Bitcoin, Ether, Dogecoin the pressure on prices continues

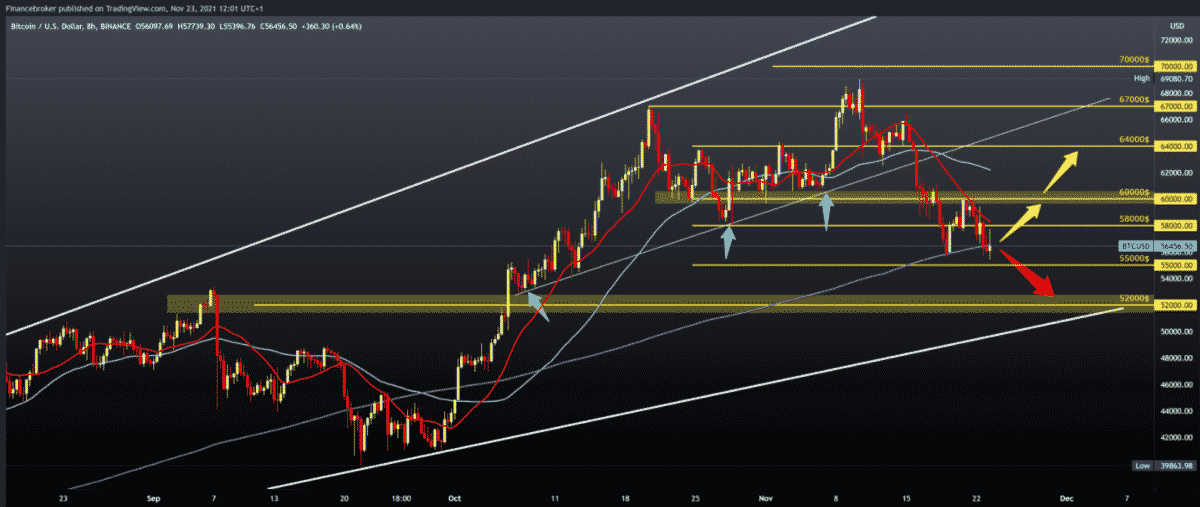

Bitcoin chart analysis

The price of bitcoin this morning found support at $ 56,000, and for now, we are approaching the zone at $ 58,000. We hope to get support in the MA200 moving average that will push us above $ 60,000. If the price rises above $ 60,000, it will form a double bottom on the chart, which can be an additional sign of finding support and continuing towards the previous historical high.

Bullish scenario:

- First, we need a break above $ 58,000 to get MA20 moving average support.

- Then we come to the $ 60,000 psychological level where we had a previous rejection and dropping the price below $ 56,000.

- A break above $ 60,000 boosts bullish pressure and leads us to the next resistance at $ 62,000 to the MA50 moving average.

- Further price growth meets the next resistance at $ 64,000, then at $ 66,000, the previous high last week.

Bearish scenario:

- We need negative consolidation, a break below $ 56,000, and a zone test at $ 55,000.

- Stronger pressure could lower the price below and send it to the bottom line of the trend up to $ 52,000.

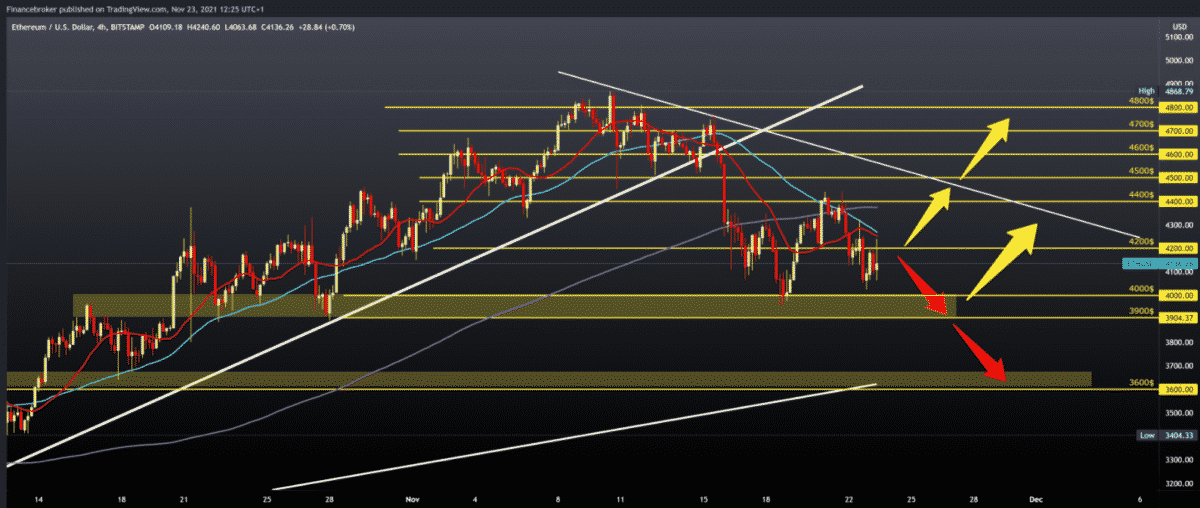

Ethereum chart analysis

The price of ETHUSD jumped to $ 4150 today after yesterday’s withdrawal to $ 4025. Our current hurdle is the $ 4200 zone along with the MA20 and MA50 moving averages. The pressure on the $ 4,000 price is still evident, and it is possible that we will test it again.

Bullish scenario:

- We need a break above $ 4200 and an MA20 and MA50 moving averages.

- A further sequel climbs us above $ 4300, and the next resistance is at $ 4400 with an additional one in the MA200 moving average.

- Our target is to climb to the top trend line in the $ 4500 zone, and a break above would boost bullish optimism for winning new levels on the chart.

Bearish scenario:

- We need a price withdrawal and a new zone test at $ 4,000.

- Further negative consolidation lowers the price to $ 3,900 in October support.

- Price break below, the descent us to the next support on the lower trend line to the $ 3600-$ 3700 area.

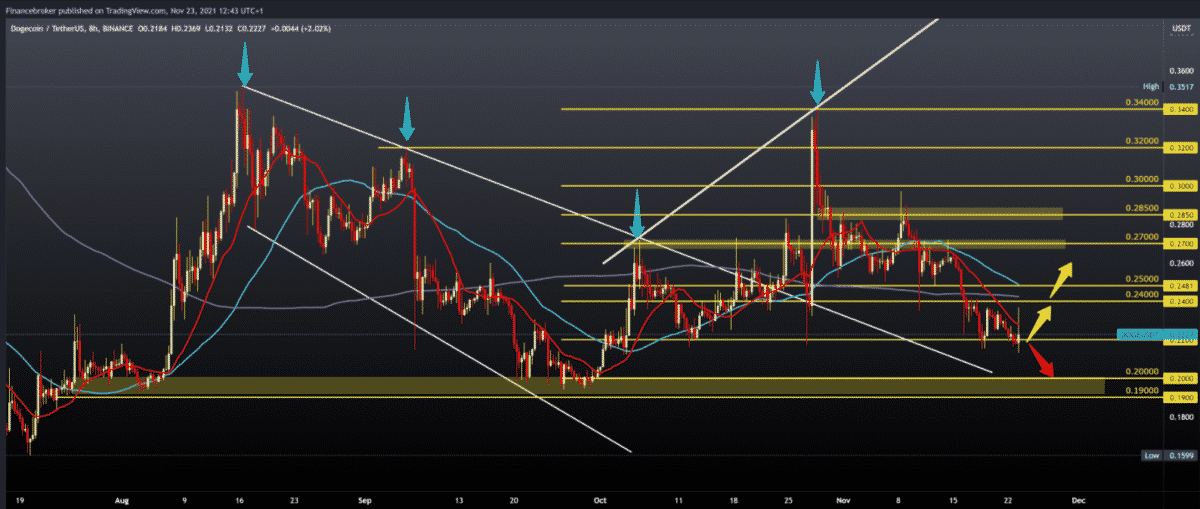

Dogecoin chart analysis

The price of Dogecoin has been very significant in the last 4 hours, and it reached a new two-month low at 0.21320. We returned to the support zone from October, expecting it to endure and send us back into the bullish trend.

Bullish scenario:

- We need better support at the 0.22000 level and positive consolidation, which, with the help of the MA20 moving average, would move the price of Dogecoin above 0.23000.

- After that, we come across the next MA50 moving average at 0.23500. The break above drives us to the zone at 0.24000, the site of a previous bullish attempt.

- Our next resistance is at 0.25000, then MA200 at 0.26000, and a very important zone at 0.27000.

Bearish scenario:

- We need negative consolidation with new pressures at 0.22000.

- The potential break below opens the door to 0.21000, and then the next support is at 0.20000 October support zone.

- A further drop in the price of our descent into the August and September support zone.

Market news

As the state of Texas faces a rapid influx of bitcoin mining operations, its electrical infrastructure will have to support the expected 5,000 megawatts of additional energy needs by 2023.

The bitcoin mining industry in Texas currently consumes about 500 to 1,000 MW of energy. According to reports, the Texas Electricity Reliability Council (ERCOT) predicts that demand could increase as much as fivefold by 2023 and plans an additional 3,000 to 5,000 MW.

This expansion comes when Texas plans to become home to 20% of the world’s bitcoin mining operations. Texas has emerged as a destination for bitcoin miners since the Chinese government officially banned bitcoin mining earlier this year. The state government has capitalized on Chinese repression by making Texas a haven for cryptocurrency miners who can now enjoy 10-year tax breaks.

-

Support

-

Platform

-

Spread

-

Trading Instrument