Bitcoin, Ethereum and Dogecoin Daily Views of the Chart

Bitcoin chart analysis

Looking at the daily time frame chart, we see that the price has climbed to the current $ 47,000 to 50.0% Fibonacci levels. This zone coincides with the low of April 25, which was then the target for possible support. Now that level is current resistance, and we can expect some consolidation. It is currently a bullish impulse. So for now, we expect further price correction towards 61.8% Fibonacci level at $ 51247. Meanwhile, before that, we have a psychological level at $ 50,000.

We can ask for additional support in the 200-day moving average at $ 45,000. For the bearish trend, we first need a negative consolidation. Additionally, we need a pull below the MA200 with a view to the 38.2% Fibonacci level at $ 42660. In early August, two moving averages, 20-day and 50-day moving averages, made a bullish cross, giving us a bullish signal and price support.

Ethereum chart analysis

Looking at Ethereum daily, we see that the price has managed to consolidate above 50.0% Fibonacci levels at $ 3045. The price tested the level at $ 3,200 this morning, and after the flow, we are in a brief price hike to the current $ 3,117. Based on previous candlesticks, we can expect the price of Ethereum to continue to rise. If the price growth continues, our target is 61.8% Fibonacci level at $ 3360, and the last time we were there was on May 19. For the bearish scenario, we need the price to continue to fall below 50.0% Fibonacci levels, with a further drop to 38.2% Fibonacci levels at $ 2730. That level will coincide with the 20-day moving average if the price makes a stronger pullback. The MA50 and MA200 move in the $ 2200 zone.

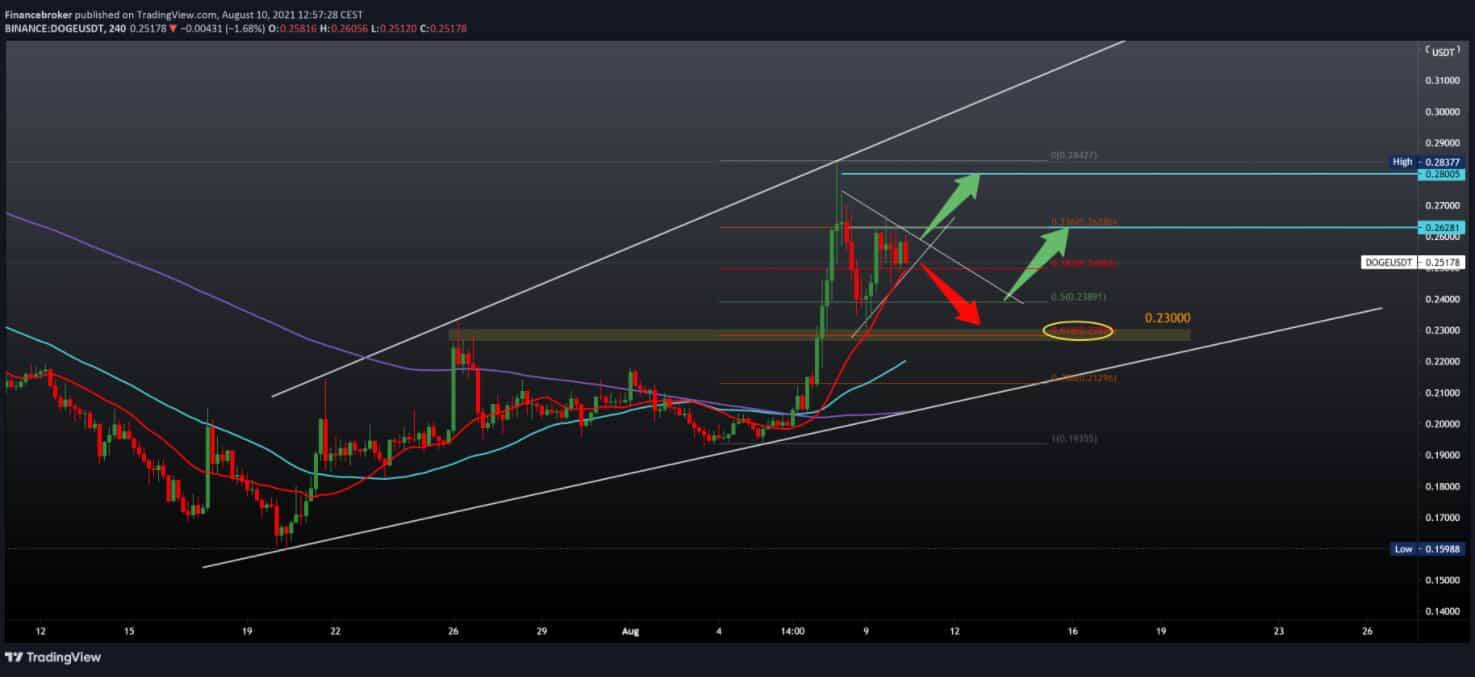

Dogecoin chart analysis

Looking at Dogecoin on a four-hour time frame, we see that the price of Dogecoin has met resistance at 0.26000. The price had met resistance at 0.26000 since the beginning of the American session yesterday. At the same time, it finds support at 0.25000 at 38.2% Fibonacci level. A fall below this support level leads us to a 61.8% Fibonacci level at 0.23000. The maximum pullback potential is at 78.6% Fibonacci level at 0.21300, at the bottom support line. We also need a break below the 20-day moving average, potentially reaching a 50-day moving average. We expect the price to jump out of this corrective triangle for the bullish option. As well as, go above the 23.6% Fibonacci level at 0.26286. After that, we climb to 0.27000. While the ultimate potential on this time frame is our previous high at 0.28377 from August 07.

Market overview

The dominance of bitcoin transactions worth over one million dollars has doubled from year to year, indicating increasing institutional engagement in cryptocurrencies.

Despite a bearish correction of 50% more this year, data provided by Glassnode show, institutions have not left the bitcoin market.

On Monday, the blockchain analytics platform reported that the dominance of bitcoin transactions exceeded one million dollars. It has doubled since September 2020 – from 30% to 70% of the total value transferred.

Since retail investors don’t usually engage in large transactions, Glassnode speculates that institutional investors may have been behind the sharp rise in the $ 1 million to $ 10 million transaction group.

Moreover, the platform noted that the Bitcoin network processed the aforementioned bulky transactions as the BTC/USD exchange rate traded lower from $ 65,000 to below $ 30,000 in the second quarter of 2021.

“As the market traded at a low of $ 29,000 in late July, the $ 1 million to $ 10 million transaction group jumped significantly, increasing dominance by 20%,” Glassnode wrote in a report Monday.

“This suggests that these large transactions are more likely to be batteries than sellers, and yet it’s quite constructive in terms of price.”

Transactions of less than a million dollars fell by half – from 70% in September 2020 to 30% -40% dominance in March-May 2021. The decline suggests that small investors capitulated their investments in bitcoins to ensure early profits.

-

Support

-

Platform

-

Spread

-

Trading Instrument