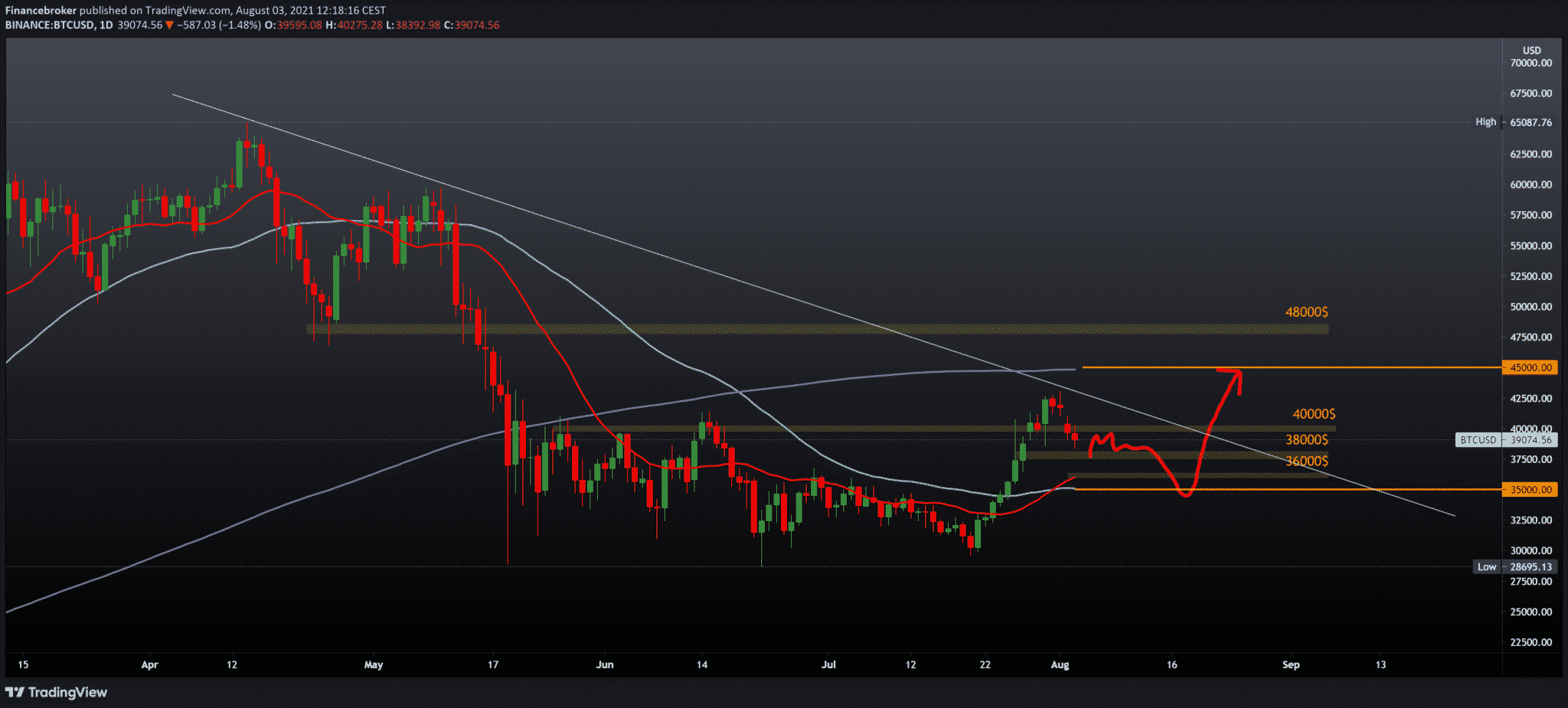

This week started very badly for Bitcoin. The price has been falling for two days now, dropping below $ 40,000 to the current $ 39,000. At one point, the price dropped to $ 38,350. Based on the current situation on the chart, we expect a further drop in the price of Bitcoin to better support, and we are looking for support in 50-day and 20-day moving averages in the $ 35000-36000 zone. If we think on the bullish side, we need a price jump above $ 40,000 again, as a potential obstacle to continuing to bullish territory is our upper downward trend line. A break above that line can lead us to the previous high at $ 43,000. After that, our next target or resistance is our 200-day moving average in the zone, around $ 45,000.

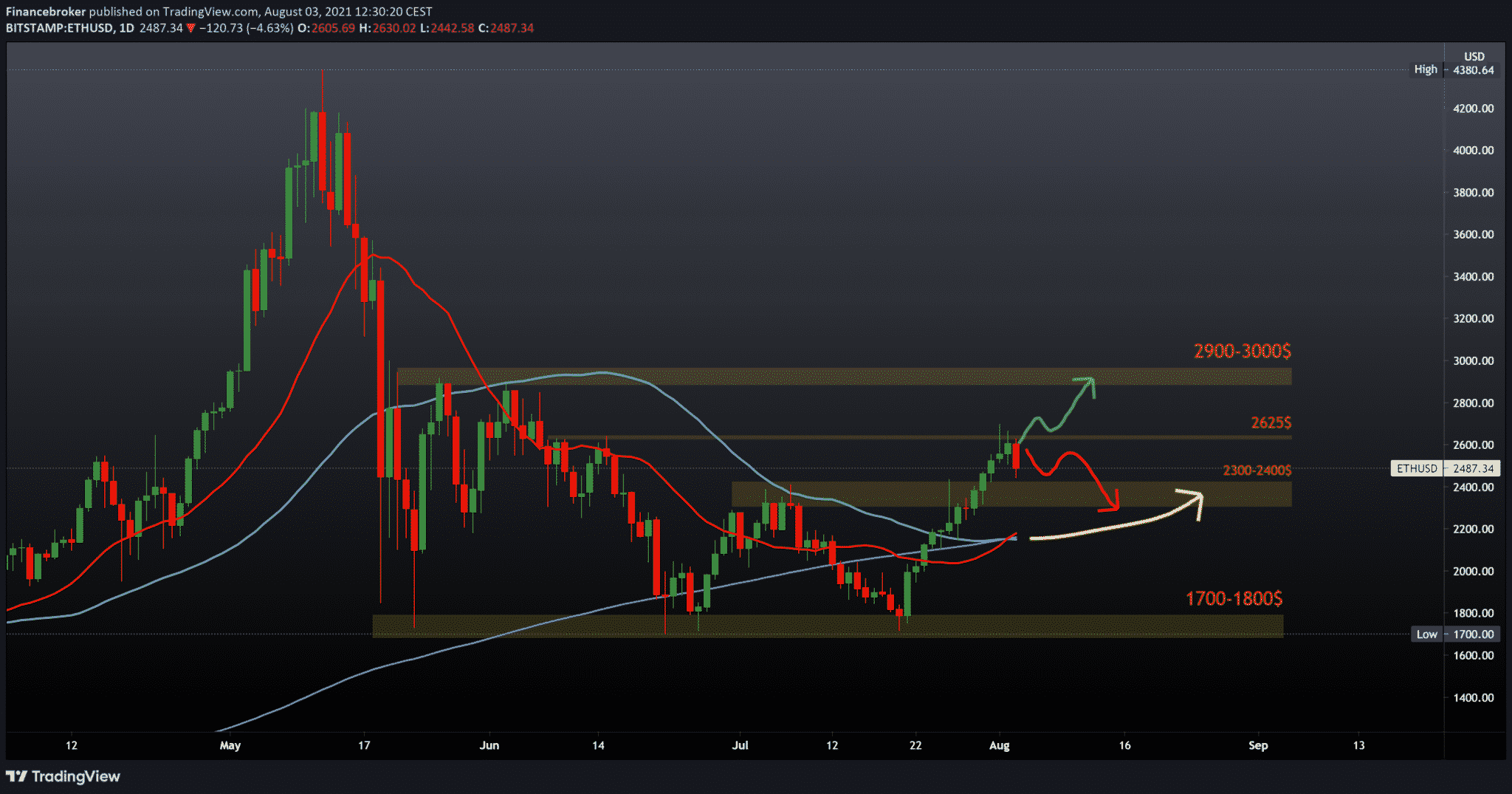

Today’s candlestick is very bearish for Ethereum, as the price has dropped from $ 2625 to the current $ 2490. If today’s candlestick closes like this, we can expect the price to continue to fall, asking for better support. Our first place of support is the $ 2300-2400 zone, and below that, in the $ 2200 zone, we are looking for support in moving averages. There were no signs that there would be a potential reversal of the trend on the bearish side yesterday. For the bullish view, we need a decline from the $ 2300-2400 zone and a jump in the Ethereum price, at least above $ 2650. To keep the price at that level to consolidate for further continuation towards the $ 2900-3000 zone.

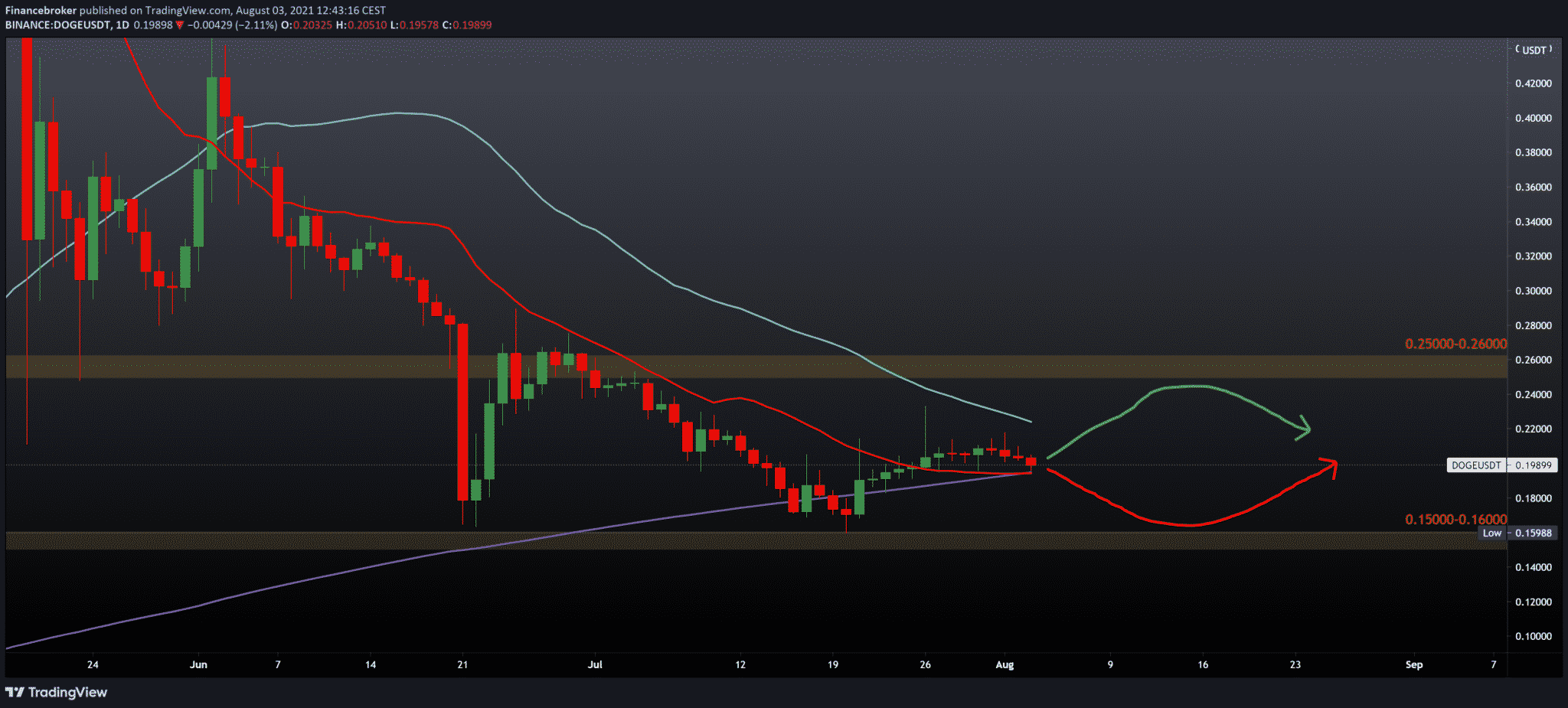

Dogecoin

Dogecoin continues its lateral consolidation with a 200-day moving average in the zone of around 0.20000. The bearish pressure on Dogecoin has been increasing for the last few days. It is now possible to see a break below MA200 if the bearish pressure increases. Then we expect the price to fall again in the support zone of 0.15000-0.20000. Conversely, a break above MA200 and a move towards MA50 at 0.22000 may occur, further growth leading us to the top of this lateral consolidation in the 0.25000-0.26000 zone.

Bitcoin’s hashrate recovery, stable peer-to-peer markets, and the constant volume shown by Asian stock exchanges indicate that China’s attempt to ban BTC was ineffective.

Bitcoin (BTC) may have suffered the largest coordinated attack in recent months. But the investor community has not capitulated in this case. China has banned mining in most regions after giving BTC miners a two-week notice, causing the biggest adjustment to mining difficulties after the network hash rate fell by 50%.

The market mood of the Bitcoin environment has already been damaged after Elon Musk announced that Tesla would not accept Bitcoin payments due to the impact of the mining environment process. It remains unknown whether the Chinese decision was influenced or related to Musk’s remarks. But undoubtedly these events had a negative effect.

A few weeks later, on June 16, China blocked cryptocurrency exchanges in web search results. Meanwhile, Huobi began restricting trade in levers and blocking new users from China.

Finally, on June 21, the National Bank of China (PBoC) instructed banks to close over-the-counter bank accounts. Even their social media accounts were banned.

Conclusion

After reaching a peak of 186 million TH / s on May 12, the dispersion rate of the Bitcoin network, an estimate of total mining power, began to decline. The first few weeks were due to restrictions in coal-fired zones, estimated at 25% mining capacity.

However, as the ban spread to other regions, the indicator reached a bottom of 85 million TH / s, the lowest level in two years.

Complete suppression of trading by Chinese entities would likely be reflected in stock exchanges previously based in the region, such as Binance, OKEk, and Huobi. However, looking at recent volume data, there was no significant impact.

China’s mining ban and bitcoin transactions may have led to temporary problems and a negative impact on the price of BTC. But the network and price have recovered in a way that is better than many expected.

There is currently no way to measure OTC transactions where larger blocks are traded. Still, it is only a matter of time before these intermediaries find new gateways and payment routes.

-

Support

-

Platform

-

Spread

-

Trading Instrument