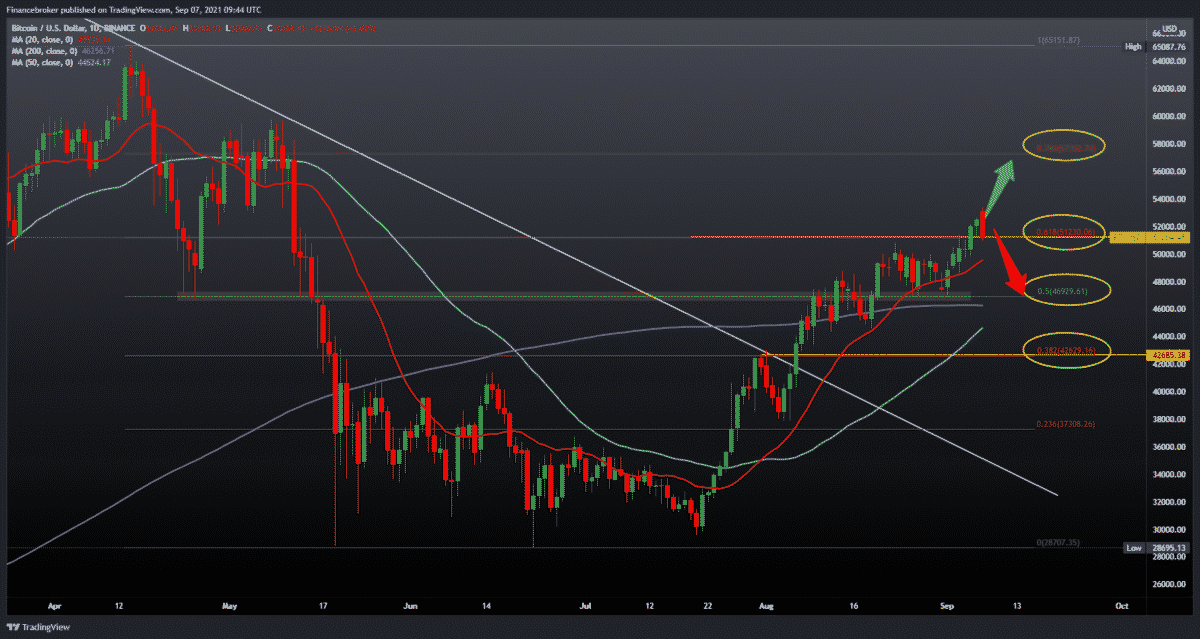

Bitcoin, Ethereum, and Dogecoin in the Short-term Pullback

Looking at the chart on the daily time frame, we see that the price of Bitcoin this morning reached a new four-month high at $ 53,400. After that, we have a price pull to the current 51730. If this candlestick closes negatively today, then we can expect a continuation of the pullback to $ 50,000 or consolidation of around 61.8% Fibonacci levels. A larger support zone awaits us in the zone of about 50.0% Fibonacci levels at $ 46,930 with the additional support of the 200-day moving average. For the bullish scenario, we need a new positive consolidation and a new direction of the price towards the above targets. Upstairs, we are facing resistance at 78.6% Fibonacci level at $ 57,350. We were there for the last time in May, after which there was a drop in the price of Bitcoin to $ 28,695.

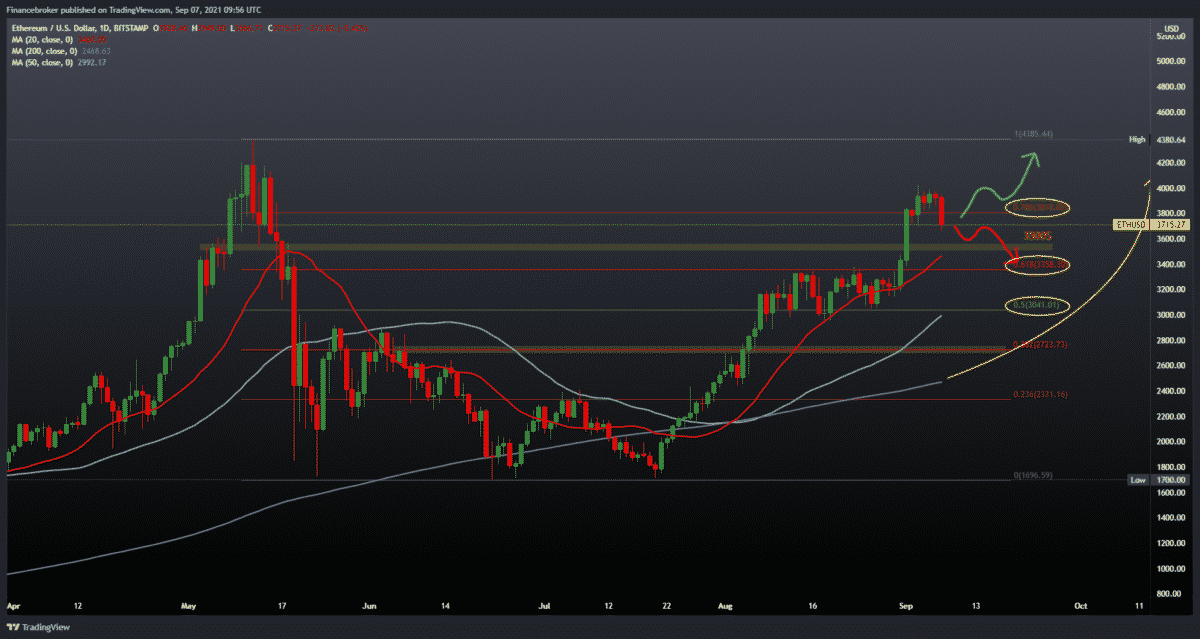

Ethereum chart analysis

Looking at the chart of the daily time frame, we see that the price of Ethereum has retreated from the current high from $ 4020 to $ 3675. This image on the chart can be seen as resistance on the 78.6% Fibonacci level at $ 3810. Below we find the first psychological support at $ 3500. Meanwhile, below it, we have more support at 61.8% Fibonacci level at $ 3360.

An additional sign for the continuation of pullback is if the price drops below the 20-day moving average. Our 50-day moving average is at 50.0% Fibonacci level at $ 3040, and the 200-day moving average is far down at $ 2500. To continue the bullish scenario, we need the support of a 20-day moving average, which would again direct the price towards the upper levels. If we go back above 78.6% Fibonacci levels again, then we can expect the price to approach the historic high of May.

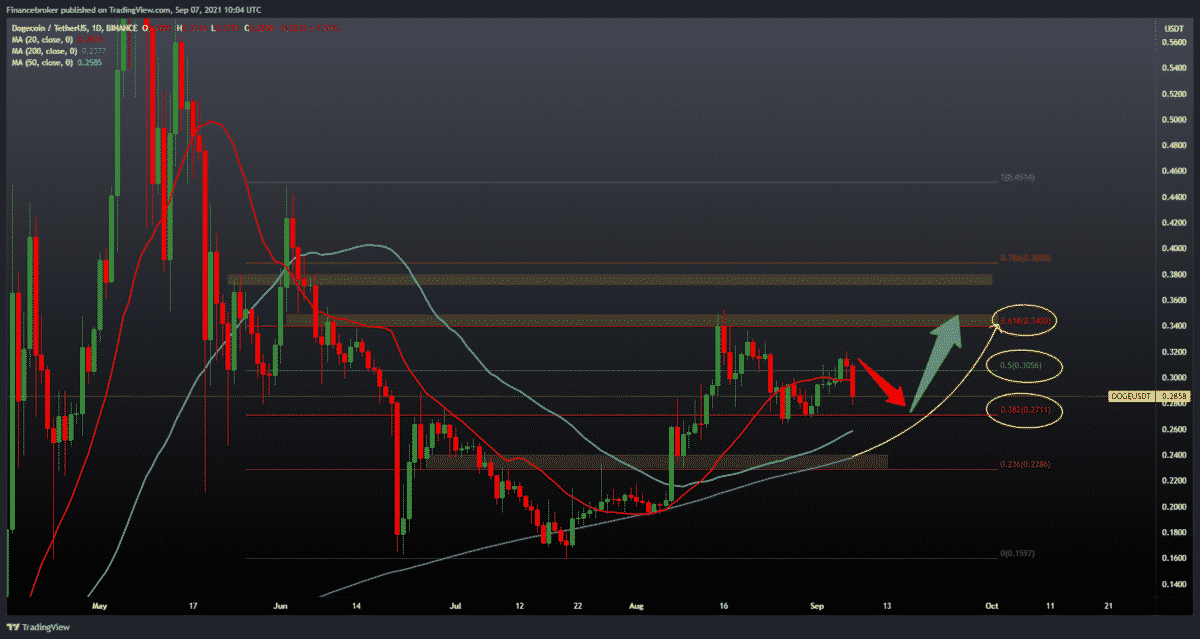

Dogecoin chart analysis

Looking at the chart on the daily time frame, we see that Dogecoin also made a pullback, just like the remnants of the cryptocurrency, dropping to the current 0.28400. As support, we can look at the 38.2% Fibonacci level. The previous two cases it proved to be solid support. Moreover, it prevented the price from continuing further to the bearish side.

If we see the price break through this support zone, we are looking for an additional 50-day and 200-day moving average that supports a longer-term bullish trend. To continue on the bullish side from the current position, we need a jump above 50.0% Fibonacci level. As well as a break above 61.8% Fibonacci level on 0.34000. This would be a clear signal to us to return to the bullish side.

Market Overview

El Salvador became the first country in the world to adopt Bitcoin as a legal tender. Country officials see the move as a leap in strengthening their economy. Consider this – About 70% of the population in the region does not have a bank account. But starting today, millions of Salvadorans will be able to use BTC to store and transaction value legally.

According to Argueta, companies that refuse to conduct bitcoin transactions and do not use the national Chivo wallet will face sanctions under state consumer protection law.

The timing of this statement is noteworthy. Not so long ago, President Nayib Bukele argued that including a digital token would be completely optional. At the time, he said, “If someone wants to carry cash and not receive a sign-up bonus, not win over customers who have bitcoin, don’t grow their business and pay a remittance commission, they can continue to do so.”

Conclusion

Needless to say, Arguetta’s latest comments have provoked much criticism in the community. Opposition members also quickly criticized the government. Anabel Belloso of the FMLN, for example, replied, “They say that it is not obligatory, and today they are talking about sanctioning those who do not accept it. Liars. People reject Bitcoin .”

Belloso did not stop there either, and the representative also implied a possible motive for the manipulation.

El Salvador residents have also vented their anger against the highly controversial Article 7. The article in question makes the acceptance of cryptocurrencies mandatory for suppliers. However, in addition to issuing a formal dismissal, some resorted to sorcery to curse officials.

However, the local population is not convinced. As previously reported, about 70% of all Salvadorans voted against the law. Moreover, 99% of the crowd, including traders and suppliers, believe that accepting BTC should be purely voluntary.

-

Support

-

Platform

-

Spread

-

Trading Instrument