Bitcoin, Ethereum, and Dogecoin after a quiet weekend

Bitcoin chart analysis

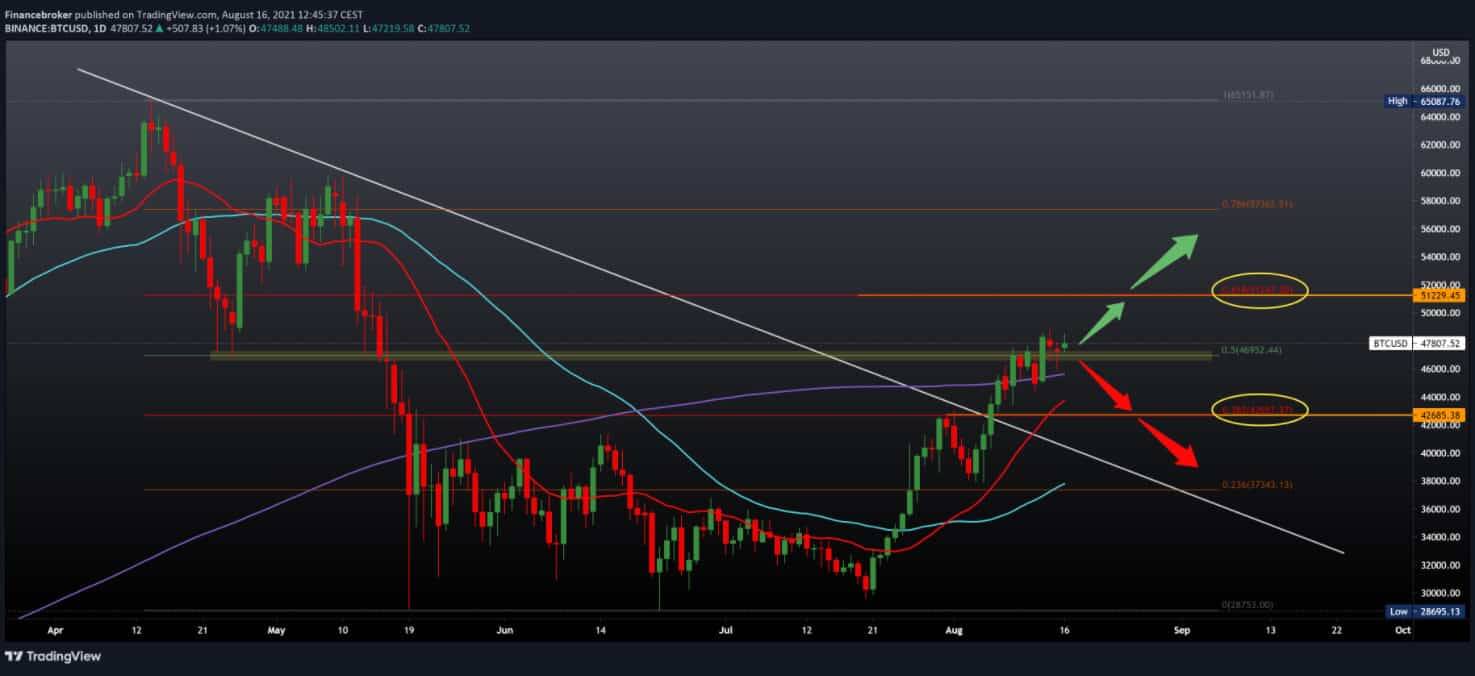

Looking at the Bitcoin chart on the daily time frame, we see that the price of Bitcoin did not make any positive changes over the weekend, so we would hope to see the price at $ 50,000. Bitcoin’s price is still consolidating slightly above the 50.0% Fibonacci level at $ 46,950. On the positive side, we can still be above the 200-day moving average, and if the price resists pressure from sellers, we can expect the bullish trend to continue. We still target 61.8% Fibonacci level at $ 51,250. For the bearish scenario, we first need a price withdrawal below the 200-day moving average, and then we find support for the 20-day moving average in the zone around $ 44,000. At the same time, stronger support awaits us at 38.2% Fibonacci level at $ 42,655.

Ethereum chart analysis

Looking at Ethereum on the daily time frame, we see that the price is still around 61.8% Fibonacci levels at $ 3358. We are still in the bullish trend because we have support in moving averages from the bottom. Viewed in this way, we can expect further price growth towards the next psychological level at $ 3500, while the next technical Fibonacci level is at $ 3810 at a 78.6% level. For the bearish scenario, we need a pull towards the 50.0% Fibonacci level at $ 3040. We can expect a deeper pullback up to a 200-day moving average, whose movement will climb to 38.2% Fibonacci levels at $ 2723.

Dogecoin chart analysis

Looking at the Dogecoin chart on the daily time frame, we see that Dogecoin has advanced the most, climbing to the current 0.34500. The price yesterday managed to break above 23.6% Fibonacci level to 0.29650. The price jump is similar to August 9. If the price continues to rise, the next resistance we look up at 0.38100 at 38.2% Fibonacci level. For the bearish scenario, we need negative consolidation and empowerment again towards a 23.6% Fibonacci level. Following moving averages, they are currently deep in the bullish territory in the zone below 0.25000.

Market overview

Owners of cryptocurrencies in Singapore prefer Ethereum to Bitcoin, according to research by the cryptocurrency exchange Gemini. A total of 50,000 Ethereums worth $ 165 million were burned as London’s hard fork makes ETH more prone to deflation. Ethereum invested in the ETH 2.0 investment platform reaches a new record.

The future of Ethereum is likely to be deflationary with the burning of higher levels of ETH. The amount of ETH held on stock exchanges is constantly declining.

A recent survey of the Gemini cryptocurrency exchange revealed that Ethereum is the most popular cryptocurrency in Singapore. Almost 78% of crypto investors in Singapore hold Ethereum and 69% own Bitcoin.

Ethereum’s growing popularity can be attributed to the increase in deflationary blocks produced since EIP-1559 came out live with London hard fork. A $ 165 million ETH has been burned in the last ten days.

As more Ethereum withdraws from circulation, analysts notice an increase in Total Value Locked (TVL) on DeFi and a jump in the amount of Ethereum invested in the ETH 2 contract.

Guy, a cryptocurrency and YouTube analyst at CoinBureau, states that Ethereum locked in DeFi is kept in smart contracts. It is most likely used in DeFi protocols to supply liquidity, earn interest, or other types of yield cultivation tactics.

ETH, which represents DeFi TVL, is used for certain purposes, and investors who hold this Ethereum are less likely to sell it in the short term. At the same time, Ethereum invested in the ETH2 contract reached a new all-time high of 6.72 million ETH. Ethereum, which is locked, is out of circulation in the long run, which encourages the bullish outlook of traders.

Ethereum surpassed Bitcoin in terms of transaction volume, daily trading volume, and return on investment, according to the Blockchain Center.

Furthermore, as the Ethereum network moves towards Merge, an upgrade that replaces the current Consensus of Evidence Consensus (PoV) mechanism with energy-efficient and secure Proof of Contribution (PoS), Ether inflation is expected to fall, leading to deflation.

-

Support

-

Platform

-

Spread

-

Trading Instrument